⚡Fear is back. So is opportunity.

Money is flowing into this "boring" onchain business

Read Time: ~5 minutes

⚡In This Edition

Historical Bitcoin performance this week

Maple Finance getting serious traction

Jerome Powell speaks Tuesday

By the way, here are the top September airdrop opportunities.

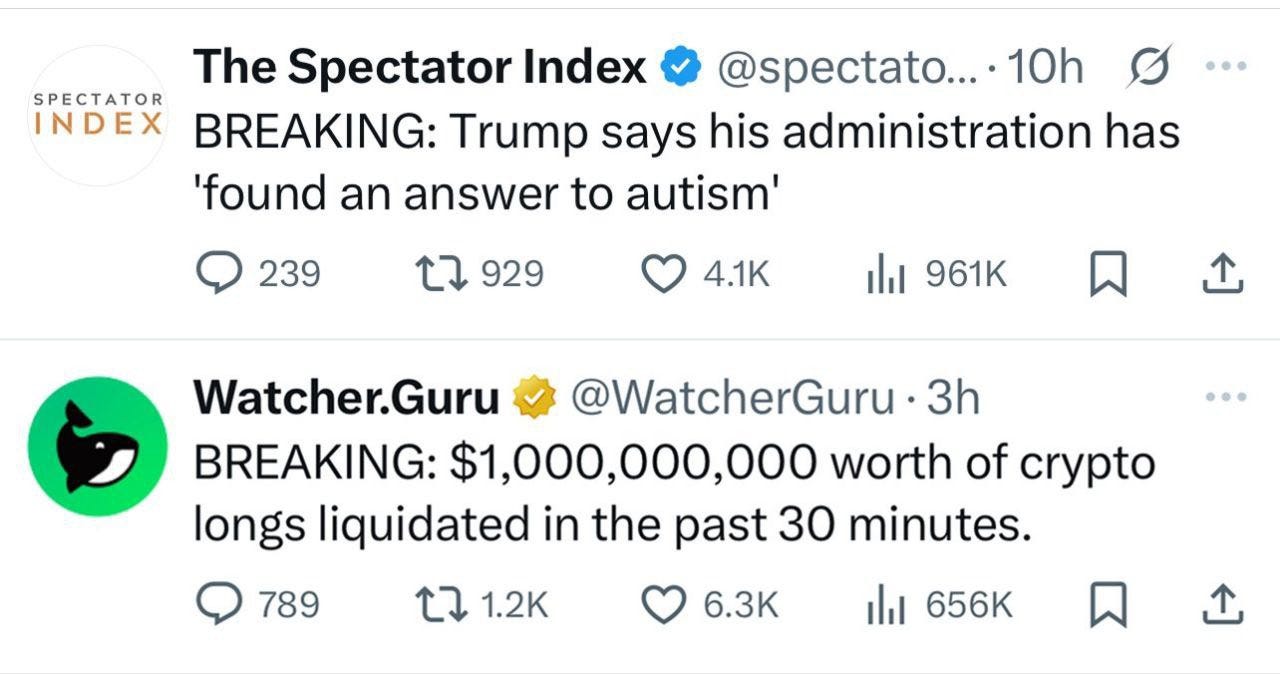

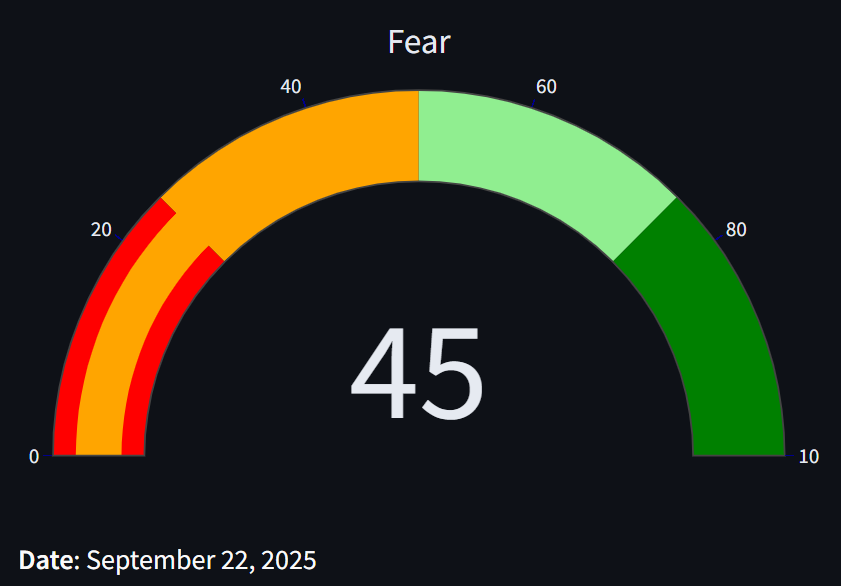

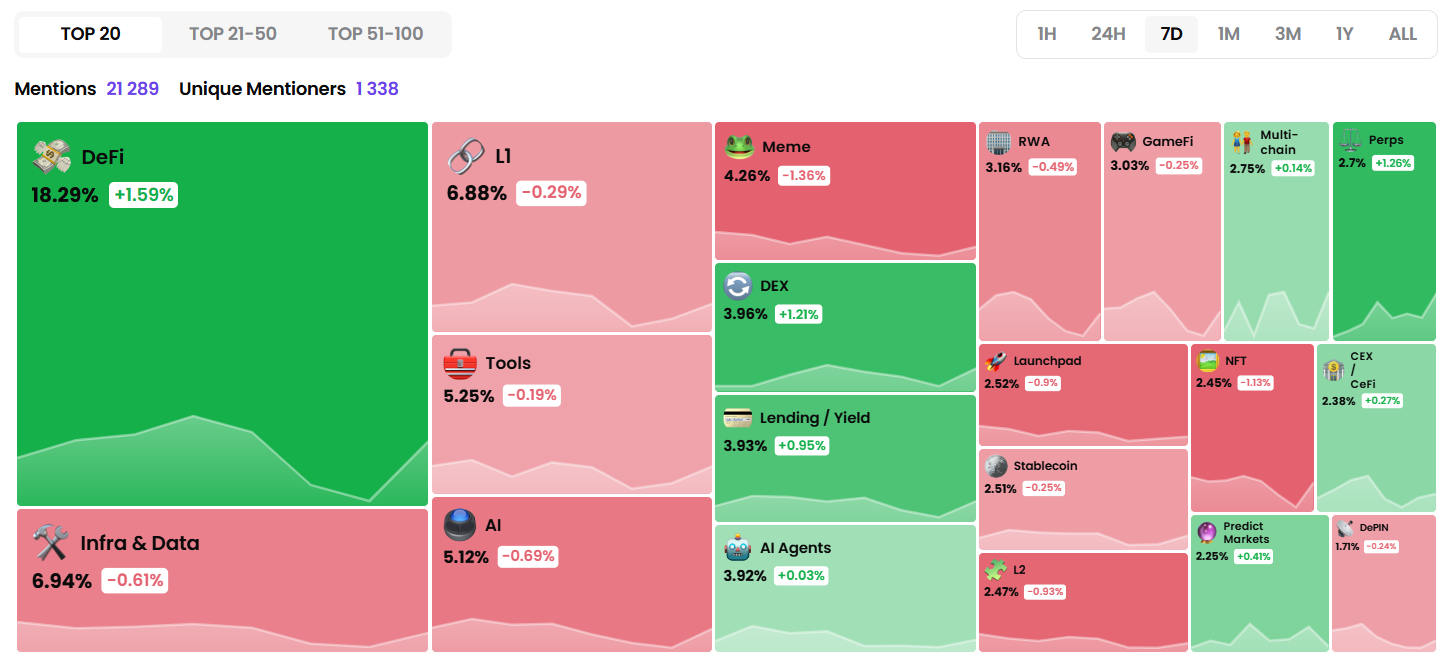

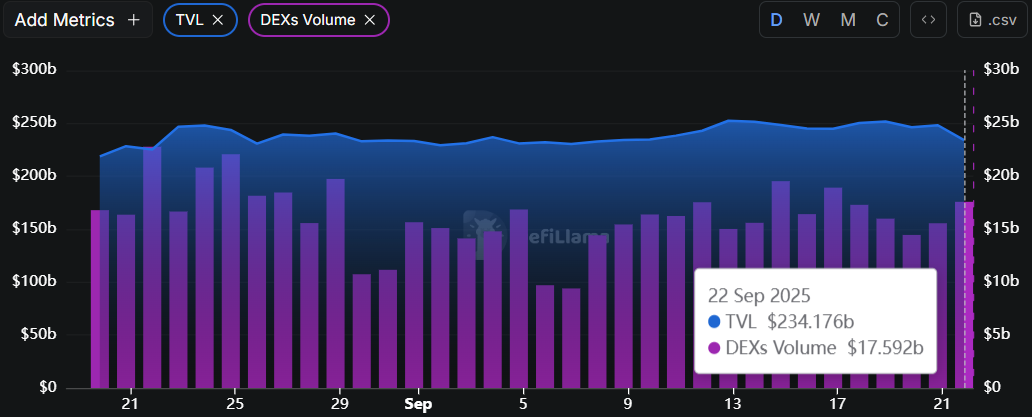

⚡Metrics Snapshot

Top 100 Coins at a Glance (7d)

Fear & Greed Index: 45 (Fear)

Narrative Mindshare (7d)

Historical Bitcoin Performance This Week (Week 38)

DeFi Market Metrics: Global TVL & DEX Volume

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. Plasma Announces “The One App” for Global Stablecoin Access

Tether-backed Plasma announced One: a stablecoin-native neobank offering yield, spending, and zero-fee USDT transfers in 150+ countries. It’s built to serve markets like Istanbul and Buenos Aires where stablecoins are already replacing local banking infrastructure.

What This Means

Plasma is executing on stablecoin product-market fit with real-world demand. This is a Stripe-meets-CashApp designed for borderless dollar access. Massive unlock for stablecoin adoption if they stick the landing.

2. Metaplanet Buys $632M in Bitcoin

Japanese treasury firm Metaplanet just purchased 5,419 BTC ($632.5M), bringing its total to over 25,000 BTC. It now ranks among the top 5 public Bitcoin holders globally.

What This Means

The Saylor playbook is going global. Metaplanet raised $1.4B to buy more BTC and just launched a U.S. subsidiary to monetize via derivatives.

The DAT narrative is hot, but not over yet: expect more small-cap firms to become Bitcoin holding companies with revenue-generating strategies.

3. Scaramucci Backs $700M AVAX Treasury Strategy

AgriFORCE (AGRI) is rebranding to Avax One, aiming to raise $550M to buy $700M+ in AVAX. Anthony Scaramucci is leading the advisory board, with support from Hivemind, Galaxy, ParaFi, and others.

What This Means

This marks the first major DAT strategy targeting AVAX, and it’s being backed by institutional capital and recognizable names.

“tokenization needs performant L1s” is an attractive narrative and Avalanche is being positioned as enterprise-ready infra.

For builders, this signals more liquidity, more incentive programs, and a renewed cycle of attention.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Why DOGE is a good analog for this cycle

Have we seen the peak of crypto price action?

⚡September 2025 Airdrop Checklist

Use these to potentially qualify for the biggest airdrops this year

⚡Proposal to Reduce HYPE Total Supply by 45%

Jon Charbonneau & Hasu propose changes to Hyperliquid’s economic model

⚡The best metrics to measure perp DEXs

Volume is easy to fake

Launchpads, Telegram bots, pre-IPO markets, Incumbents and more

⚡What to Expect in the Market This Month

The Dynamo DeFi team prepared an in-depth research report on the ecosystems and narratives driving the crypto market right now.

Patrick, Dynamo DeFi Founder, went live last Wednesday to walk through what to expect in the market and answered questions from the DeFi community.

We covered Ethena, Hyperliquid, prediction markets, digital asset treasuries and other narratives that are driving the market right now.

Get the first 30 minutes of the call FREE right here.

Pro members will receive instant access to a complete recording of the call and the presentation slides.

🔢Onchain Analysis

Record Week for Maple Finance

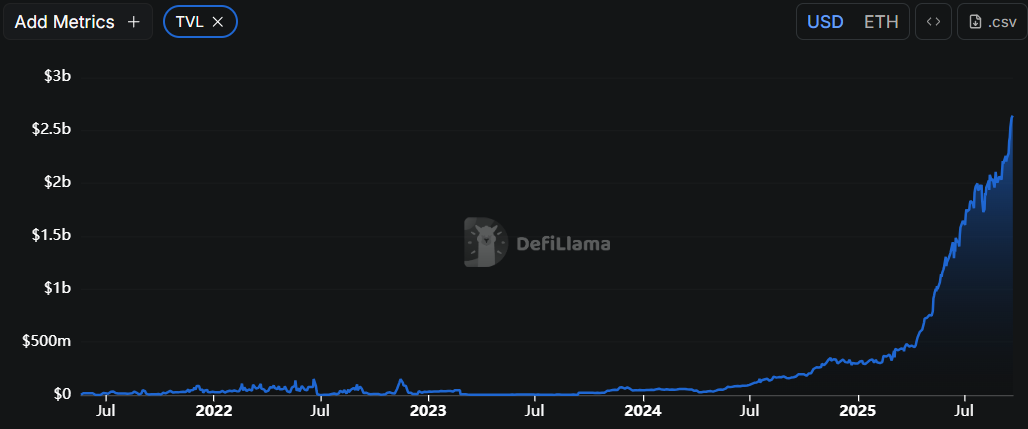

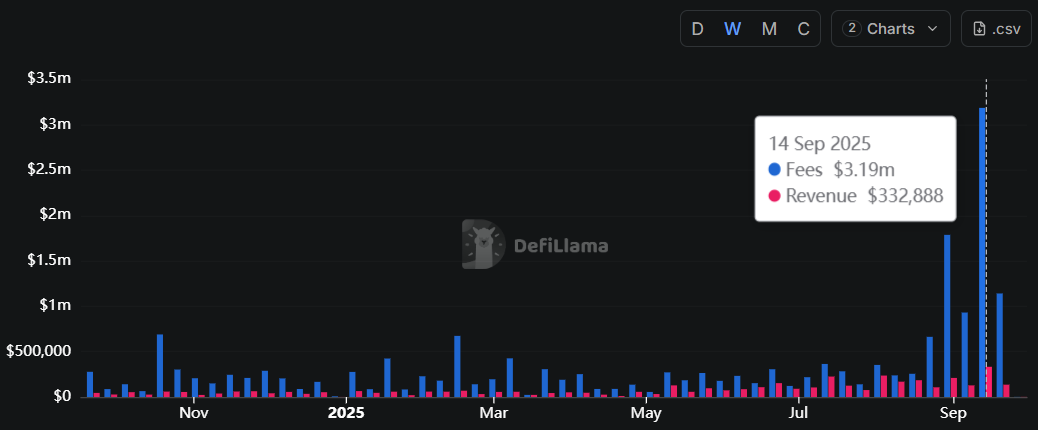

Maple Finance has been around for several years, traction began to accelerate about a year ago.

Since then, it’s been off to the races: TVL has increased 10x since this time last year, and more money flows into the onchain private credit protocol each day.

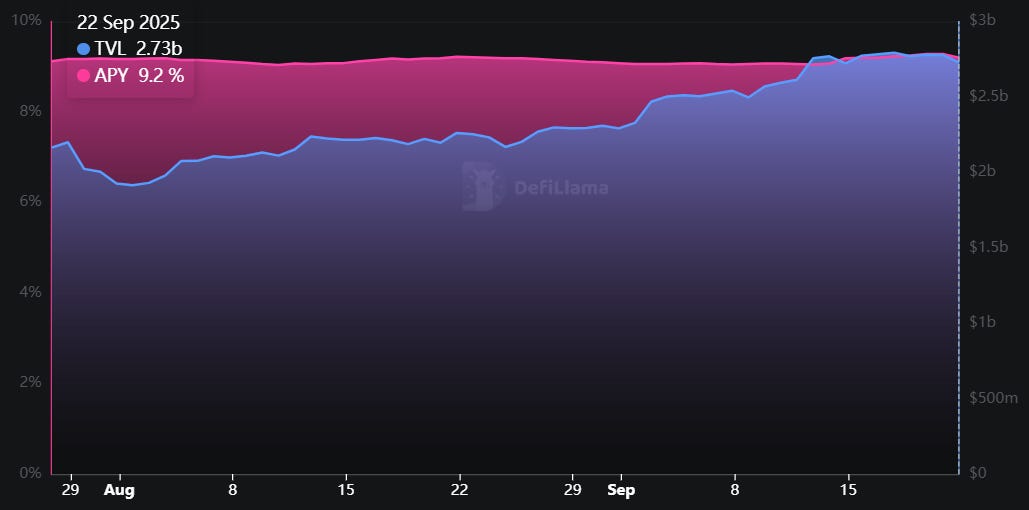

Maple’s products (onchain asset management, syrupUSDC backed by overcollateralized loans) are compelling: Maple wins on transparency, risk management and global reach.

400+ loans have been issued to institutions around the globe, and funding is generally completed within 24 hours.

9% APY on a stablecoin might sound boring to those in the trenches, but for an institution looking to earn yield on tens or hundreds of millions, it’s an offer worth looking at.

Maple is hitting its stride onchain: last week was a fee & revenue record.

RWAs, even if they seem boring, will be a pillar of institutional capital. Maple is carving out their place among the competition.

🚜Farm of the Week

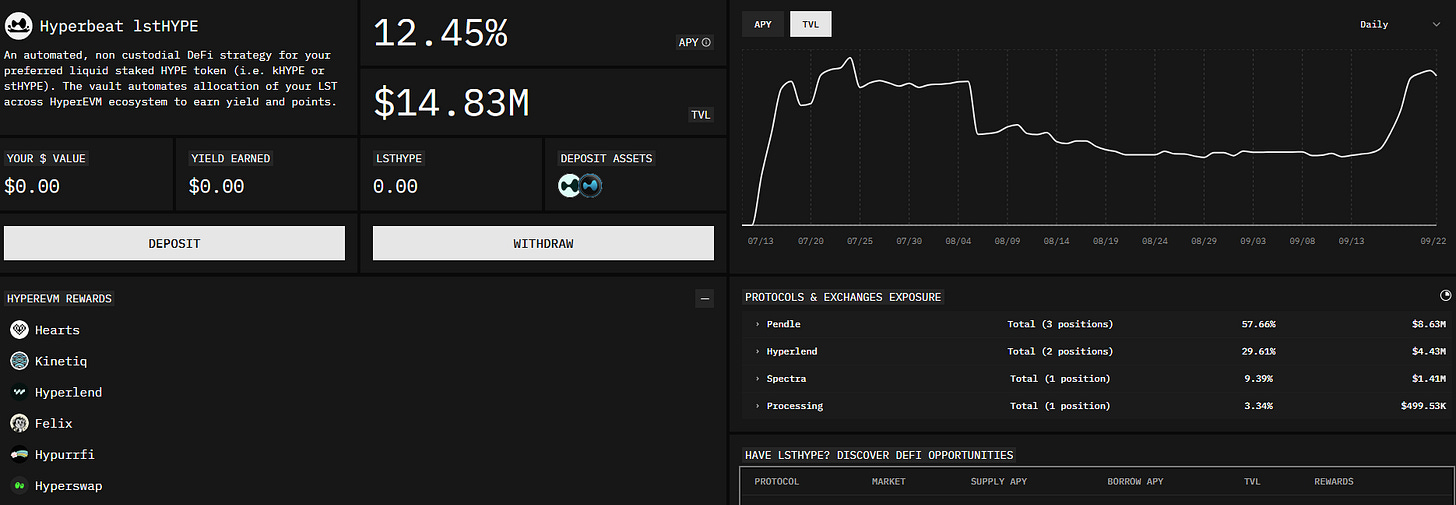

Hyperbeat lstHYPE Vault

Hyperbeat facilitates DeFi strategies on the Hyperliquid L1. This specific vault automates allocation of either popular LSTs on Hyperliquid: stHYPE or kHYPE.

Target APY is 12% and the vault earns points from 6 protocols on Hyperliquid.

How it Works

Head to Hyperbeat and deposit the LST token of your choice.

There’s a 3-day processing mechanism for withdrawals, or you can instantly withdraw from the vault for a 0.5% fee.

Risk Level: Low

Risks

Smart Contract risk

Protocol Layer risk

⚡Pump Crypto Analysis: The Launchpad Generating $700m in Revenue

🛠️Tool Spotlight

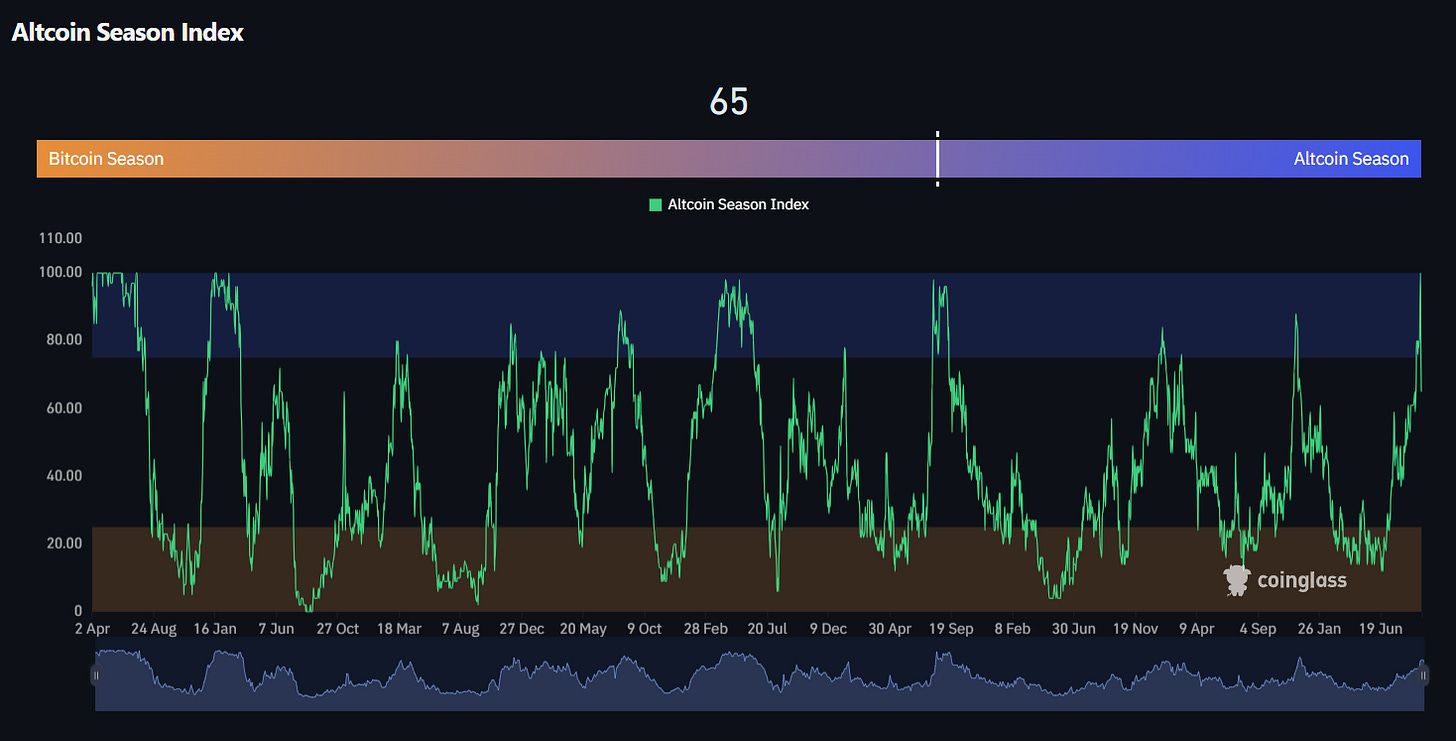

Is it Alt Season?

The Altcoin Season Index spots outperformance in altcoins relative to Bitcoin. It takes volatility, performance and sentiment into consideration.

It’s a helpful tool in the toolbox to better understand current market dynamics.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Fed Chair Powell Speaks - September 22nd

📊 August New Home Sales data - September 23rd

📊 August Durable Goods Orders data - September 24th

📊 US Q2 2025 GDP data - September 24th

📊 August Existing Home Sales data - September 24th

📊 August PCE Inflation data - September 25th

Token Unlocks: $150m Unlocking This Week

🔓MURA (1.09%) - September 23rd

🔓BICO (0.76%) - September 23rd

🔓TORN (2.4%) - September 23rd

🔓REZ (12.11%) - September 23rd

🔓VENOM (2.28%) - September 25th

🔓SCA (1.69%) - September 25th

🔓TRIBL (1.96%) - September 26th

🔓AXL (1.47%) - September 26th

🔓JUP (2.03%) - September 28th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 $COOK metamorphosis ends - September 23rd (Source)

🚀 GRVT rewards 2.0 - September 23rd (Source)

🚀 Plasma mainnet launch - September 25th (Source)

🚀 Hedera Upgrade - September 25th (Source)

🚀 Pendle hwHLP launch - September 25th (Source)

🚀 DOP Migration to V2 ends - September 26th (Source)

🚀 Ethena S4 points program ends - September 17th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi