⚡Return to Fundamentals [Dynamo DeFi Pro Report]

On-chain insights and DeFi strategies

💡Dynamo’s Thoughts

The Metrics that Decide which Protocols Survive & This Newsletter

I’m changing the format of this premium newsletter a bit. After the memecoin bubble and subsequent crash over the past few quarters, I’m focusing more on fundamentals.

This means two things:

Networks that stand to benefit from concepts like Metcalfe’s Law

Protocols that earn real revenue

As a result of this, I’m making this newsletter weekly again, with a focus on metrics. Real metrics. Protocols that are growing in ways that are difficult to fake and protocols generating real revenue from real usage.

For this week, that will focus on highlights of interesting things I’ve encountered onchain like in last year’s premium newsletters. Moving forward that will incorporate more direct analysis of protocols that offer real value in a market devoid of such.

I’m also going to start including more DeFi strategies here. This week, that includes the high level IPOR rates—in the future, I’ll be seeking opportunities to outperform those too, without needing to move farms each week.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are growing?

Onchain Metrics

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

Onchain Milestones - Chains and protocols that hit on-chain milestones, such as breaking their ATH in TVL

🔭Market Outlook

Market Health

Total DeFi TVL

Down 33% from the highs in December. Back to the March-July range we saw in 2024.

Fear & Greed Index

In late January, the F&G Index briefly popped up to 84. At the time, we talked about how the F&G index doesn’t typically stay above 80 for very long.

Since then, the index dropped dramatically, falling as low as 10 on February 27th. The index has spent time at or below 10 only nine times since 2018.

The market has become slightly more confident since falling to extreme fear, and is now back in the 30 range.

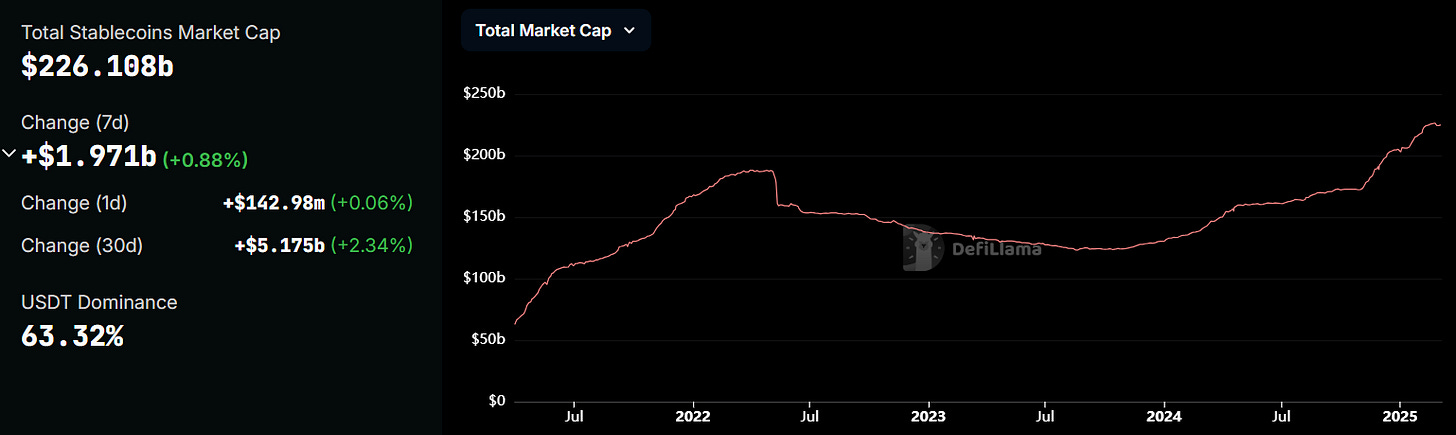

Stablecoin Market Cap

Stablecoin market cap saw a small dip last week after hitting $226B, but already reclaimed that number after adding nearly $2B in the last 7 days. Market cap is currently sitting at all-time highs.

ETF Flows

After 5 consecutive months of inflows, BTC ETFs saw their largest outflow month ever to the tune of $3.5B in outflows. $2.6B of those outflows came in a single week - February 22nd-28th.

March has not been very kind to Bitcoin ETFs either.

February was a positive inflow month for ETH ETFs ($60M). However ETH ETFs saw outflows for 10 out of the last 11 trading days, erasing the March inflows.

Since inception, Bitcoin ETFs accumulated $36B in net flows and Ethereum ETFs accumulated $2.7B.

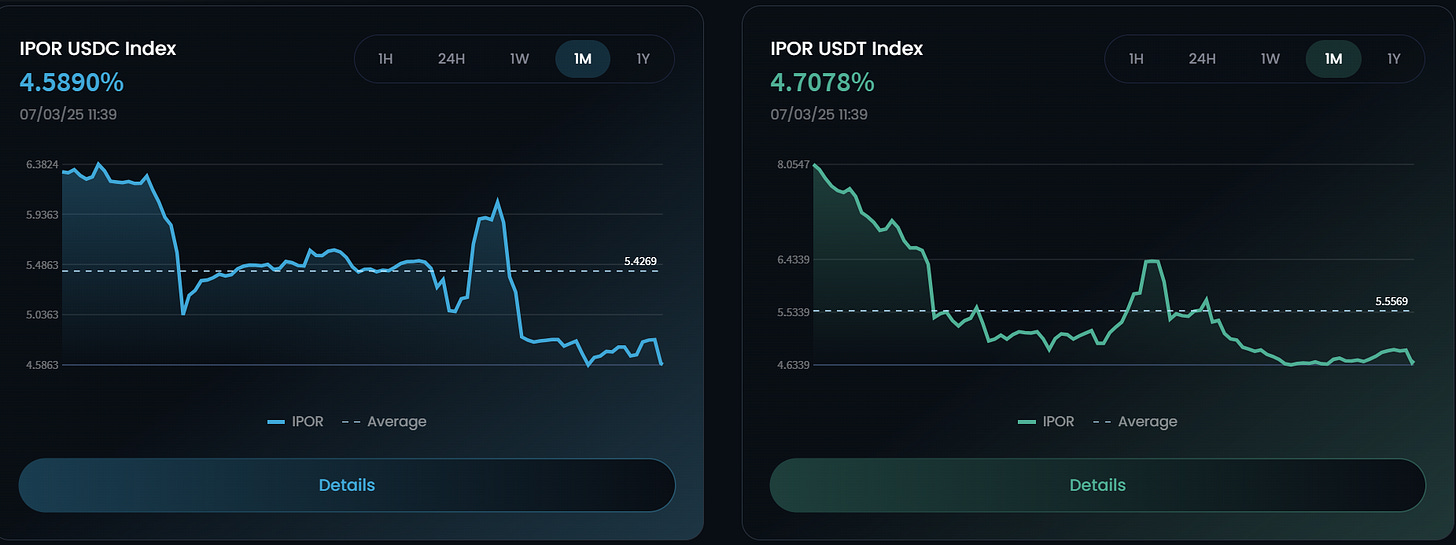

IPOR Stablecoin Indeces

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity. The benchmark stablecoin rates are trending down after peaking in mid-December.

Category and Chain Trends

Category TVL Changes

The Developer Tools and Farm categories showed the strongest growth this week. Developer Tools is a miniscule category in terms of TVL, while Farm growth was driven by Zircuit. Despite relatively weak prices this week, relative points of strength have been Liquidity Managers and NFT Lending.

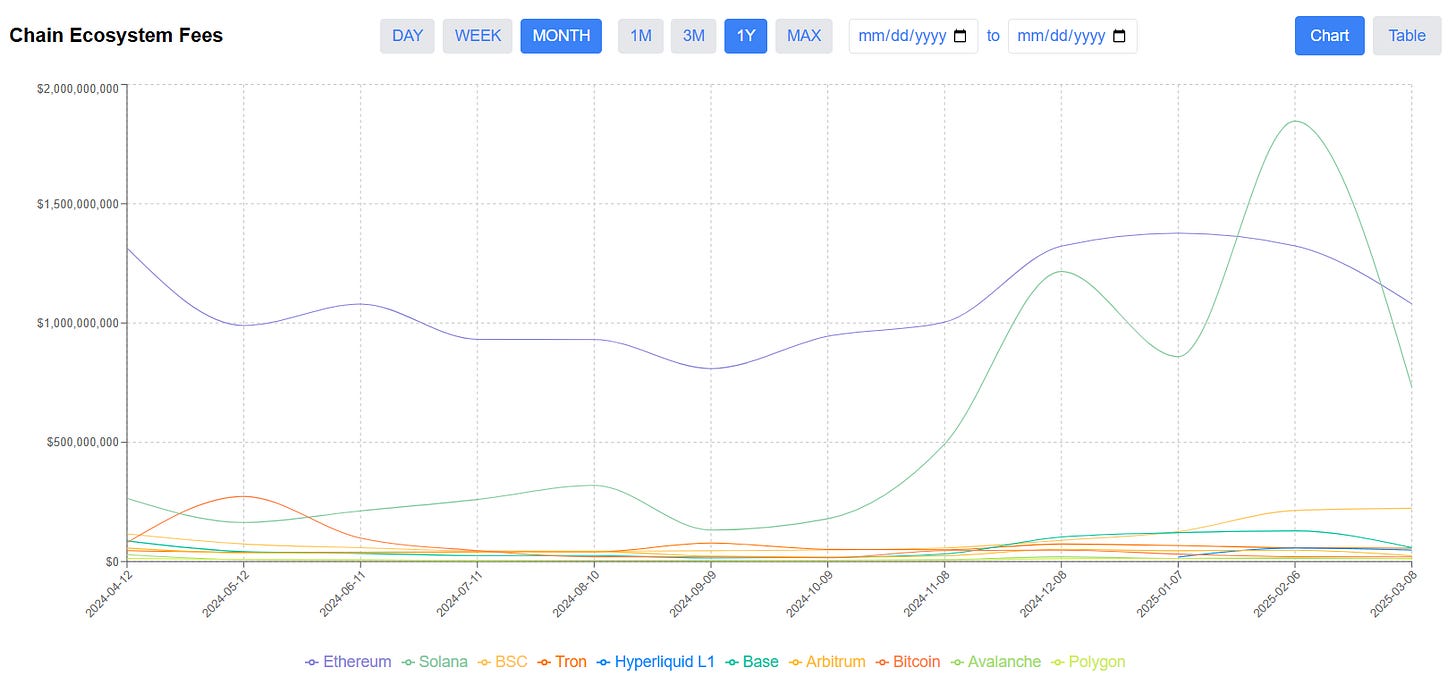

Chain GDP / Chain Ecosystem Fees

Chain GDP, which I’m now calling Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

Since this has been a custom metric up to this point, I built a dashboard myself to show this over time by chain: https://dashboard.dynamodefi.com/

Ethereum’s steady $30-40M daily fees are handily above all other chains. Solana activity cooled down, but only back to levels last seen in October.

Solana still earned 70% of Ethereum’s monthly fees.

BSC, Berachain and Sonic are the only chains with positive 30d growth. Avalanche saw a 52% spike in ecosystem fees over the last 7 days.

Fastest Growing Chains ($100M+ TVL)

Zircuit’s insane TVL growth was driven by massive inflows into the Zircuit Staking Farm.

Cardano’s strong price following news about its potential inclusion in a strategic reserve pushed its TVL upwards.

Sei’s TVL denominated in SEI tokens is up and to the right for the last 5 months, spiking even further the past 2 weeks. Prominent protocols like Yei Finance, Sailor and Avalon Labs TVL’s are up 50-200% on the week.

Yei Finance has impressive supply rates for lending - specifically WBTC earns 12%, higher than WETH. It’s not easy to find 10%+ APYs on BTC.

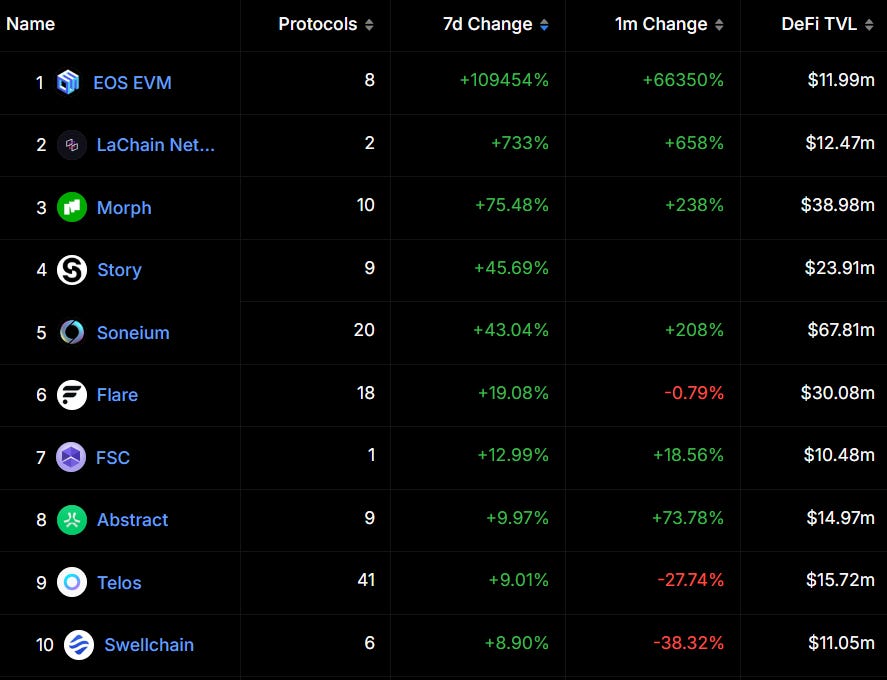

Fastest Growing Chains ($10M-100M TVL)

TVL increased on a number of emerging ecosystems this week, most dramatically on EOS EVM and LaChain. Other notable increases were on Morph, which had a sudden jump in TVL, Story, which is an IP-focused blockchain and incipient DeFi ecosystem, and Soneium, Sony’s chain the Superchain ecosystem.

📊Onchain Metrics

Onchain Highlights

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.