⚡The Fight to Own the Future of Betting [Dynamo DeFi Pro Report]

Chainlink, CFTC approvals, and crypto-native traction collide in a $10b market

💡Dynamo’s Thoughts

Polymarket recently announced a partnership with Chainlink to launch 15-minute crypto up/down markets.

0DTE options, prediction markets, perps, 15 minute up/down markets…

There are increasingly numerous ways to ape into the current market.

Fortunately, it’s possible to make money on this trend, even if you are too sane or too statistically informed to try your hand at 15 minute up/down markets anyways. Polymarket’s evolution into a platform for binary options on the market puts it more directly in competition with perp exchanges like Hyperliquid.

In this way the race is on to create a superapp for speculation.

Pump is also competing in this vertical, but from a very different angle. Pump is lets users ratchet up risk, not by adding leverage, but by buying smaller, more volatile assets. And rather than betting on future events (Polymarket) or price movement (Hyperliquid), Pump lets you bet on which memes or streamers will go viral.

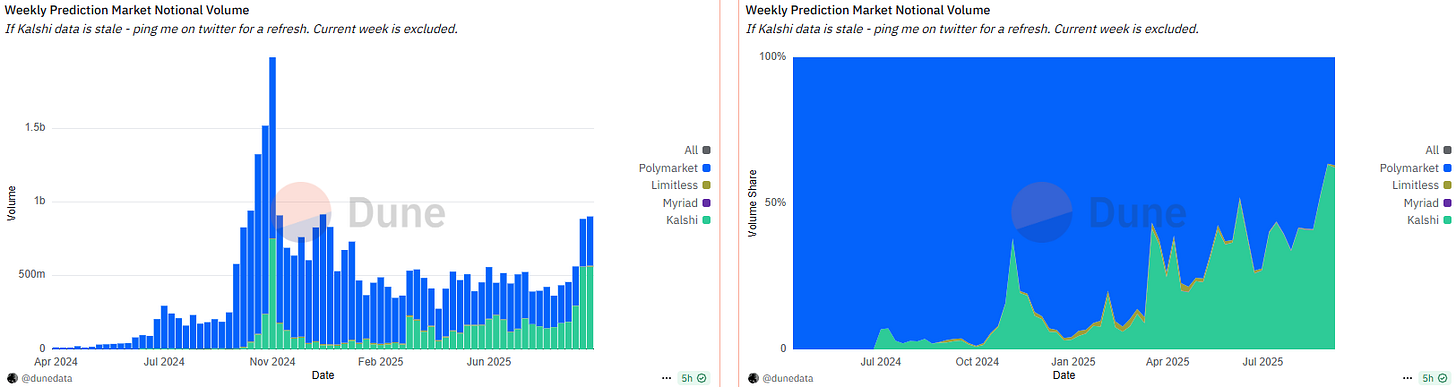

But back to prediction markets, while Polymarket has been the market leader for a few years, it’s dominance is not a guarantee.

Kalshi’s CFTC- registered exchange gave it a legality edge while Polymarket was under investigation.

Not exactly a long-term moat, but enough to grab some market share. Now, Kalshi is making some overtures towards the crypto market (despite a contentious relationship in the past), and gaining traction.

In the first two week of September, Kalshi has facilitated more notional volume than Polymarket.

Robinhood is also moving quickly on prediction markets for a reason.

With widespread distribution, a strong onchain presence, access to equities & IPOs, prediction markets and sports betting, Robinhood presents the first real financial superapp that already has tens of millions of users.

The competition is fierce, but prediction markets are mainstream and growing. Polymarket is reportedly raising another round at a $10b valuation and Kalshi has a $5b val raise coming up.

By the way, it’s probably worth noting that Polymarket has a non-zero probability of airdropping a token.

We don’t know who will emerge as the dominant prediction market or speculation superapp, but we do know that many of these apps are making serious revenue. Arguably the first DeFi businesses to do so at scale.

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are winning?

Onchain Metrics

Digital Asset Fundamentals

Onchain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

Before I start, if you’re looking for a more comprehensive overview of trends driving the market, check out our monthly Zoom call from this week:

Dynamo DeFi Pro Group Call - August 2025

Each month, I conduct a group Zoom call with premium Dynamo DeFi subscribers to discuss the trends driving the crypto market.

🔭Market Outlook

We’ve heard your feedback from last week’s poll that you want more trending altcoins. We’ll be introducing several new newsletters each month:

Top 5 altcoins based on fundamentals that month. 3 will be free and 2 will be paywalled.

Portfolio changes each month. For paid subscribers, I’ll provide a monthly update on what I’m holding, based on fundamentals.

Market Health

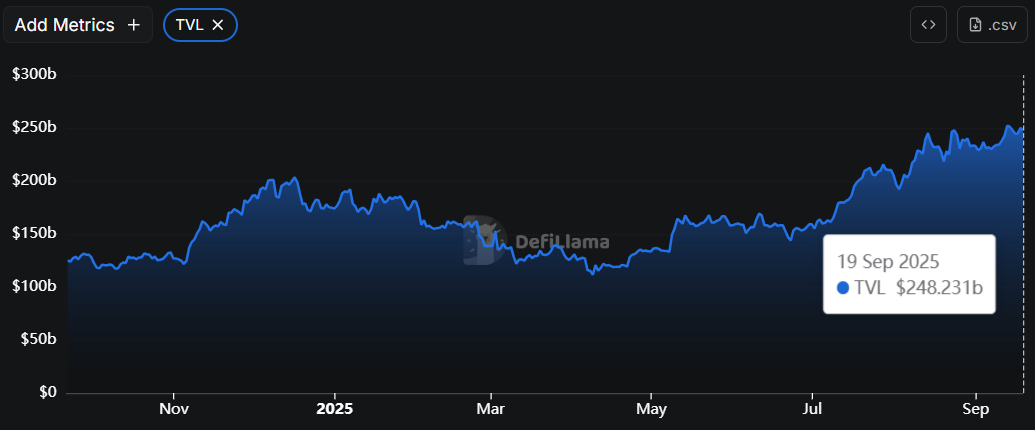

Total DeFi TVL

Total DeFi TVL is knocking on the ATH door. Currently just under $250b.

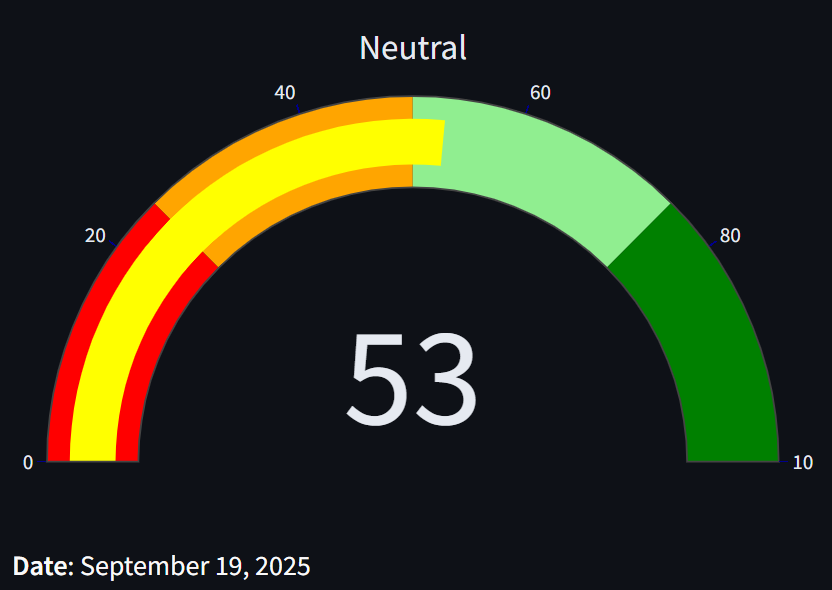

Fear & Greed Index

I created a website to track Fear & Greed with more detail. Check it out here.

Today’s reading: 53, Neutral

Stablecoin Market Cap

We’re going to see $300b very soon.

Ethena USDe growth added another $1b in market cap over the last 10 days.

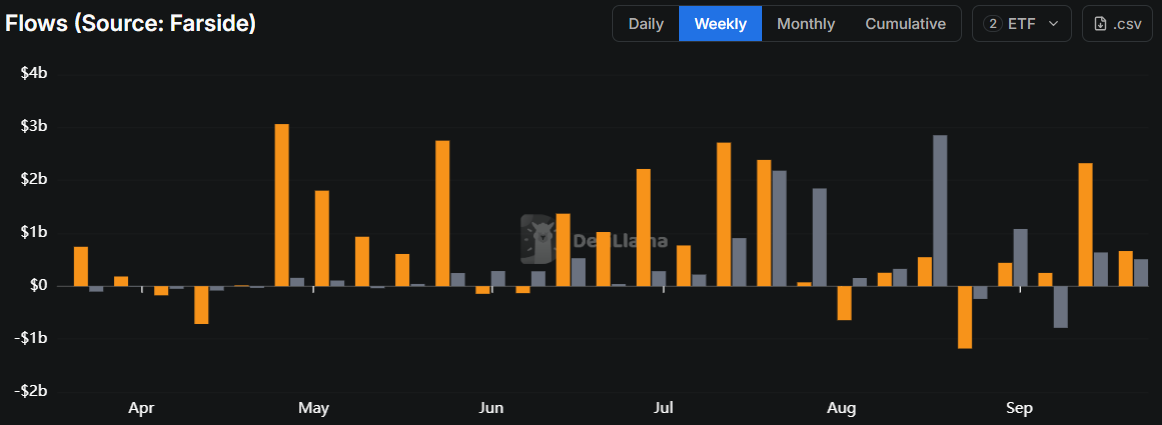

ETF Flows

Late August and early September were sluggish for ETFs, but Bitcoin is on a 4-week inflow streak and ETH has seen back-to-back $500m inflow weeks.

Both ETF cumulative flows are at all-time highs.

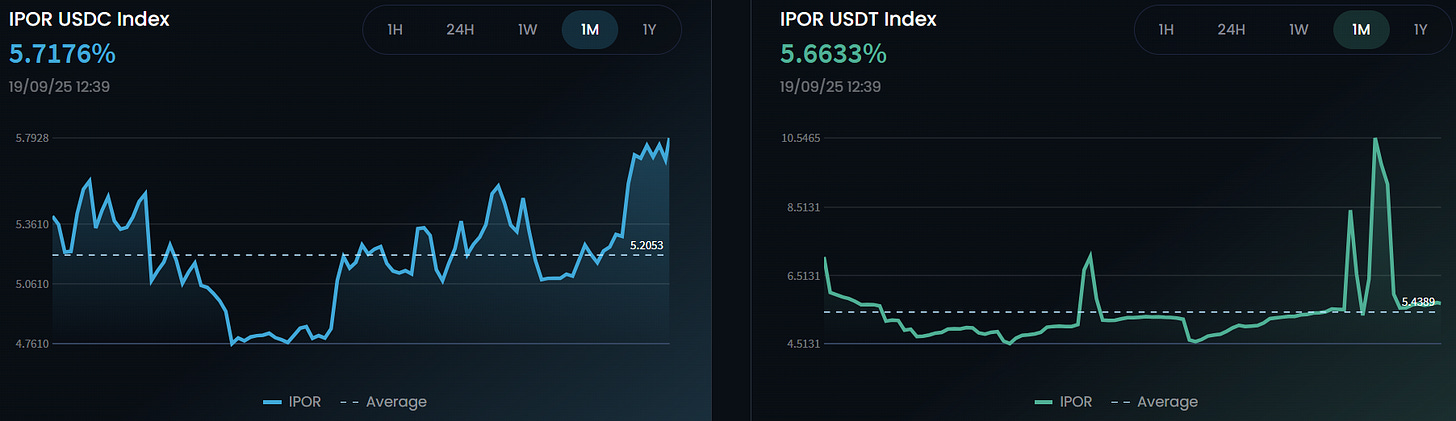

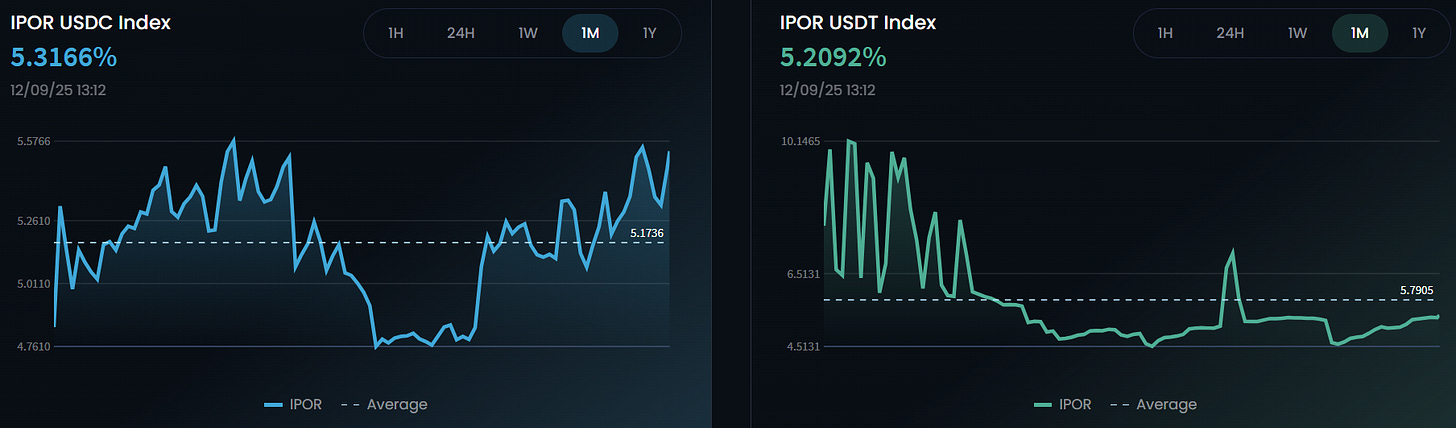

IPOR Stablecoin Indices

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity.

Rates for USDC & USDT are still hovering above 5% and generally creeping upward.

Higher than the monthly average, still lower than the yearly average.

For reference, here are last week’s numbers:

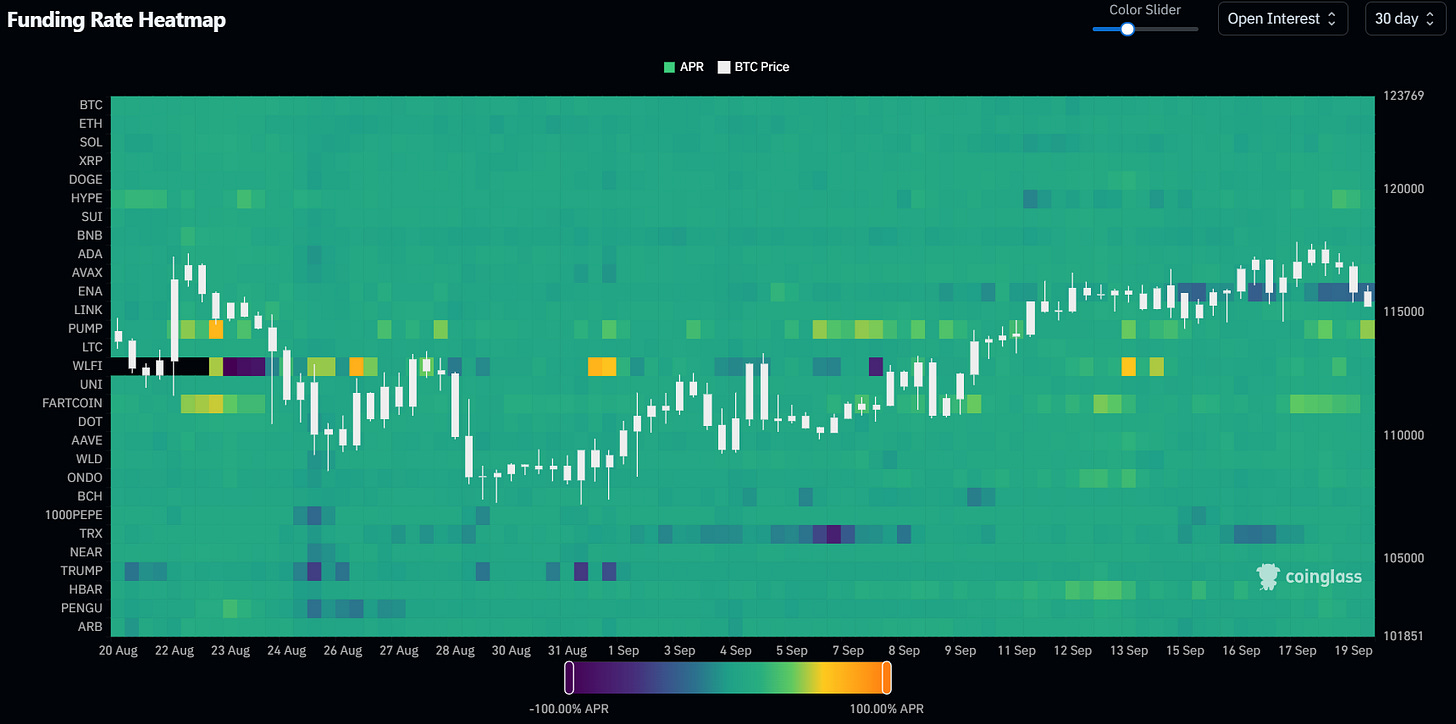

Funding Rate Heatmap

The Funding Rate Heatmap from Coinglass displays funding rates across some of the largest crypto assets.

Brighter colors indicate elevated funding rates for longs, and darker colors indicate low or negative funding rates (indicates large short positions).

Funding rates have increased for PUMP (46% APY to long), HYPE & Fartcoin. ENA funding is the most expensive perp to short, with shorts paying longs 25% APY.

Category and Chain Trends

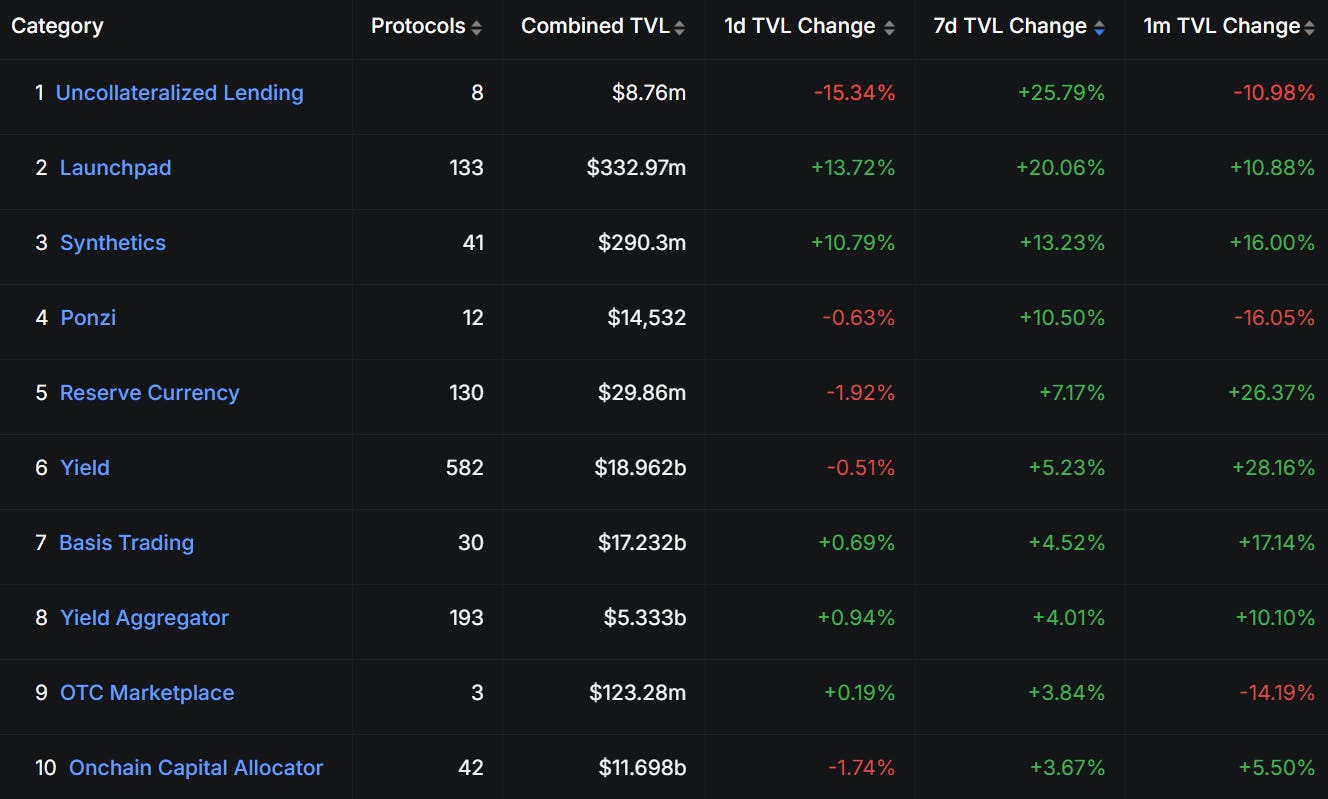

Category TVL Changes

The launchpad category, while not known for having high total TVL, is a top 5 category for earnings, with combined 24hr revenue ~$1.8m. Pumpfun, Meteora and Metaplex have almost no registered TVL but hundreds of thousands (or in Pump’s case, millions) of fees earned in the last 24 hours.

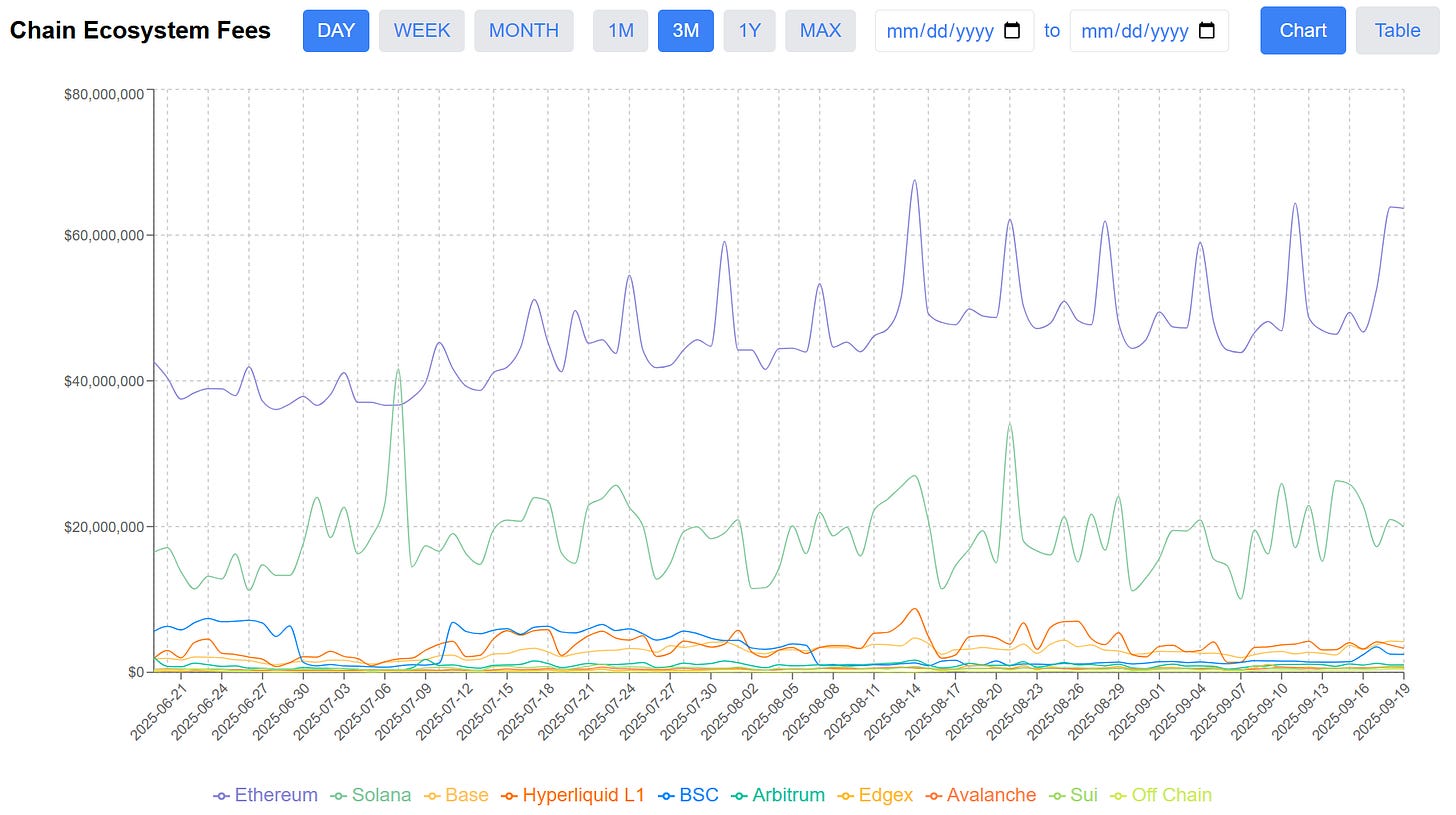

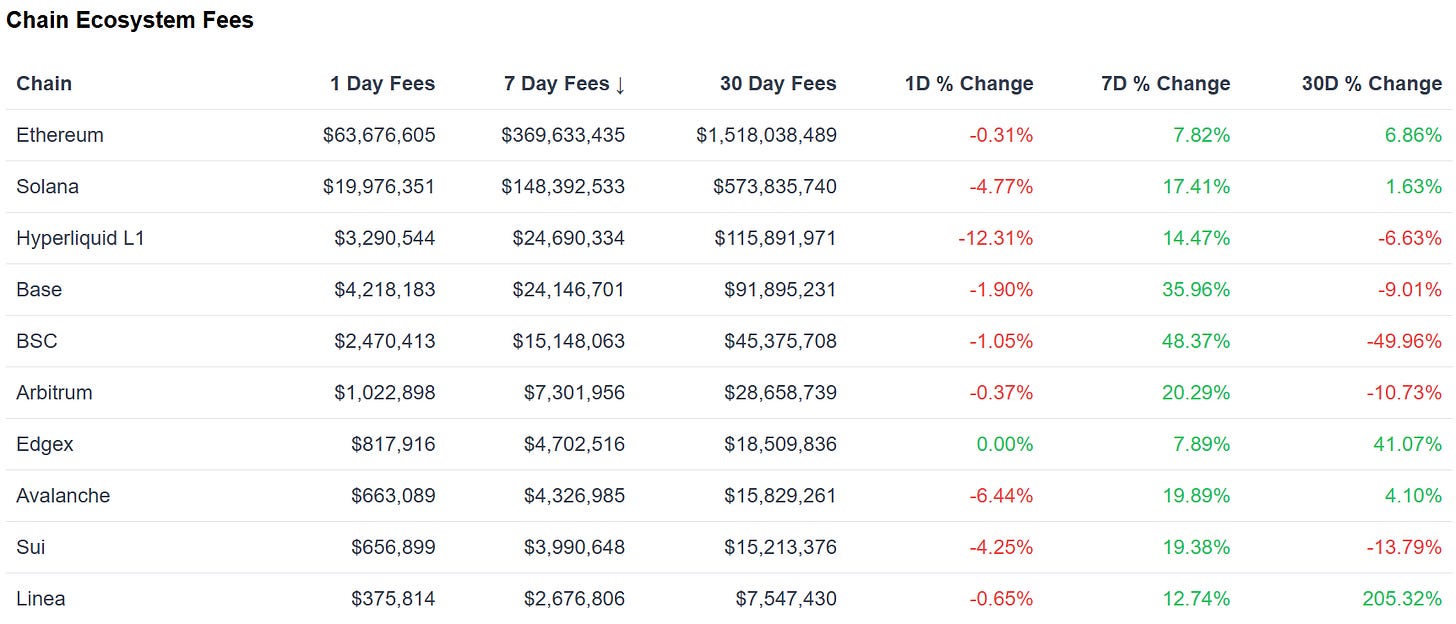

Chain GDP / Chain Ecosystem Fees

Chain GDP, also known as Chain Ecosystem Fees, measures the sum of fees spent on all applications on a chain.

I built a dashboard to show this over time by chain before it was available elsewhere: https://dashboard.dynamodefi.com/

CEF have remained mostly unchanged for most chains: they’re up on the week, down on the month. EdgeX, a Hyperliquid competitor, has nearly $5m in 7-day Chain Ecosystem Fees.

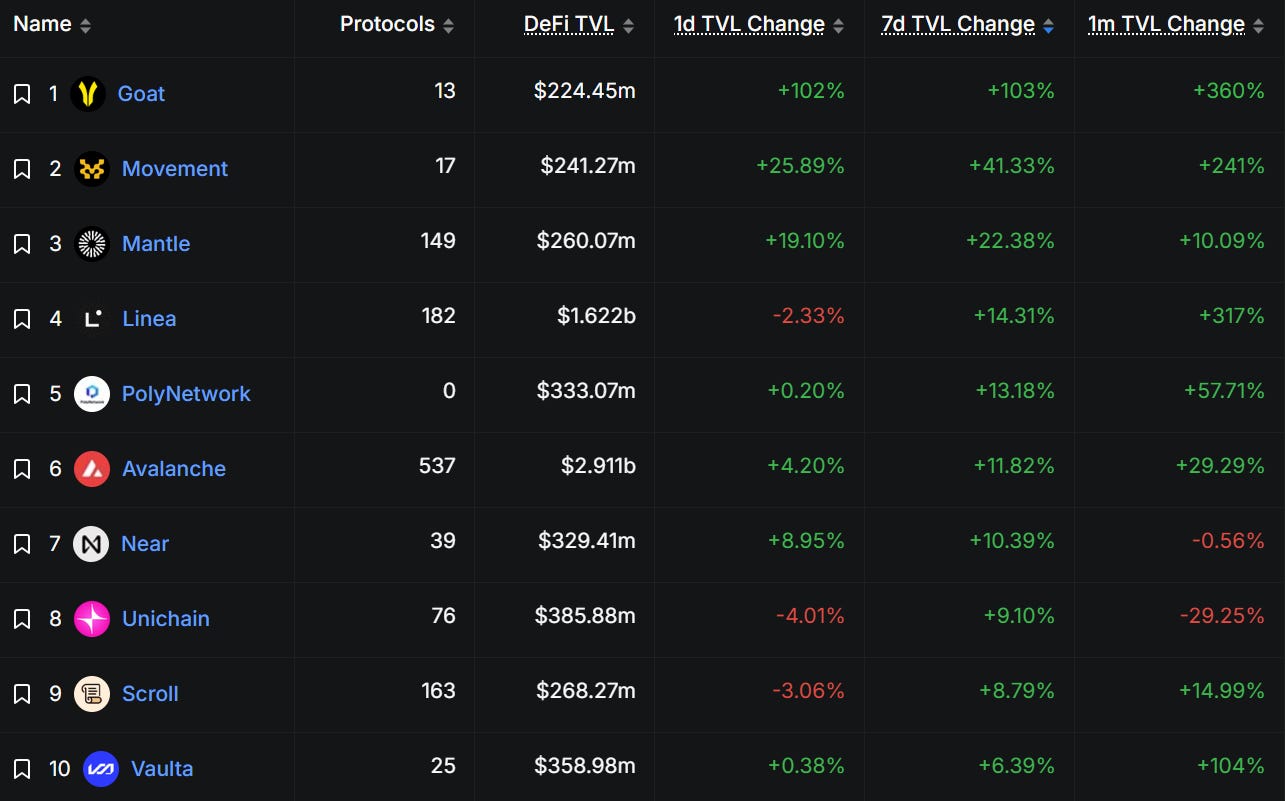

Fastest Growing Chains ($100M+ TVL)

Goat Rollup leads growth again this week. Pell Network TVL on Goat is up 100% in 7d.

Movement TVL is up 41% this week after announcing a transition to an L1.

Linea’s TVL is still growing, and Avalanche TVL is at its highest point since 2022.

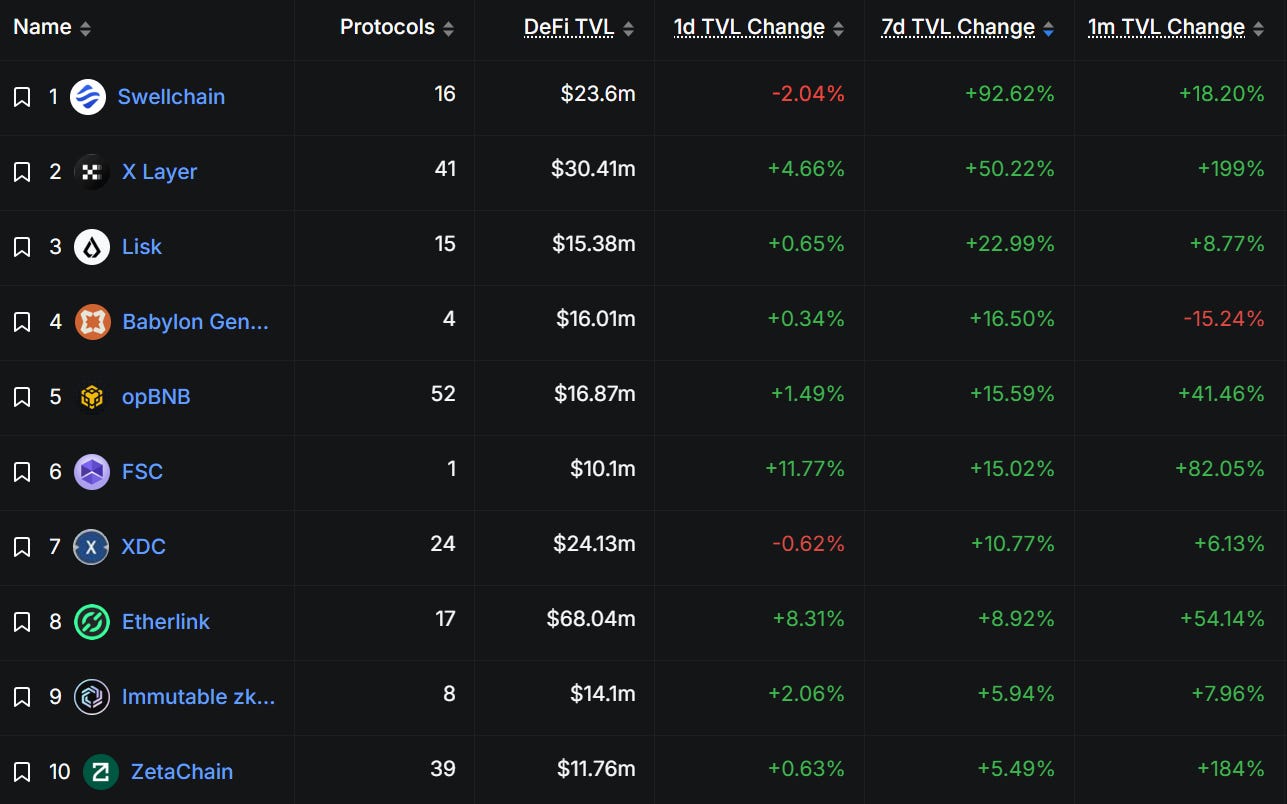

Fastest Growing Chains ($10M-$100M TVL)

X Layer and ZetaChain TVL is up triple digits over the last month.

Etherlink and X Layer are the only chains on this list at TVL all-time highs.

📊Onchain Metrics

Digital Asset Fundamentals

This section dives deeper into the fundamentals behind digital assets with unique visuals to help you explore the intrinsic value of different tokens.

Below you’ll find 3 visuals:

Chain Valuation Ratios Matrix

Protocol Revenue Analysis

Protocol Fees, Revenue, and Holders Revenue Treemaps

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.