⚡Is Solana DeFi About to Explode?

Plus: BlackRock is back to finish the job

Read Time: ~5 minutes

⚡In This Edition

How Solana DeFi could benefit from $2B in DAT purchases

BlackRock wants to tokenize everything

Federal Reserve announces potential interest rate cut on Wednesday

By the way, here are the top September airdrop opportunities.

⚡Metrics Snapshot

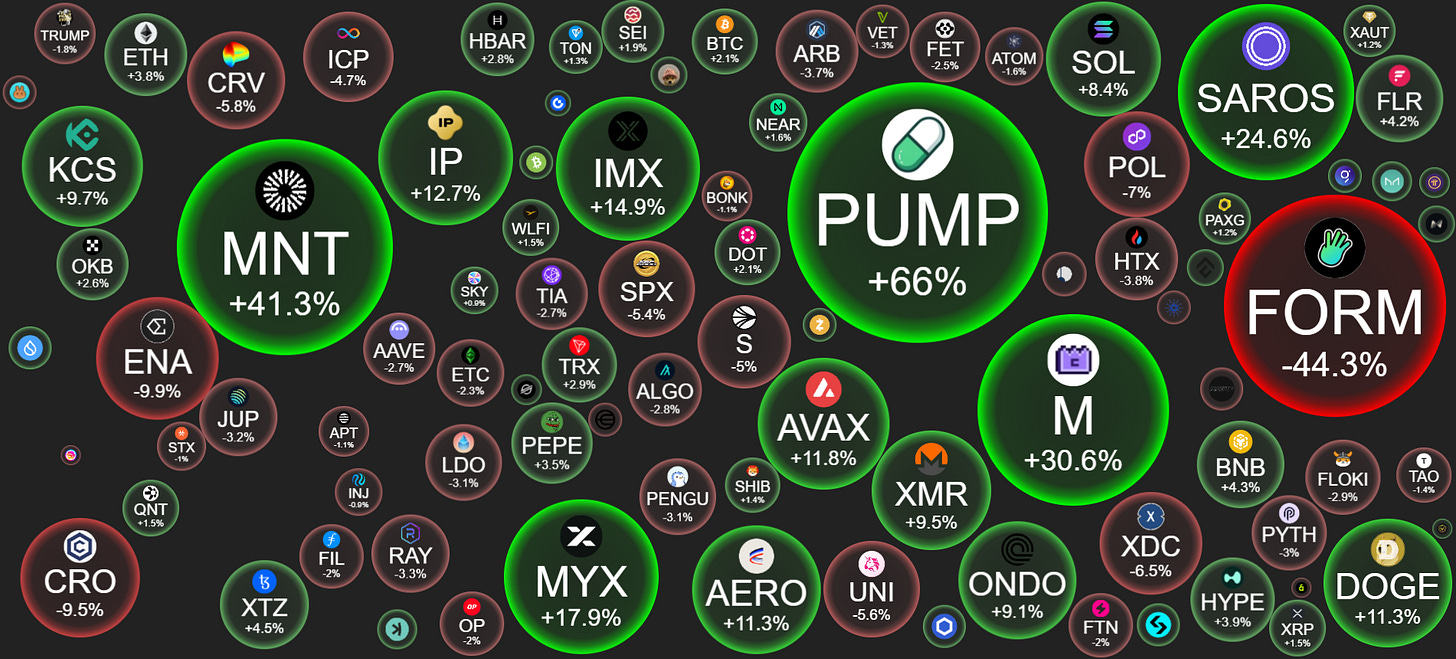

Top 100 Coins at a Glance (7d)

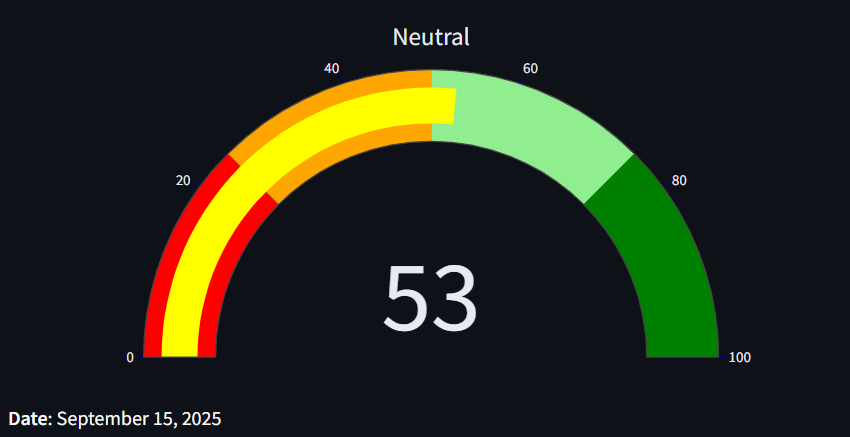

Fear & Greed Index: 53 (Neutral)

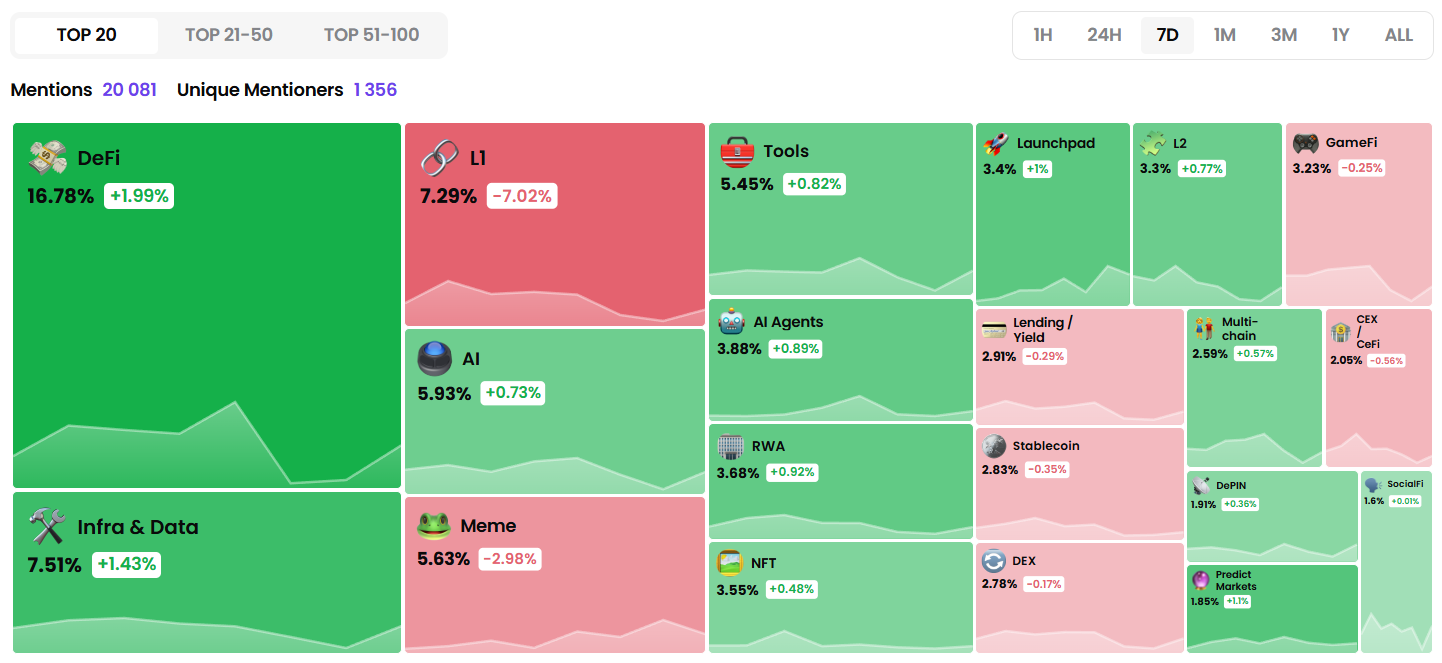

Narrative Mindshare (7d)

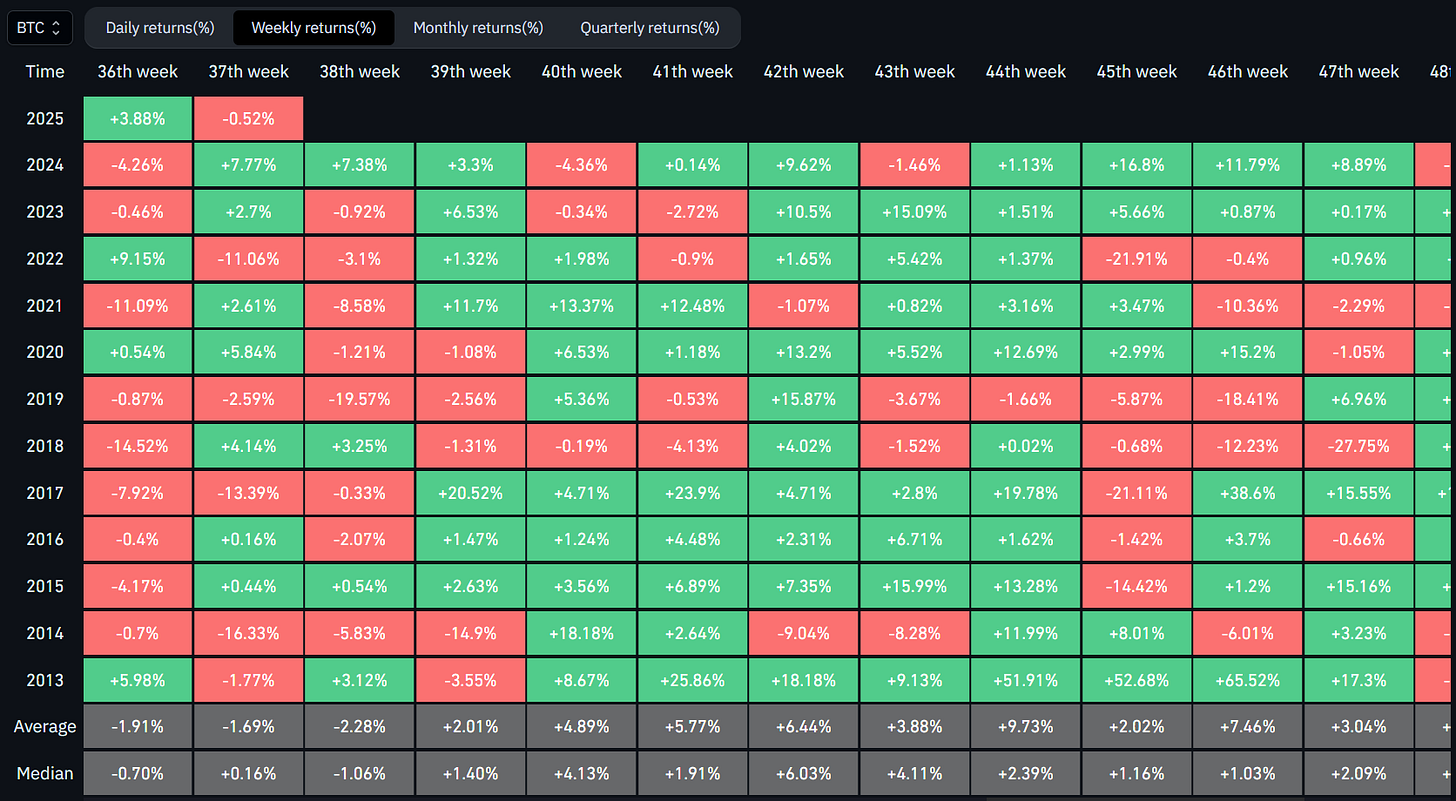

Historical Bitcoin Performance This Week (Week 38)

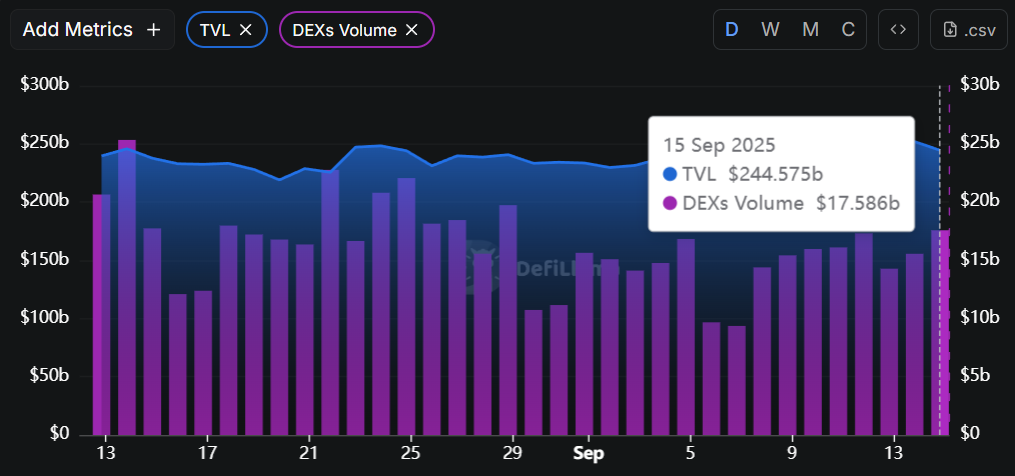

DeFi Market Metrics: Global TVL & DEX Volume

TVL is up slightly MoM and DEX volume has been holding steady, trading around $15b per day.

3️⃣ Things to Know this Week

The biggest headlines moving the market and what it means for you

1. BlackRock Plans to Tokenize ETFs

Following the success of its $2.2B tokenized treasury fund BUIDL, BlackRock is now preparing to tokenize equity ETFs, real estate, and credit funds. This would be the first time a traditional asset manager moves mainstream funds onchain at scale. Pending regulatory approval, of course.

What This Means

If approved, RWAs may start to become the financial system's default format. Trillions in assets onto public blockchains would bring composability, 24/7 trading, and programmable liquidity to traditional finance.

It’s a serious upgrade. Ethereum, where BUIDL (and most of the $16b RWA market) lives, could be the biggest beneficiary.

2. Kraken Launches Perpetuals, Eyes IPO and Layer 2

Kraken introduced perpetual futures trading to everyday investors, expanding beyond Kraken Pro. Kraken has a rumored Q1 2026 IPO and follows recent product rollouts including tokenized xStocks and work on its Ethereum L2, Ink.

What This Means

Perps are the most dominant product in crypto today. Kraken is positioning itself as a full-stack crypto financial platform for both retail and institutions.

With financial super-app competition including Robinhood and Coinbase, Kraken has their work cut out for them.

3. Native Markets Wins Hyperliquid’s USDH Stablecoin Bid

After a competitive governance process that drew bids from Paxos, Ethena, Frax, and others, Native Markets has been selected to launch USDH, the official Hyperliquid-native stablecoin.

The yield from reserves will be split between HYPE buybacks and stablecoin distribution programs.

What This Means

The vote is an onchain governance milestone for Hyperliquid. It also confirms that major players view Hyperliquid as one of crypto’s next big venues, and want to own key primitives on it.

Watching established stablecoin issuers make offers to share revenue and even buy back HYPE tokens prompted questions from other communities wondering why their dominant stablecoins aren’t passing on yield to the chain. Perhaps stablecoin issuers will take note.

Get curated data dashboards & onchain metrics sent straight to your inbox each week.

📖 Recommended Reads

⚡Every New Financial Market was First Called Gambling

First it’s gambling, then it’s useful, then it’s indispensable

⚡September 2025 Airdrop Checklist

Use these to potentially qualify for the biggest airdrops this year

⚡Forward Industries announces completion of $1.5b in SOL purchases

Solana’s largest DAT makes its move

⚡Top DePIN protocols without tokens

Handy list of DePIN protocols that don’t have tokens

⚡Crypto x Robotics projects with clear product and revenue pipeline

Good place to start for those looking to get into crypto x robotics

⚡Ethena, Hyperliquid, Prediction Markets: Here’s your Research

Join an in-depth presentation on the ecosystems and narratives driving the crypto market this month.

Patrick, Dynamo DeFi Founder, will go live Wednesday at 5:30pm EDT to walk through what to expect in the market this month and answer questions.

Pro members will receive a recording of the call and the PDF presentation slides.

To receive an RSVP for the call, join Dynamo Defi Pro:

Want to see what the call is like? Here’s a free look at last month’s call.

🔢Onchain Analysis

Forward Industries $1.5b SOL Purchase is Over. Now What?

Forward Industries, the DAT that just purchased over $1.5b in SOL, has a mandate to increase the amount of SOL held per share.

Both Forward Industries and Pantera-backed Helius have stated they plan to use the purchased SOL in Solana DeFi.

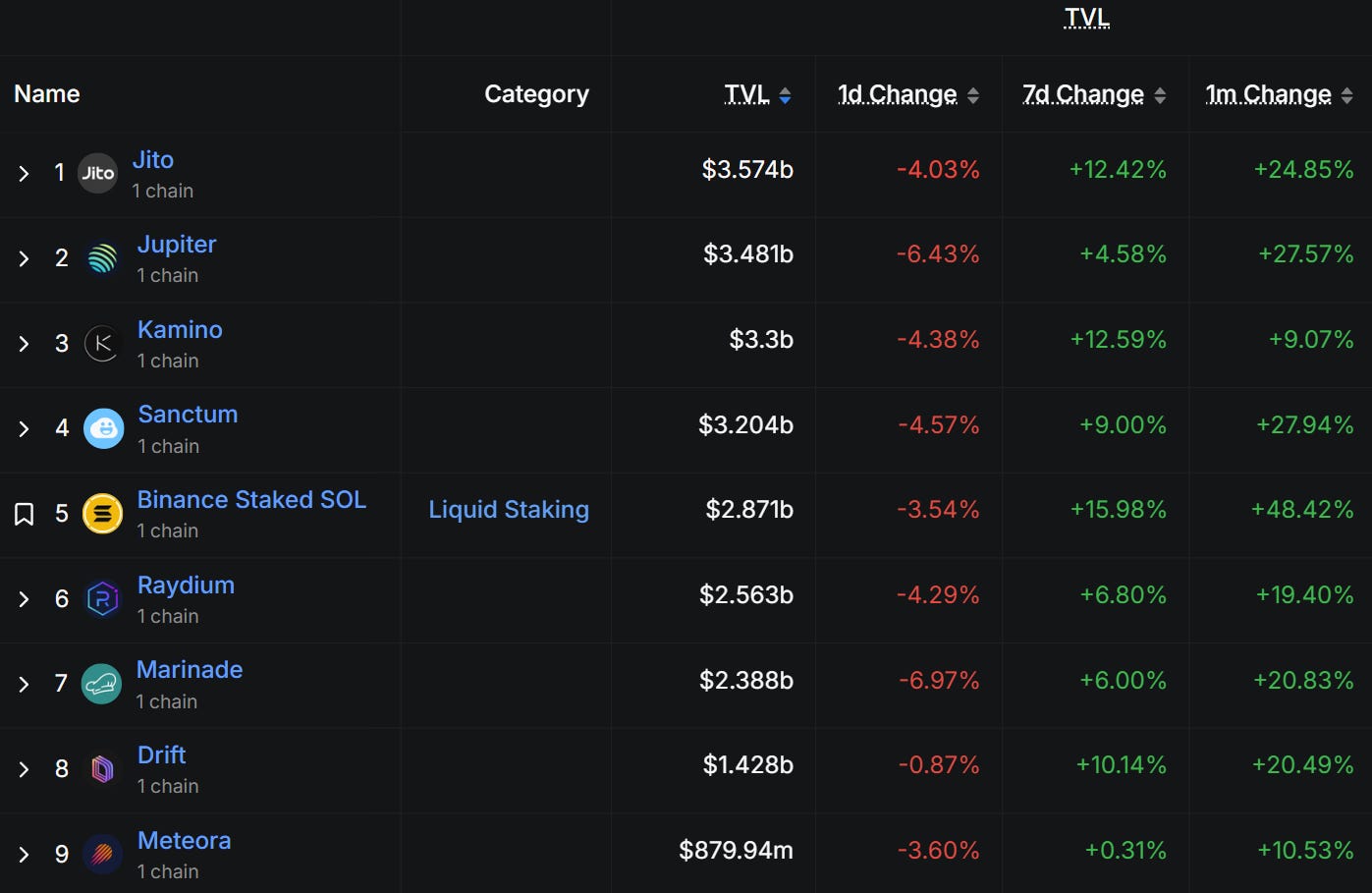

Top protocols on Solana already saw large TVL increases over the last week and month, as total Solana TVL hit an all-time high.

DEX volume also remained elevated, facilitating $30b last week. Five of the top 10 DEXs by volume are on Solana, and Solana is the chain with the highest DEX volume over the last 30 days.

Now that these protocols have grown to house billions, it’s easier for a large capital raise to confidently deploy capital throughout the ecosystem.

This would not have been possible two years ago.

Forward Industries also plans to potentially acquire strong teams and projects within the ecosystem. An age of M&A may be upon those who build good projects on Solana.

Now more than ever, Solana teams with good products, a strong community and reasonable tokenomics have the potential to see massive capital inflows.

Thought exercise for those wondering where the deployed capital might go: if you were the head of Forward Industries, how would you deploy the purchased SOL?

SOL’s 7% APY offers an advantage. They’re also likely to utilize:

Staking & liquid staking

Lending

Derivatives

Liquidity provision throughout Solana DeFi

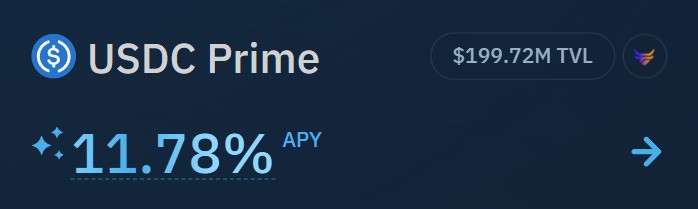

🚜Farm of the Week

USDC Prime on Kamino

Kamino Season 4 is live. Instead of earning points that translate into tokens, you earn KMNO tokens straightaway.

How it Works

While 11% may not seem like the world’s most exciting yield, this is a great place to earn on any stables you’re holding.

It’s conservative and quite liquid: no lockups and $200m in TVL. Steakhouse manages the vault, and there’s no performance fee.

Simply head to Kamino, connect your wallet and deposit USDC to start earning yield immediately.

Risk Level: Low

Risks

Smart Contract risk

Protocol Layer risk

⚡How to Farm Leveraged Loops on Kamino

🛠️Tool Spotlight

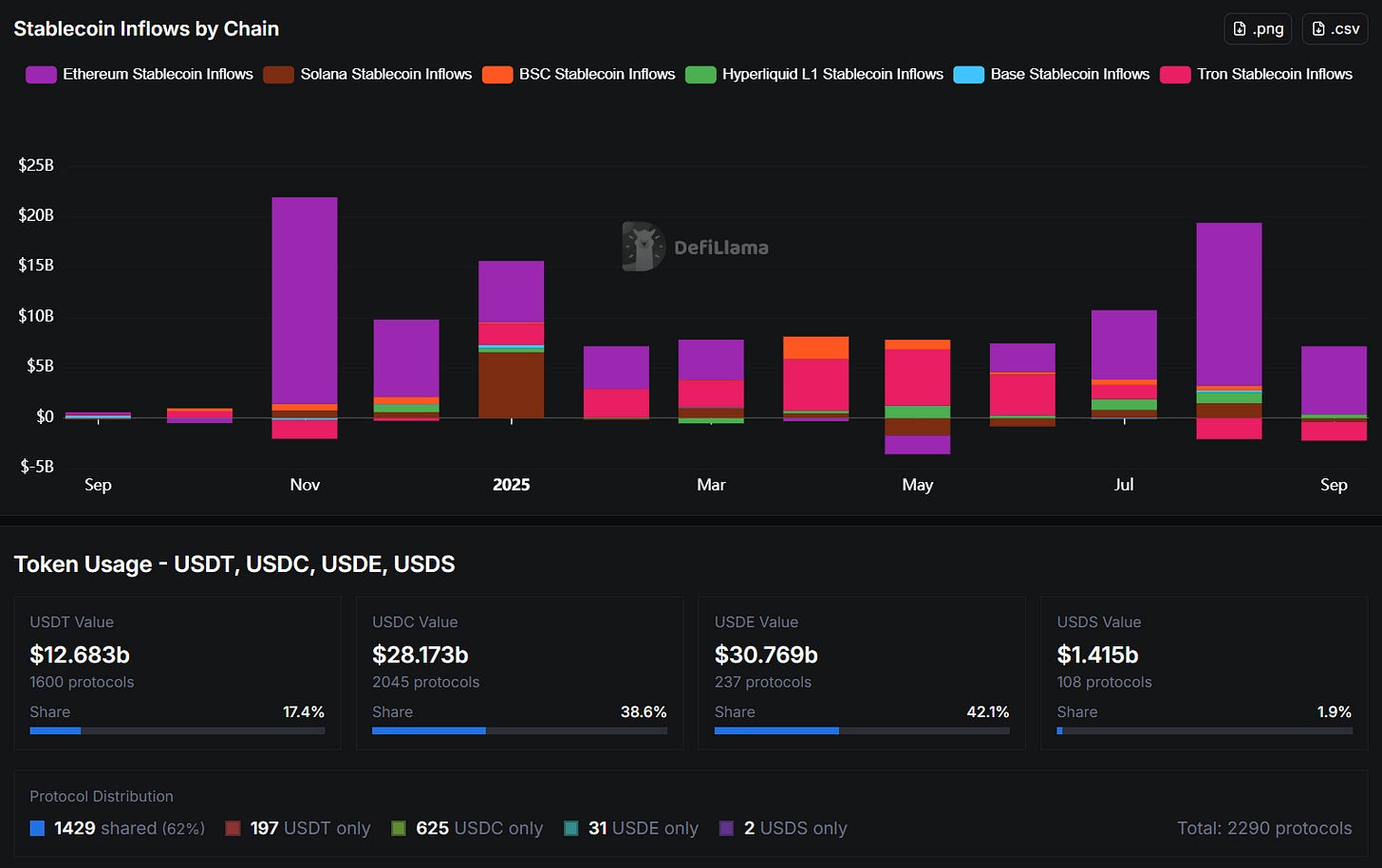

DeFiLlama Stablecoins Tracker

The Stablecoins Tracker dashboard has a variety of custom metrics to show which stablecoins are growing and where to find yield on them.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 August Retail Sales data - September 16th

📊 Fed Interest Rate Decision, press conference, projections - September 17th

📊 Philadelphia Fed Manufacturing Index - September 18th

📊 Initial Jobless Claims data - September 18th

Token Unlocks: $250m Unlocking This Week

🔓STRK (5.98%) - September 15th

🔓XCN (0.83%) - September 15th

🔓SEI (1.18%) - September 15th

🔓ARB (2.03%) - September 17th

🔓TRIBL (1.32%) - September 17th

🔓ZK (3.61%) - September 17th

🔓APE (1.72%) - September 17th

🔓FTN (2.08%) - September 17th

🔓ZRO (21.51%) - September 19th

🔓VELO (13.63%) - September 20th

🔓KAITO (3.15%) - September 20th

🔓OP (6.89%) - September 21st

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Cod3x terminal launch - September 15th (Source)

🚀 Forte testnet - September 17th (Source)

🚀 Mavryk network mainnet - September 17th (Source)

🚀 dKargo mainnet - September 17th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi