⚡Solana Faces a Real Stress Test

Plus Ethena's incredible growth, find smart money with DEX Screener, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

Upgrade to the premium newsletter for access to premium articles, videos, and a Discord group.

The Perpetuals DEX Built for Traders

RabbitX is the fastest, and fastest growing, perpetuals DEX in DeFi. With 20x leverage, no gas fees, deep orderbook liquidity, and a truly professional trading experience. Check out the best mobile app in crypto and Back The Bunny.

Trade now: https://app.rabbitx.io/trade

Sponsored

📈Trends and Narratives

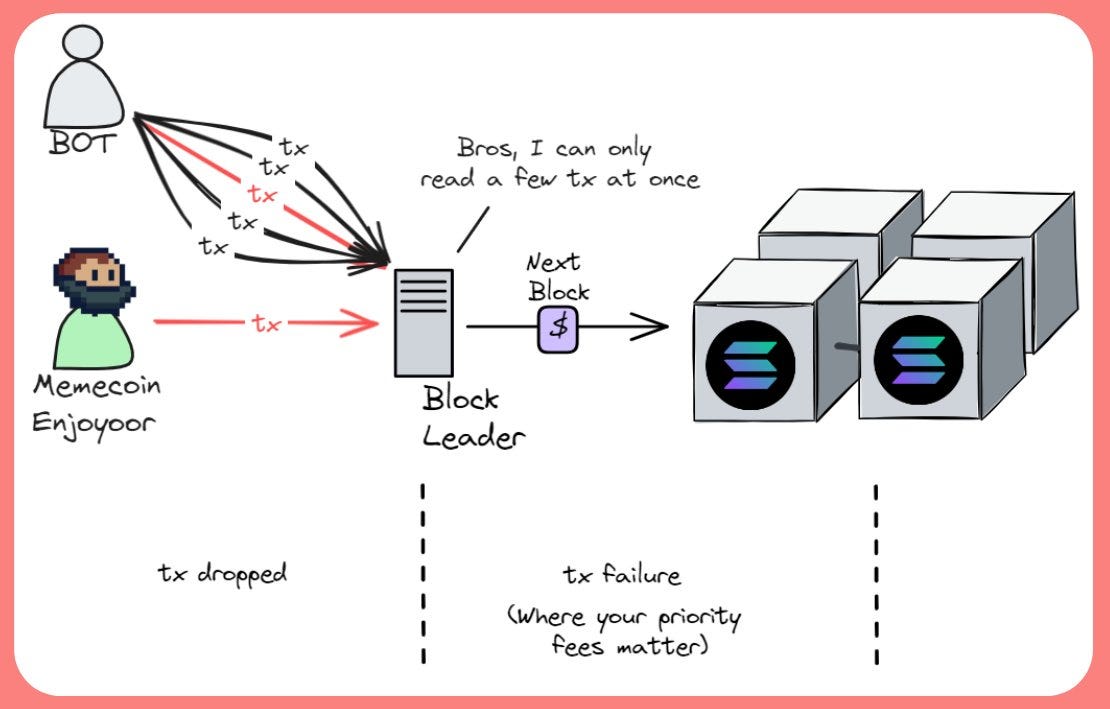

Solana Faces a Real Stress Test

If you’ve tried to use Solana anytime in the last few weeks, you’ve probably been a bit frustrated.

So what’s going on? And when will it be fixed?

Here’s the Scoop:

Knowing this, the natural question is: Where is the spam coming from?

“It's important to note that this is different from a typical failed transaction. Failed txs usually mean the txs were processed by a validator and didn't succeed due to the state of the chain. The failures you're seeing now are at the network layer (QUIC is pretty new tech), which needs to be improved.”

— 0xCygaar

One of the major causes of the network performance issues is Ore Protocol, a Proof of Work mining project on Solana.

A network upgrade was released earlier today, so stay tuned for whether this alleviates the ongoing issues.

How to Capitalize

Amidst congestion on Solana, Base has overtaken it as the chain on which the most memecoins are being launched. Until (and possibly after) the issues are resolved, the Base ecosystem will benefit.

SOL and many Solana ecosystem tokens are now in a significant dip. For those still bullish on the ecosystem long-term, this may be an opportunity.

🔢On-Chain Analysis

Ethena Grows Even Amidst Market Slowdown

Even with the crypto market dipping this week, Ethena continued to attract deposits and their stablecoin, USDe, continued to grow in market cap.

Total value locked on Ethena surpassed $2.3B, making it the 16th largest DeFi protocol by deposits.

For its part, Ethena’s stablecoin USDe has had an exceptional year so far, growing from almost nothing to over $2B in circulating supply, making it the 5th largest stablecoin in all of crypto.

🚜Farm of the Week

WETH-ARB on Camelot

Kamino is a popular Solana protocol with a solid team that prepares pools of brand new tokens quickly. The protocol has over $1B in TVL.

How it Works

This pool yields as much as ~150% APY at the time of writing, depending on the strategy chosen. Simply head to the pool’s page on Camelot, select ‘Auto’ if you want to make managing the pool easy. Choose which strategy you prefer - Gamma’s Narrow strategy yields the highest results, but with recent market volatility, it may be better to either select the Wide strategy. Alternatively, the Jones strategy automatically rebalances and still yields a high APY.

Risks

🛠️Tool Spotlight

Find Smart Money with DEX Screener Top Traders Tab

If you’ve traded tokens on-chain, there’s a good chance you have used DEX Screener at some point to chart tokens on Decentralized Exchanges.

Fewer people know that DEX Screener can also be a powerful tool to find wallets with a proven track record of making good trades. For any token, select the ‘Top Traders’ tab at the bottom to see the wallets with the highest realized PnL. You can then take these addresses over to DeBank or another wallet tracking tool to see what else they’re holding.

Here’s a sample of what the 'Top Traders’ tab looks like for AERO on Base:

⚡Learn about DeFi with Dynamo DeFi Pro

The premium version of Dynamo DeFi gives you deeper insights and teaches you how to research yourself.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

📅Key Events This Week

Macro Events

📊 Fed Chair Powell speaks - April 16th

📊 Bitcoin Halving - April 20th

Token Unlocks

🔓 STRK (8.79%) - April 15th

🔓 ARB (3.49%) - April 16th

🔓 PSP (0.83%) - April 15th

🔓 APE (0.73%) - April 15th

🔓 DYDX (0.69%) - April 16th

🔓 AXS (7.59%) - April 17th

🔓 MANTA (8.07%) - April 18th

🔓 IMX (2.40%) - April 18th

🔓 PIXEL (7.55%) - April 19th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Exverse alpha game launch - April 15th (Source)

🚀 Parex mainnet launch - April 15th (Source)

🚀 $SKID airdrop to SOL holders - April 15th (Source)

🚀 SmarDEX halving - April 15th (Source)

🚀 Stacks Nakamoto Upgrade - April 15th-29th (Source)

🚀 Vaiot AI legal assistant 2.0 - April 16th (Source)

🚀 Dexalot Arbitrum launch - April 16th (Source)

🚀 Spectraswap DEX launch - April 17th (Source)

🚀 Aqtis beta Dapp launch - April 17th (Source)

🚀 $BRN 90% token burn - April 19th (Source)

🚀 Notcoin $NOT token launch - April 20th (Source)

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi