⚡Is DeFi Back?

Plus tokenized securities, ChatGPT for analyzing smart contracts, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

In this issue:

🔢On-Chain Metrics

📈Trends & Narratives

🛠️Tool Spotlight

📅Key Events This Week

On Friday, I shared a special post with 3 lessons that I learned advising the project known as Clip Finance.

As I explained in that post, if you’re interested, the first chance to get involved in the Clip NFT ecosystem is in their NFT mint this week. Learn more about Clip’s NFT mint this week here.

🔢On-Chain Metrics

Total DeFi TVL Grows

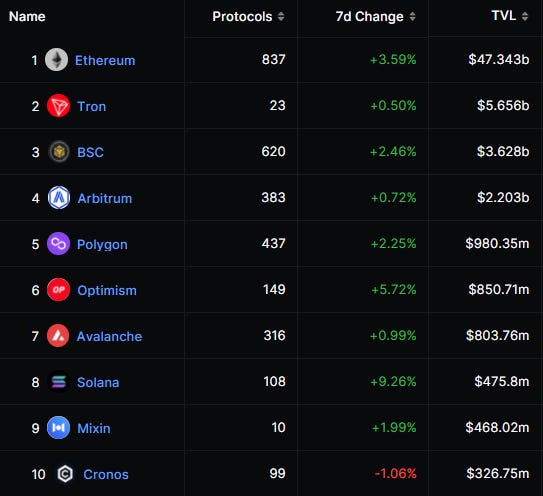

Total DeFi TVL grew from $65.3B to $67.4B this week, as price increases pushed it higher. This growth was driven by Solana, with a 9.26% increase, Optimism with a 5.72% increase, and Ethereum with a 3.59% increase.

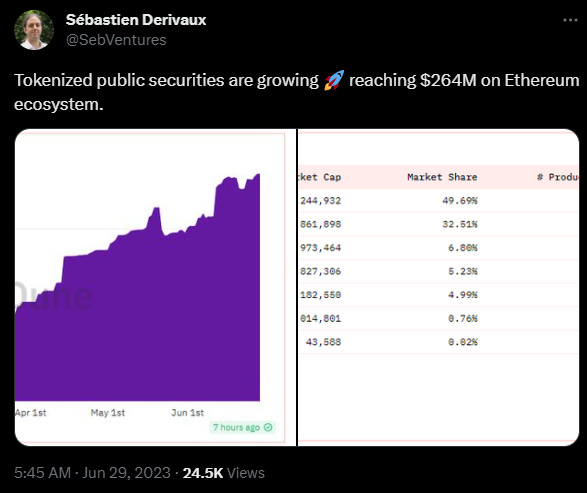

Tokenized Public Securities on the Rise

Tokenized public securities are on a strong uptrend, reaching $264M in total this week. This aligns with a narrative we’ve been covering in this newsletter about how tokenized “real world assets” is a growing narrative. Long-term, I’m of the belief that everything that can be tokenized, will be.

Google Searches for Bitcoin Hit Cycle Lows

Google searches from Bitcoin are at a cycle low, despite the price of Bitcoin going up this year. This can either be bearish or bullish depending on how you look at it. Bearish, because there’s no retail interest yet. Bullish, because there’s no retail interest yet AND prices are increasing anyways. Not exactly an on-chain metric, but is a useful market indicator.

📈Trends and Narratives

Aura Ecosystem Expands to Arbitrum

Aura is making a major splash in the Arbitrum ecosystem. Aura is best known as a yield and governance optimizer for Balancer; however, that understates their vision and the strength of their team to execute that vision.

Within the Arbitrum ecosystem, Aura has made partnerships with Pendle, Davos protocol, Curvance, Midas Capital, Sentiment, Beefy, and more. As I always say, the highest potential crypto products are those with an entire ecosystem built on them. In Aura’s case, this ecosytem is turning them into a core piece of infrastructure for yield-bearing assets.

DeFi and NFTs Decoupling

On the back of a controversial Azuki mint, NFT floor prices have been cratering. Simultaneously, DeFi, including many older DeFi projects, has started to trend upwards.

This decoupling has some people wondering whether the NFT community might take a new interest in DeFi. NFTs onboarded more people to self-custody than any other technology last bull-run. I’m hopeful that some of those people will find creative ways to fuse the best aspects of NFTs with the best aspects of DeFi.

Master List of Airdrop Tools

Alex Wacy released a master list of airdrop tools this week. Airdrop hunting, like other strategies for making money in crypto, tends to go in waves.

My personal impression, based on the growing number of addresses across crypto, is that since the Arbitrum airdrop, major players are farming them on an industrial scale. However, with some discipline and luck, this is still one of the best ways to make money with a small account.

🛠️Tool Spotlight

Smarter Contracts ChatGPT Plugin Analyzes Smart Contracts

The Smarter Contracts ChatGPT plugin allows you to enter an Ethereum smart contract address and than ask ChatGPT questions about the contract at that address.

In this example, I chose the address for a token that recently rugpulled, to test if ChatGPT would identify any red flags:

And lo and behold, ChatGPT quickly identified this as a potential honeypot, among other red flags, and advised against interacting with it. 10 seconds can save you from being scammed.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

Thanks for sharing

Great job! Reading on vacation while the wife is in the pool and kid playing on the slide. 🤙🏻