⚡PayPal to Bring Stablecoins to Millions

Plus Base and Mantle gain traction, total TVL dips, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

In this issue:

🔢On-Chain Metrics

📈Trends & Narratives

🛠️Tool Spotlight

📅Key Events This Week

🔢On-Chain Metrics

Total Value Locked Trends

Total DeFi TVL (including Liquid Staking) had a very slight dip this week, moving from $62.61B to $62.32B. This drop was more pronounced on Layer 2s and alt Layer 1s than on Ethereum.

Despite overall TVL being down, there were bright spots in the market. Spark, a new protocol built by MakerDAO, grew 156% to surge past $100M in TVL. Curve and Convex recovered some of their lost TVL. Real World Asset protocols continued to outperform as well.

Cross-Chain Flows

Arbitrum and zkSync Era saw the largest net inflows this week, with Ethereum and Gnosis Chain also experiencing net inflows.

Top Earning Protocols

The top 10 protocols by fees collected this week saw a lot of familiar faces. Aave had a massive increase in fees related to interest rates spiking due to the Curve situation.

📈Trends and Narratives

PayPal Launches PYUSD Stablecoin

This week kicked off with major news in the world of stablecoins. Payment giant PayPal is launching their own stablecoin, known as PYUSD. Here’s what we know so far:

PYUSD will be issued as an ERC-20 on Ethereum

PayPal is partnering with Paxos to launch PYUSD

PYUSD will be backed by USD deposits, short-term US Treasury bills, and cash equivalents

PYUSD will be integrated into Venmo

Such a well-known payment provider launching a stablecoin has the potential to, not only drive stablecoin adoption, but to lend legitimacy to stablecoins in general. Millions of PayPal’s users will likely be exposed to stablecoins for the first time.

Tether generated over $1B in operating profit last quarter. If PYUSD is similarly successful and profitable, I expect more institutions to follow suit.

New Generation of Layer 2s Heat Up

Through 2022 and early 2023, we witnessed adoption of Arbitrum and Optimism skyrocket. Now a new generation of Ethereum Layer 2s, with major backers, have started to gain steam.

Base, Coinbase’s Layer 2, after a dramatic start, steadily gained traction this week, approaching its peak TVL from last weekend.

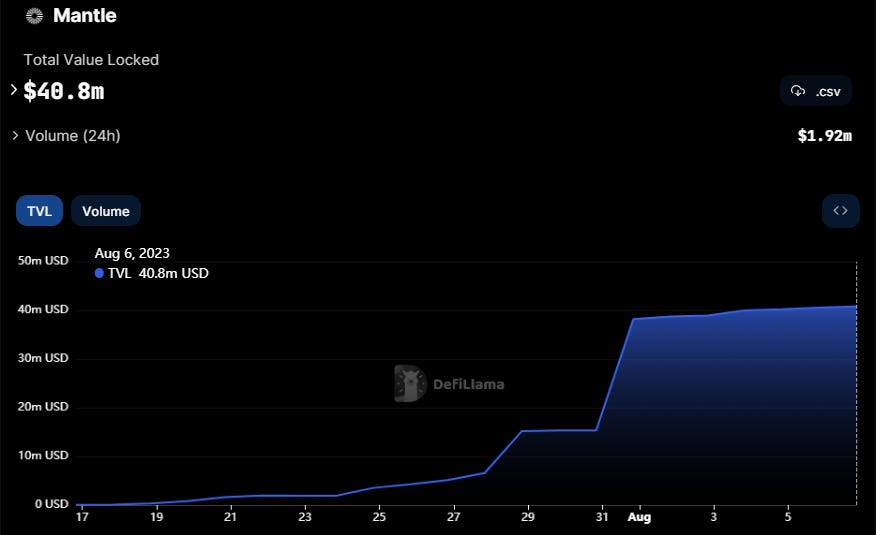

Mantle, BitDAO’s Layer 2, is also a recent winner, climbing to over $40M in TVL from nothing less than a month ago.

Time will tell whether these chains can reach the same heights as Arbitrum and Optimism; however, if they do, I expect their ecosystems to perform well.

If you’re trading on-chain, you can now snipe DEX listings, set limit orders, swap MEV free, and more with Unibot. (Affiliate Link)

🛠️Tool Spotlight

Use Alphascan to Find Influencers who Called a Token Early

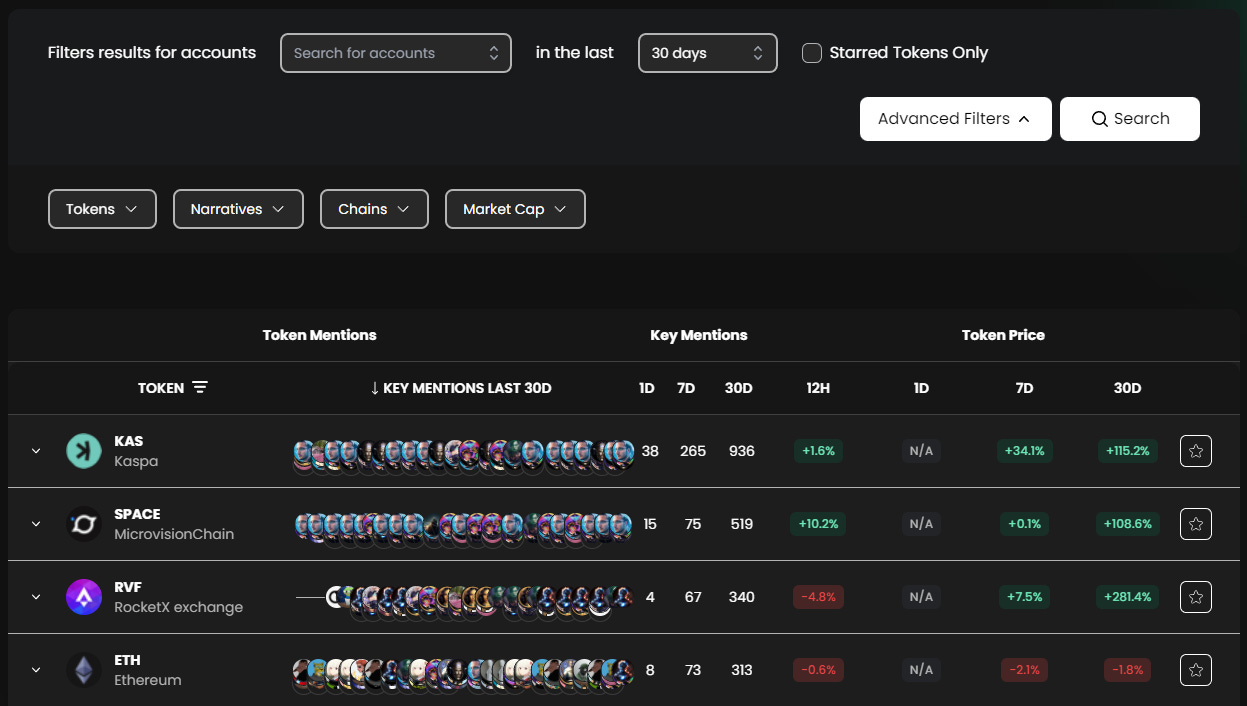

Hedge fund billionaire Dan Loeb recently said, “fundamental analysis is increasingly taking a back seat to monitoring option expiries and Reddit message boards.” That’s why I’m making more and more use of tools that place data on social signals.

Foremost among those tools in Alphascan, which tracks which influencers called a token early and how specific influencers’ calls have performed in the past.

*Disclosure: I am a paid ambassador for Alphascan’s analytics platform, but have been using it since before starting an official relationship.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter, TikTok, and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

Great edition, always learn about something interesting from your newsletter thank you for sharing your research

Thanks for sharing!

Soon a Paypal permissioned L2 built on the OP stack to run the Stable? :D