⚡Short-term pain, long-term gain: Where does crypto go from here?

Trade war impact, protocols still growing, and a story for anyone down bad

Read Time: ~6 minutes

⚡Snapshot

How is a trade war affecting the markets?

Trump’s World Liberty Financial wants to buy crypto tokens - for a price

Jupiter Overview: the Front End of Solana

SOL lending APY on Kamino Finance

📖 Recommended Reads

⚡Why is the market going down?

The market’s reaction to tariff’s, the economy, and the hope for crypto

⚡A story for anyone down bad in the crypto market right now

A unique way to get leverage in the market

⚡There’s a ton of edge in simply being curious

Trying new things in crypto is still worth the effort

⚡Trump’s World Liberty Financial is hunting for token swaps

The company is negotiating with blockchain teams: buy WLF tokens in exchange for $10M native token purchase

There are now 35 active crypto ETF applications, Solana and Ripple have them most filings

⚡Hedge Against Market Uncertainty with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

Hyperliquid.

🔢Onchain Analysis

Short-term pain, long-term gain

If, by chance, you’ve stepped away from the crypto market for a few days, you’ve been spared carnage.

Crypto markets took the brunt of trade war fears over the weekend.

Last week we looked onchain and did an analysis of the crypto market. In short, things looked tenuous, and we proposed the idea that if you’ve done well this cycle, protect yourself.

However, we also suggested that people are likely overestimating the effect of regulatory clarity in the short term but severely underestimating it in the long term.

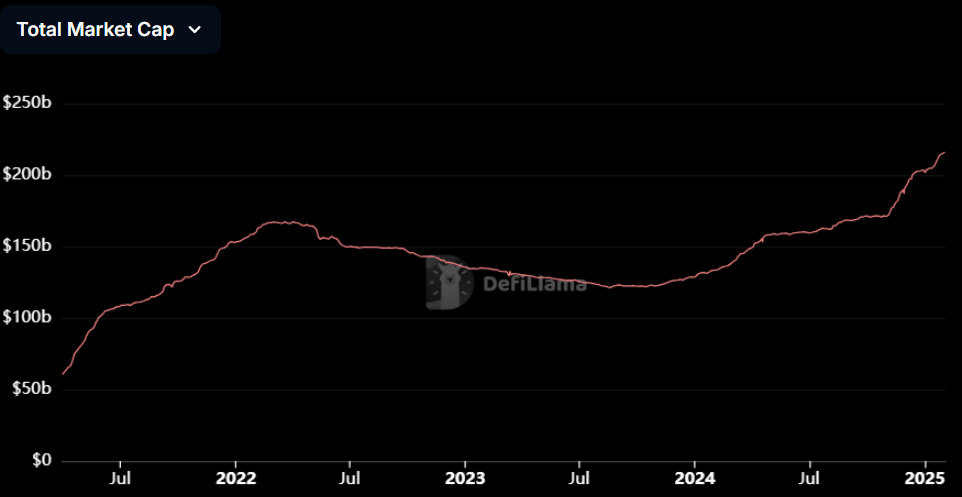

Total stablecoin market cap is still up and at all-time highs, up ~1% this week. A good sign.

Protocols holding up

TVL

Ethena’s TVL is up on the week, recently crossing $6B. Ethena also earned nearly $10M in fees over the last month, showcasing it’s fundamental strength across multiple metrics.

Jupiter TVL is green across multiple timeframes. After the most recent round of airdrops and a flurry of announcements at Catstanbul (including acquisitions, token burn & repurchase proposals, and more), Jupiter has momentum and market share.

Volume

Hyperliquid volume is up 40% this week as traders look to take advantage of volatility. This increase is important to note, as most onchain DEX volume is down anywhere from -25% (Uniswap) to -45% (Raydium).

On the chain front, Sui and Sonic are amongst the few chains who’s volume is up.

Bluefin, a spot & derivatives DEX on Sui surged in volume this week.

The DEX responsible for the Sonic volume surge is called WAGMI.

Revenue

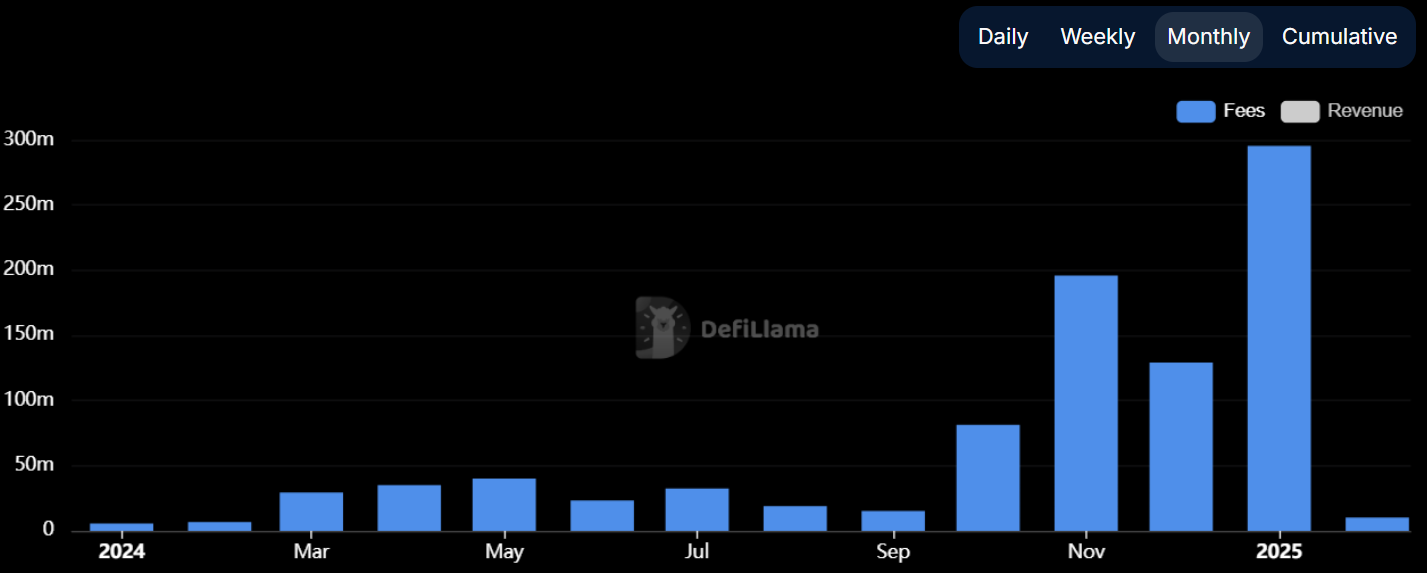

Jito is hauling in fees, second only to Tether in fees earned over the last month. January was Jito’s highest fee-earning month ever.

🚜Farm of the Week

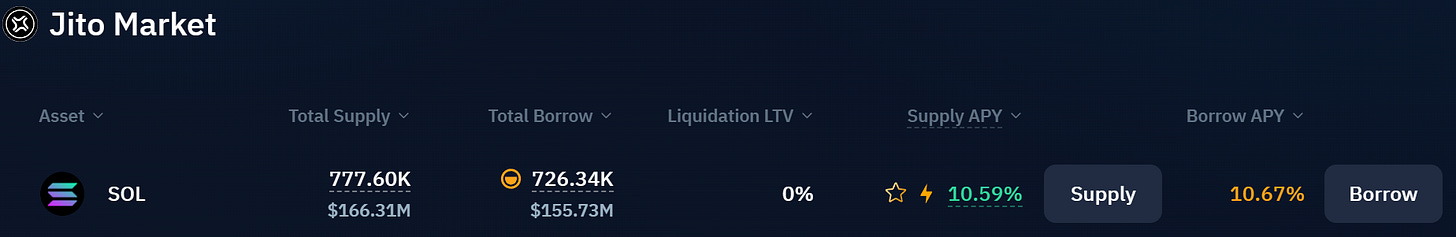

Solana APY on Kamino Finance

In an effort to outpace Solana network emissions, many turn to liquid staking their SOL tokens for ~10% APY. There’s another option on Kamino Finance.

Lend SOL tokens for 10-20% APY and other perks with just a few clicks.

How it Works

Head to the lending market’s main page on Kamino.

The pool is quite simple - you’re lending SOL and earning yield from those paying to borrow SOL.

When you lend SOL tokens, you’ll earn around 9% APY plus:

Kamino Season 3 points (this market also earns a points boost, so you earn 3x the points while lending SOL)

Additional JTO rewards (equates to ~1.6% APY)

Simply connect your wallet, deposit SOL, and start earning yield. To learn more about lending risk and how it works, click on Info & Risk. Kamino does a great job clearly explaining how the process works.

Risks

Jupiter Explained: Protocol Overview

⚡No-fluff toolkit for serious onchain traders

I built the Onchain Academy to be the resource I wish I had when I started using DeFi.

In less than 3 hours, you’ll be able to:

Track smart money flows before they trend

Spot undervalued gems using on-chain metrics

Find the next big airdrops using real data

Analyze protocols like a professional

Skip the expensive lessons. Get instant access to my complete framework →

🛠️Tool Spotlight

DeFi Chain Fees Dashboard - Built by Dynamo DeFi

The DeFi Chain Fees Dashboard tracks and compares the “GDP” across different blockchains by measuring the fees users pay to interact with each chain.

This includes not only fees spent on the chain itself, but also fees spent on apps on the chain, like DEXs. You can view fee data across multiple timeframes and compare how different chains stack up against each other.

The dashboard communicates which chains are seeing the most actual usage and economic activity, since fees represent real user demand and willingness to pay for blockchain services.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 JOLTS Job Openings data - February 4th

📊 ADP Nonfarm Employment data - February 5th

📊 January Jobs Report - February 7th

📊 20% of S&P 500 companies report earnings

Token Unlocks: $600M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓 KAS (0.67%) - February 5th

🔓 XDC (5.36%) - February 5th

🔓 IMX (0.69%) - February 5th

🔓 GMT (1.55%) - February 6th

🔓 MAVIA (41.35%) - February 6th

🔓 ENS (0.94%) - February 7th

🔓 FLARE (1.61%) - February 9th

🔓 MOVE (2.17%) - February 9th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 TiFi token burn - February 3rd (Source)

🚀 Nillion mainnet - February 3rd (Source)

🚀 QUAI public mining - February 5th (Source)

🚀 AlphBanX public testnet launch - February 7th (Source)

🚀 FARM simulation game alpha release - February 7th (Source)

🚀 Fruitopia NFT launch - February 7th (Source)

🚀 ANON DeFAI public beta - February 7th (Source)

🚀 aiPump token burn and DeFAI launch - February 8th (Source)

🚀 AO mainnet launch - February 8th (Source)

🚀 Parahub v1 launch - February 9th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi

Great insight.