⚡It's an OP World and We're Just Living in It

Plus GambleFi resurgence, RWAs go parabolic, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

Slightly new format this week. On-chain metrics will now focus on a high level overview of market changes. Trends about specific categories, chains, and protocols will be incorporated into the “Trends & Narratives” section.

In this issue:

🔢On-Chain Metrics

📈Trends & Narratives

🛠️Tool Spotlight

📅Key Events This Week

🔢On-Chain Metrics

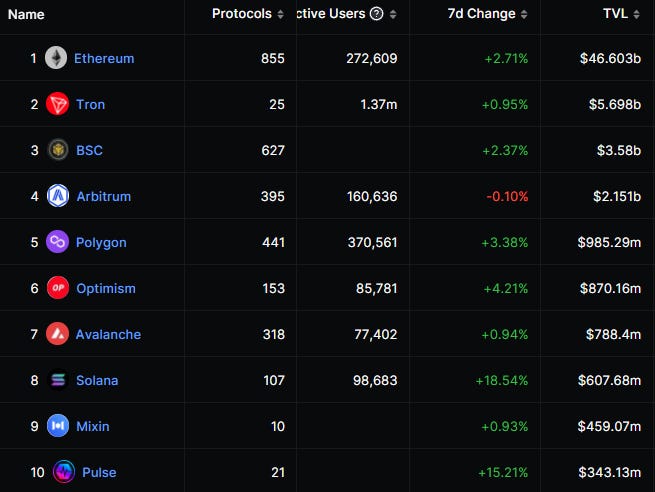

Total Value Locked Changes

Total DeFi TVL (including Liquid Staking) grew from $65.32B to $66.49B this week.

Of the top 10 chains, Solana and Pulsechain saw the largest % TVL increase, while Arbitrum alone lost TVL.

The top gaining protocol with over $100M in TVL was stUSDT, a RWA protocol on Tron, while the top 5 included 3 liquid staking solutions and Synthetix.

Cross-Chain Flows

Ethereum Layer 2s led the way in net bridge flows this week. Arbitrum and Optimism had the highest inflows by far, while Polygon zkEVM also saw large inflows.

Top Earning Protocols

The top 10 protocols by fees collected over the past 7 days, includes 4 chains, 2 Dexes, 1 rollup, 1 liquid staking protocol, 1 CDP, and 1 derivatives platform.

📈Trends and Narratives

Real World Asset TVL Goes Parabolic

Since April, Real World Assets (RWAs) have grown from a relatively niche category within DeFi, to a top 10 category.

RWAs are off-chain assets that are tokenized on-chain. Common examples are US Treasuries and real estate.

While all major RWA protocols are growing, the growth this week was driven mostly by stUSDT (staked USDT on Tron), Tangible (a stablecoin backed by real estate), and Solv (financial NFTs).

If you want to get up-to-speed on the RWA trend, this thread is a great overview:

OP Stack Summer?

The past few months, the OP Stack has emerged as the go-to place for big players to launch their own Ethereum rollup. Coinbase, Binance, and Worldcoin all announced plans to use the OP Stack to launch their Ethereum layer 2s.

Now, an existing Layer 1, Celo, has announced a proposal to transition to being an Ethereum L2, built on the OP Stack. If this trend continues, OP and the entire Optimism ecosystem stand to benefit.

GambleFi

Gambling is one of the lowest hanging fruits for crypto adoption:

Smart contracts create the ability to design new, innovative games

Token incentives can be used to attract gamblers

Crypto can ensure uncensorable financial rails in the face of regulation and limited bank access

Recently others have started to agree:

🛠️Tool Spotlight

The DefiLlama Extension Labels Ethereum Addresses and Helps You Avoid Phishing Scams

The DefiLlama browser extension for Chrome or Brave can take your on-chain analysis to the next level and keep you safe in DeFi.

This extension adds tags like this to wallets on Etherscan, so that you can instantly learn more about them.

Additionally, this extension attempts to detect phishing websites, warning you when you access one (don’t expect this to be 100% perfect).

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

Love this. So much useful information on new narratives. Helping me a lot🙏