⚡Restaking is an ETH Vacuum

Plus embracing points systems, stablecoin inflows to Solana, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

📈Trends and Narratives

Restaking is an ETH Vacuum

December 2023: ~$300M of TVL in restaking protocols.

February 2024: over $4B of TVL in these protocols

(Note that some of that TVL is double counted).

Liquid Restaking TVL. Does not include Eigenlayer’s $2.18B TVL

We haven’t seen TVL growth like this in quite some time.

So what is restaking? Essentially, it’s a way to utilize already-staked $ETH across multiple protocols. This is a way to ‘share’ ETH’s platform security with other platforms - think Layer 2s, or other Layer 1s.

Why is it so popular? EigenLayer is currently running a points system and given it’s $2B+ TVL it will likely be the largest protocol launch of the year. The benefit to using these liquid restaking protocols like Puffer and Ether.fi is that you can earn both native protocol points and Eigenlayer points. Restaking and Repointing.

DefiIgnas on Twitter summed up the benefits and risks concisely in his newsletter:

Note that protocol and smart contract risk tends to increase when you’re ‘stacking’ multiple protocols and using them concurrently.

Here’s a great tweet from Moomsxxx giving a more in-depth overview of restaking risks. Worth a read!

Embracing Point Systems and Airdrop Farming

Every day there’s a new protocol announcing point systems. It’s hard to keep up. In fact, at this point (get it?), points are almost a meme.

New projects want your time, attention and capital so their protocol can see success.

While point systems can be quite annoying at times, it’s certainly an improvement from years ago when you had no idea whether a protocol would launch a token. Protocols get more users, and users are able to pre-farm accumulating points.

However, to receive airdrops that are worth your time & effort, you need to apply a bit of discipline (don’t try to farm anything and everything) and you need to know what to look for.

I created a video about what to look for after receiving the JTO airdrop last year.

I’ve found that I’ve been rewarded the most when I act like a REAL USER - so I always ask myself: “what would a user that is trying to learn more about this protocol do?”

Be curious about the protocols you enjoy using, and you will find creative ways to earn points (and subsequently tokens) that passive farmers won’t. Better to treat 5 protocols like you’re a real user than farm 30 protocols with tiny amounts and potentially not hit the threshold for any of them.

What are the protocols with point systems that you’re most excited about right now? Comment on this post on Substack and I might cover it.

⚡Learn Crypto with Dynamo DeFi Pro

I’ve made some major improvements to the paid version of the this newsletter. Read about them here:

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

Over $250M of Stablecoin Inflows to Solana

In the midst of the Jupiter airdrop, over $250M of stablecoins entered the Solana ecosystem this week, pushing the total stablecoin on Solana above $2B for the first time since November 2022.

Watch for these stablecoins to stay in the ecosystem and for inflows to continue.

Restaking and Liquid Restaking Reach New Heights

Restaking and Liquid Restaking have been the breakout DeFi categories of the year so far.

Most protocols in these categories are relatively new and, since they often involve depositing and redepositing across multiple protocols, there’s substantial smart contract risk. However, the extra yield on ETH and points offered by these protocols is attracting serious capital.

🛠️Tool Spotlight

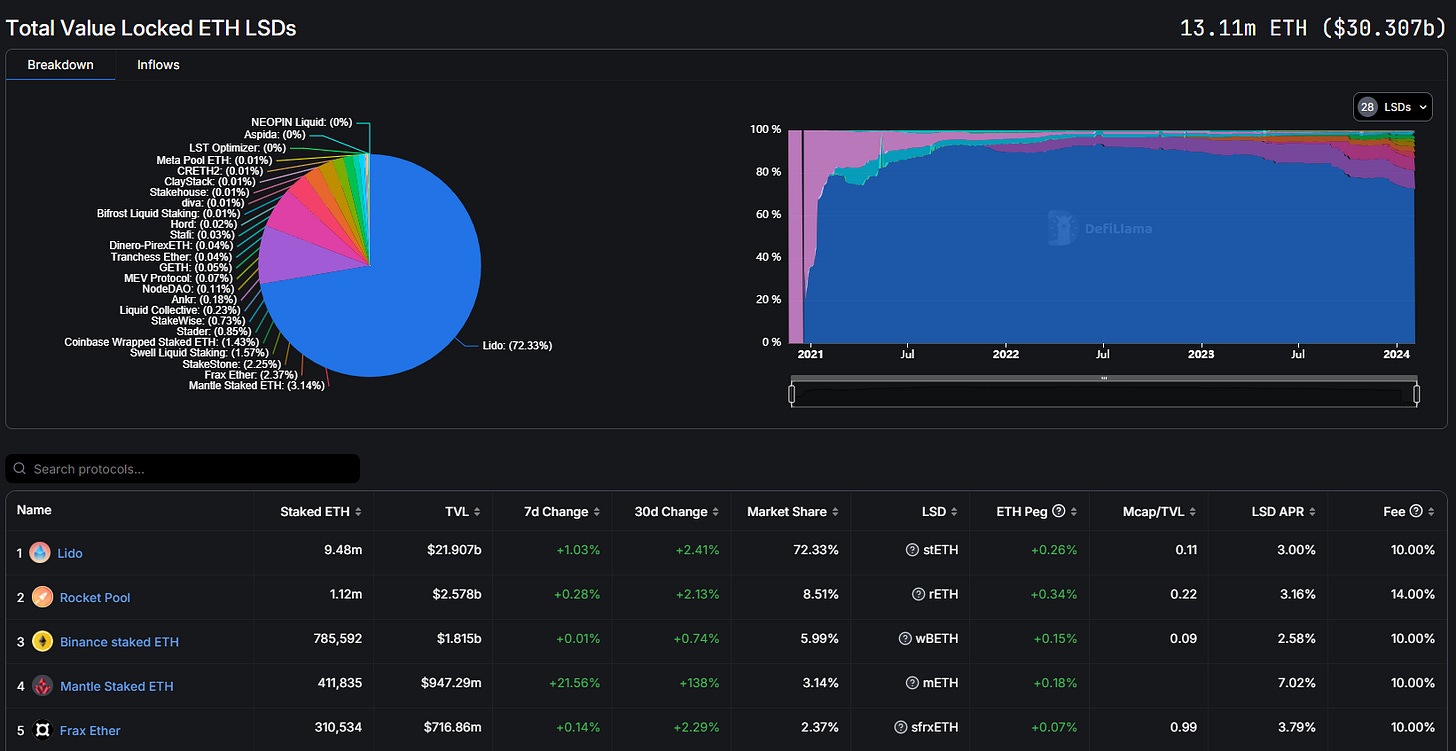

Track Liquid Staked ETH with DefiLlama’s Dashboard

DefiLlama’s protocol and chain dashboards are well-known at this point. However, they also have a number of niche dashboards that aren’t as widely used, despite being highly useful.

One such dashboard is their ETH LSD dashboard, which tracks the shifting dominance of the many ETH liquid staking protocols.

📅Key Events This Week

Macro Events

📊FED Chair Powell speaks - Feb 5th

📊 FOMC member Bostic speaks - Feb 5th

📊 FOMC member Mester speaks - Feb 6th

📊 FOMC member Kugler speaks - Feb 7th

📊 FOMC member Barkin speaks- Feb 7th

📊 FOMC member Bowman speaks- Feb 7th

📊 FOMC member Barkin speaks- Feb 8th

Token Unlocks

🔓 IMX (2.04%) - Feb 5th

🔓 GMT (6.2%) - Feb 7th

🔓 ENS (3.05%) - Feb 7th

🔓 HFT (4.02%) - Feb 7th

🔓 KWENTA (0.5%) - Feb 8th

🔓 APT (7.3%) - Feb 11th

Launches

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 $STRD airdrop to $sTIA holders - Feb 5th (Source)

🚀 Bitcoin Name Service Marketplace Launch - Feb 5th (Source)

🚀 BRISE Staking Launch - Feb 5th (Source)

🚀 Polygon Etrog Upgrade - Feb 6th (Source)

🚀 Astar dApp V3 Staking - Feb 6th (Source)

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi