⚡Real World Assets to Save DeFi?

Plus Ethereum's new roadmap, the world of crypto reacts to SEC suits, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

In this issue:

🔢On-Chain Metrics

📈Trends & Narratives

🛠️Tool Spotlight

📅Key Events This Week

🔢On-Chain Metrics

Price Drops Push TVL Down

Total DeFi TVL, including liquid staking, dropped from $67.05B to $61.21B this week.

Price drops, driven in part by the SEC naming certain tokens as securities, pushed DeFi TVL down across the board on major chains this week. The drop was most pronounced in BNB and SOL, which were explicitly identified as securities.

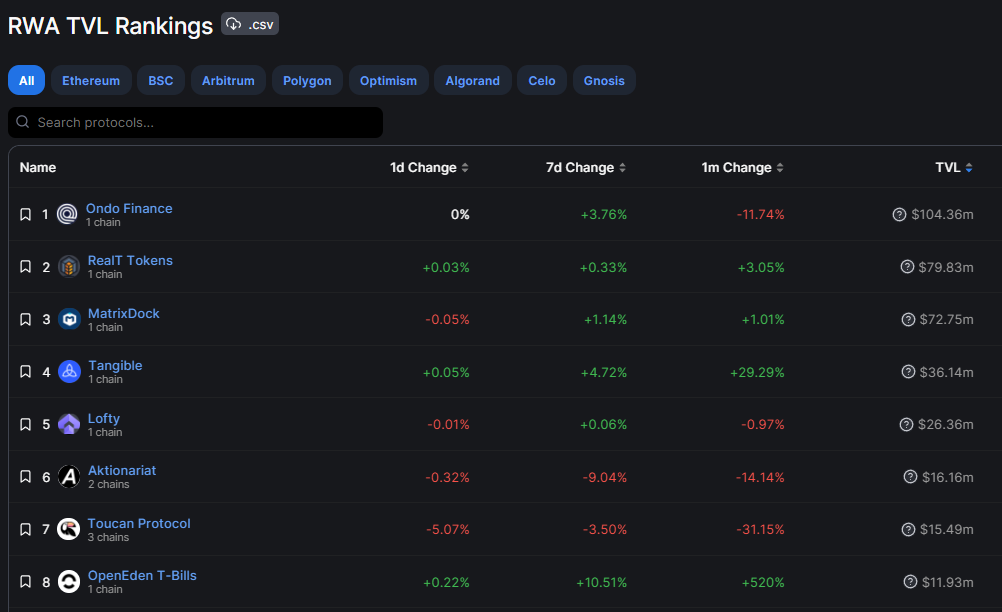

Real World Assets

Real World Assets seem to be the only category of DeFi that grew this week. This includes treasuries, real estate, and equities that are tokenized on-chain.

Perhaps projects that already built with compliance in mind are most resistant to regulation.

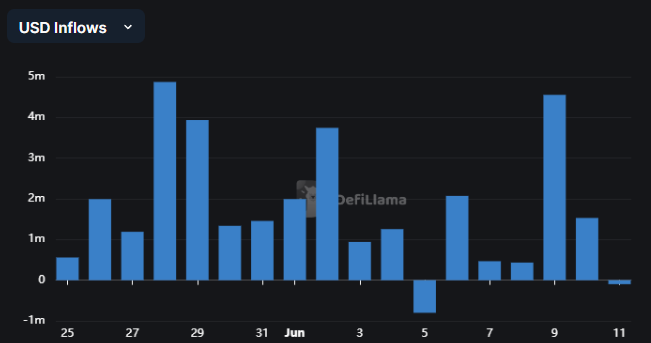

Stablecoins Continue Flowing to zkSync Era

Stablecoins continued to flow into zkSync Era this week. Nearly $10M entered the chain over the past 7 days.

📈Trends and Narratives

Crypto World Reacts to SEC Suing Coinbase and Binance

The big news in digital assets from this week was undoubtedly the SEC suits against Coinbase and Binance for operating as unregistered securities exchanges. Here are some reactions from the crypto world that stood out to me.

Brian Armstrong, Founder of Coinbase, responds:

Ryan Selkis, Founder of Messari Crypto, still sees a path to total victory for crypto in the US:

Thread on how crypto cycles, the rise and fall of heroes, and how legal action against Binance could mark the beginning of the end for the Bear Market:

Vitalik Buterin Releases New Ethereum Roadmap

Vitalik published a blogpost that outlines the technical transitions needed for Etheruem to turn into a mature tech stack:

L2 Scaling

Wallet Security

Privacy

Privacy Coins

Aside from Vitalik identifying privacy as one of the 3 key transitions for Ethereum to go through, SEC regulation has put new focus on privacy coins.

My position has always been that privacy and decentralized tokens and compliant tokens will be the biggest beneficiaries from regulation, while those that try the middle road will be most vulnerable. Here are a few updates that caught my eye…

Railgun partners with Beefy to launch private yield vaults:

Silent Protocol building compliant privacy on Ethereum:

For the real cypherpunks, DERO’s homomorphic encrypted L1 has been getting attention:

🛠️Tool Spotlight

Tracking Exchange Wallets with Arkham Intel

As concerns about exchange solvency resurface, Arkham Intel is the best free tool I’ve found for tracking inflows and outflows. Though this doesn’t show liabilities, it does show you which assets are verified on-chain in an exchange’s wallets.

Note that there is a waitlist to get an Arkham Intel account.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi