⚡Is HYPE's Valuation Justified? Our 7 Minute Valuation Framework

From $0 to $9B: How the biggest perp DEX in crypto is building an empire, burning tokens, and rewarding early users. Plus: A new points system that's 56% unclaimed.

Through the years, centralized perpetual futures exchanges were the kingmakers in crypto. BitMEX pioneered the perpetual future in 2016, and exchanges like Binance and FTX harnessed perps to become juggernauts, capturing hundreds of billions in daily trading volume. The perpetuals market still dominates crypto trading, and centralized exchanges have dominated decentralized exchanges in terms of volume.

But the collapse of FTX provided a harsh lesson: centralization in trading venues creates single points of failure that can drag down the entire market and leave users holding the bag. In the great migration from centralized exchanges to decentralized exchanges, Hyperliquid is currently the destination of choice for new perp DEX users.

It’s a great product with a competent team. HL’s community-first mindset cultivated a loyal userbase, who rallied behind Hyperliquid even after the points program had concluded and the airdrop had been distributed.

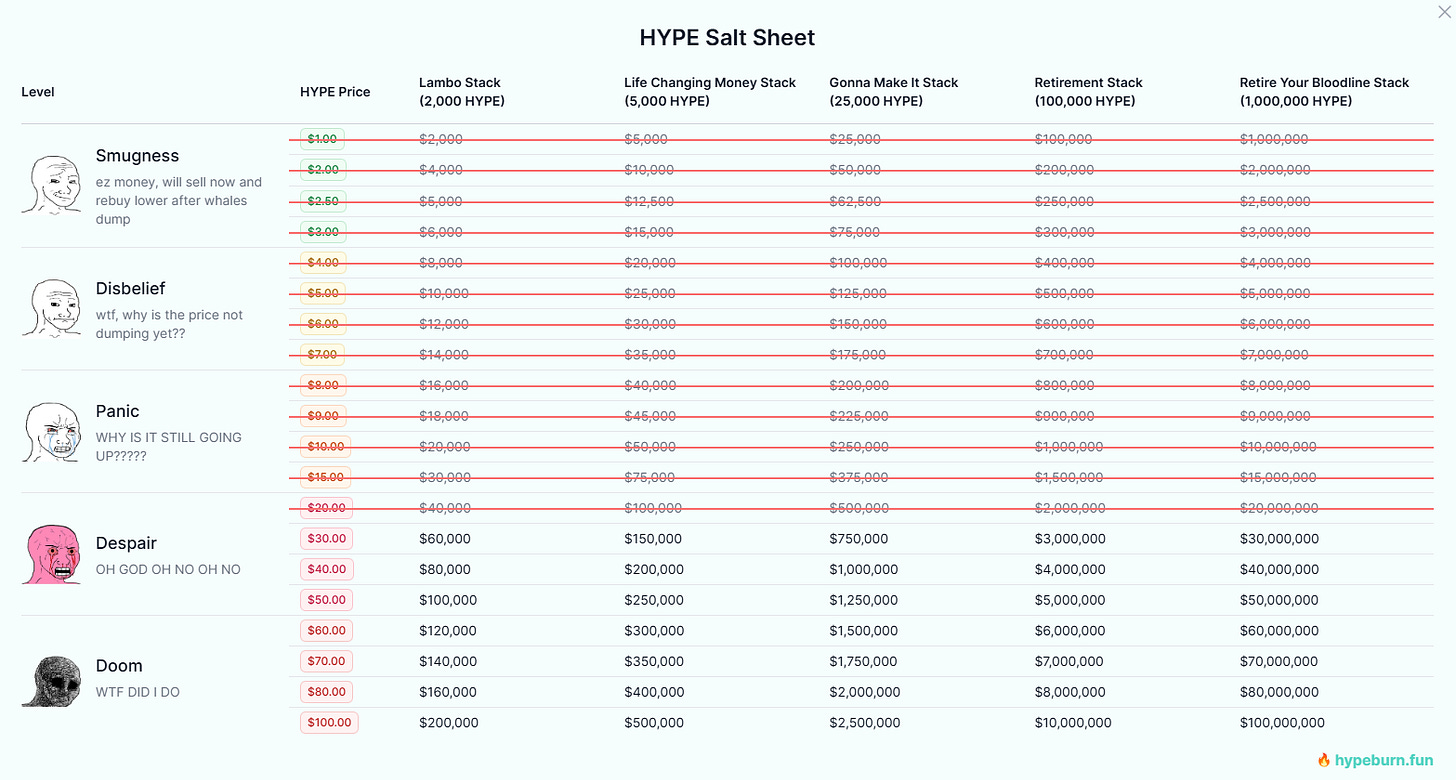

After the HYPE TGE in late November, the growing community pushed the HYPE token to a $9B market cap. Those who traded on Hyperliquid during the points program were rewarded in a major way.

In this quick one-pager, we’ll cover

How to track Hyperliquid’s process of turning revenue into HYPE burn

HYPE tokenomics and the burn mechanism that could drive token price

The upcoming Hyperliquid L1 and what that means for the ecosystem

DeFi on HYPE and how to capitalize (there’s already a project running a points system)

Resources to learn more, including dashboards & metric hubs