⚡Solana Soars Across All Metrics

Plus Bitcoin 2024 Highlights, Solana yield farms, and more

Estimated Read Time: ~4 minutes

In Today’s Edition:

Bitcoin 2024 Highlights

Big Solana protocol announcements

Solana soars across all metrics

Yield strategies on Solana

How to do your own crypto research with metrics

📖 Recommended Reads

⚡Highlights from Bitcoin 2024 Nashville

Trump want the U.S. Gov to stockpile BTC, Snowden says we’re winning, Saylor with an eyewatering BTC price

⚡Senator Cynthia Lummis proposes U.S. buy 1 million Bitcoin over 5 years

The proposed goal is “to supercharge the U.S. Dollar”

⚡Jito Announces Solana Restaking

Jito uses two components to create scalable staking infrastructure

⚡Drift Protocol to Launch Prediction Markets on Solana

Fully decentralized and completely permissionless

⚡How to absolutely crush the rest of this year

Wisdom from rektdiomedes

⚡MakerDAO’s Endgame is upon us: Launch Season

Written by Maker co-founder Rune Christensen, read the full-write up

A basket of Alpha tweets: SOL price analysis, ETH ETF inflow predictions, and a Bitcoin ownership breakdown

🔢On-Chain Analysis

Solana Soars Across All Metrics

Solana is on a tear. This week, Solana convincingly flipped Binance in market cap:

As of today (July 29th, 2024), Solana tops Ethereum in active addresses, fees, revenue and 24hr DEX volume:

Solana TVL jumped over the past week, passing $10B. It’s been 994 days since Solana’s TVL top on November 8th, 2021.

🚜Farm of the Week

SOL-USDC on Raydium

With Solana’s incredible rise in DEX volume, providing liquidity to the pools traders use is a great way to earn yield.

How it Works

Provide SOL and USDC for over 100% APR.

When you click Deposit, you’ll see a Price Range at which to provide liquidity. The default range is very tight, so we’ll make some changes.

Change Slippage amount from 2.5% to 1% (slippage settings in the upper right-hand corner)

With Solana’s price action lately, we’ll widen the range

We can still earn over 100% APR with a 15% price range.

The rewards are paid out in Raydium RAY tokens. Also, the deposit ratio is 67% SOL & 33% USDC, so fewer stablecoins are required.

Risks

Impermanent Loss

How to Do Your OWN Crypto Research with Metrics

⚡Get Better at DeFi with Dynamo DeFi Pro

Take your crypto expertise to the next level with Dynamo DeFi Pro, the premium service designed to provide you insights into the on-chain economy and the knowledge to conduct your own in-depth research.

Dynamo DeFi Pro members get access to:

⚡Exclusive Discord Community - Engage in lively discussions on trading strategies, on-chain data and airdrop alpha. Learn more here.

⚡Live Community Calls & AMAs - Join 3X monthly live sessions with our community and get all your questions answered in real-time.

⚡Premium Newsletters & Curated Data Analysis - Receive actionable insights and special in-depth reports on tokens with strong fundamentals.

⚡In-Depth Pre-Recorded Videos - Watch comprehensive videos where I share my research process. View past videos here.

⚡Monthly Group Strategy Calls - Participate in exclusive monthly video calls to discuss market trends, the latest in crypto, and more. Access calls here.

Get ahead with Dynamo DeFi Pro, for just $11/month (less than the cost of lunch in most countries).

🛠️Tool Spotlight

Find the Best Yields Using DeFiLlama Yields Dashboards

The DeFiLlama Yields page lets you endlessly customize your search for yield - filter by chain, token, TVL (min & max), specific category, or by protocol.

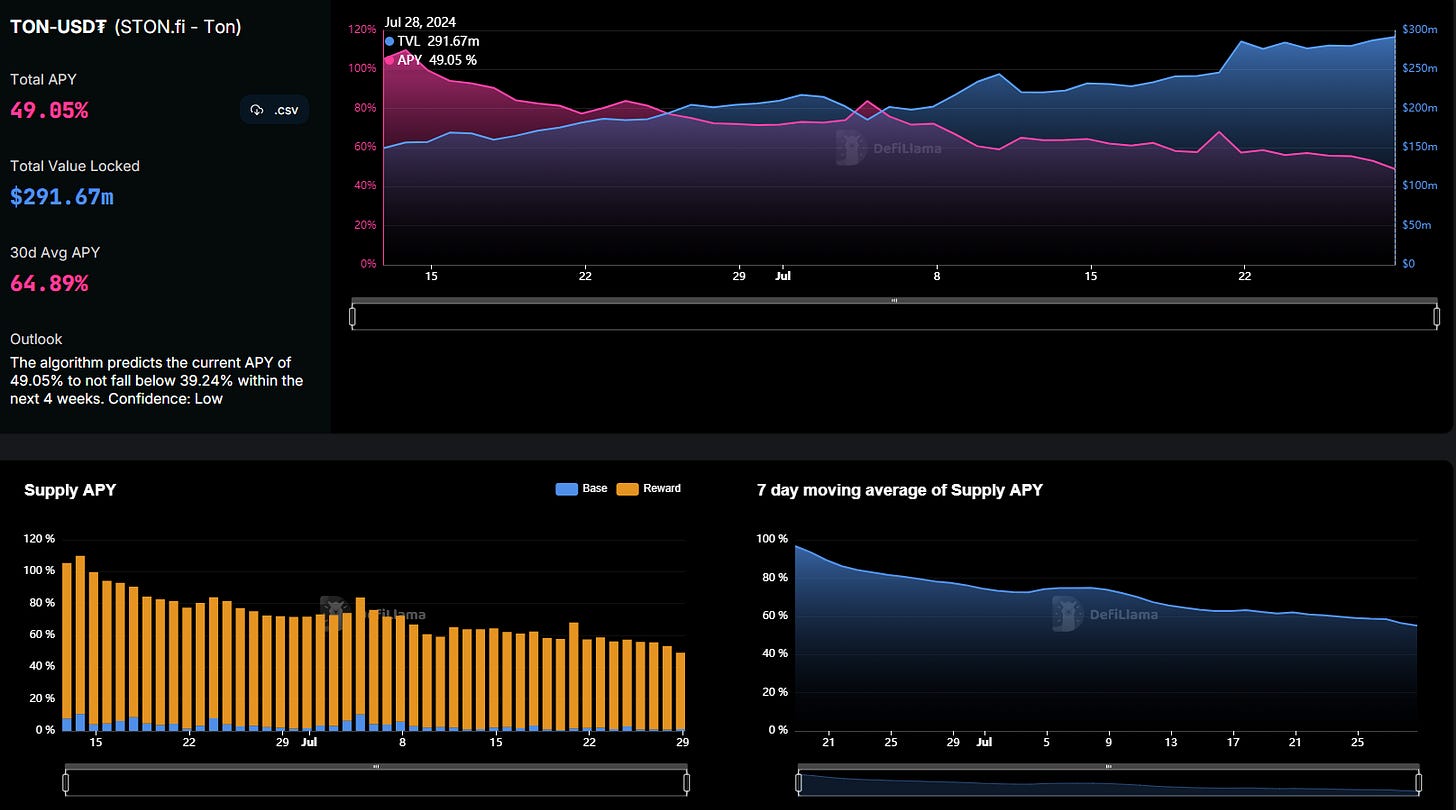

Each pool has it’s own Chart page - where you can analyze the TVL, rewards, and supply, as well as view DeFiLlama’s Outlook yield prediction.

If you’re looking for a specific type of yield, you can use the navigation window to view different types of yield. Use the Overview page to get a high-level read APY trends.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

🗳️Prediction Pulse: Forecast the World Better

Prediction Pulse is a new newsletter launched by the Dynamo DeFi team about prediction markets.

On Tuesdays and Fridays, you’ll get everything you need to know about the upcoming election, trending markets with the biggest moves, and our favorite prediction market picks to capitalize on🤝

Prediction markets, through which participants can place wagers on world events like elections, are one of the fastest growing crypto verticals.

📅Key Events This Week

Macro Events

📊20% of S&P 500 companies report earnings - All Week

📊CB Consumer Confidence Data - July 30th

📊JOLTs Job Openings Data - July 30th

📊Fed Rate Decision and Statement - July 31st

📊ISM Manufacturing PMI Data - August 1st

📊June Jobs Report - August 2nd

Token Unlocks

🔓TokenUnlocks: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓PORTAL (0.51%) - July 29th

🔓REZ (5.1%) - July 30th

🔓PRIME (1.75%) - July 31st

🔓MANTA (0.59%) - July 31st

🔓OP (2.79%) - July 31st

🔓DYDX (3.65%) - August 1st

🔓SUI (2.56%) - August 1st

🔓ZETA (18.92%) - August 1st

🔓GAL (3.52%) - August 2nd

🔓W (33.33%) - August 3rd

🔓LQTY (0.51%) - August 4th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀Synthernet inter bridge and staking launch - July 29th (Source)

🚀DASH evolution platform release - July 30th (source)

🚀Router protocol mainnet - July 30th (source)

🚀DESO focus app launch - July 30th (source)

🚀Kingchain mainnet - July 30th (source)

🚀EOS hardfork - July 31st (source)

🚀ACALA token burn - July 31st (source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi