⚡Is Crypto Ready to Reshape Finance?

Plus Avalanche ecosystem, inscription mania and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

📈Trends and Narratives

Crypto is Ready to Reshape Financial Markets

Could crypto’s iPhone moment be here?

With infrastructure and on-ramping improvements of the past few years, crypto is able to offer improvements to trading, payments, settlement, and other financial applications. If that happens, we could see a Cambrian Explosion of new, real world, applications built on crypto.

This thread, which is one of the most insightful I’ve read in weeks, goes into how this is possible:

Avalanche Ecosystem Enters Focus

Avalanche has been one of the breakout success stories of the past couple months, outperforming even SOL. A major differentiator is that it has different subnets, which function as separate chains, but are easily interoperable and are all secured by Avalanche.

The result is that they can have a traditional DeFi ecosystem on the Avalanche C-Chain (what most people think of as Avalanche), but also specific gaming subnets, custom-built subnets for tradfi, and more.

This post is a very thorough overview of the Avalanche ecosystem:

For airdrop hunters, this thread goes through confirmed and potential airdrops in the Avalanche ecosystem:

⚡Learn to Make Money in Crypto with Dynamo DeFi Premium

The paid version of Dynamo DeFi gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

Inscription Mania Brings Multiple Chains to Their Knees

This week saw inscriptions and Ordinals branch out from Bitcoin to EVM chains pushed many of them to their limits.

Daily transactions on Avalanche, Arbitrum, and zkSync Era surged from a few hundred K per day to 5 MILLION or more.

Arbitrum went down and on Avalanche, gas fees surged to unprecedented levels.

My take on this is that it shows the need for app chains, parallelization, and localized fee markets when hosting consumer applications. To make a Web2 analogy, you can’t have Stripe go down because too many people are playing Candy Crush.

For a full explanation of what inscriptions are, check out this thread:

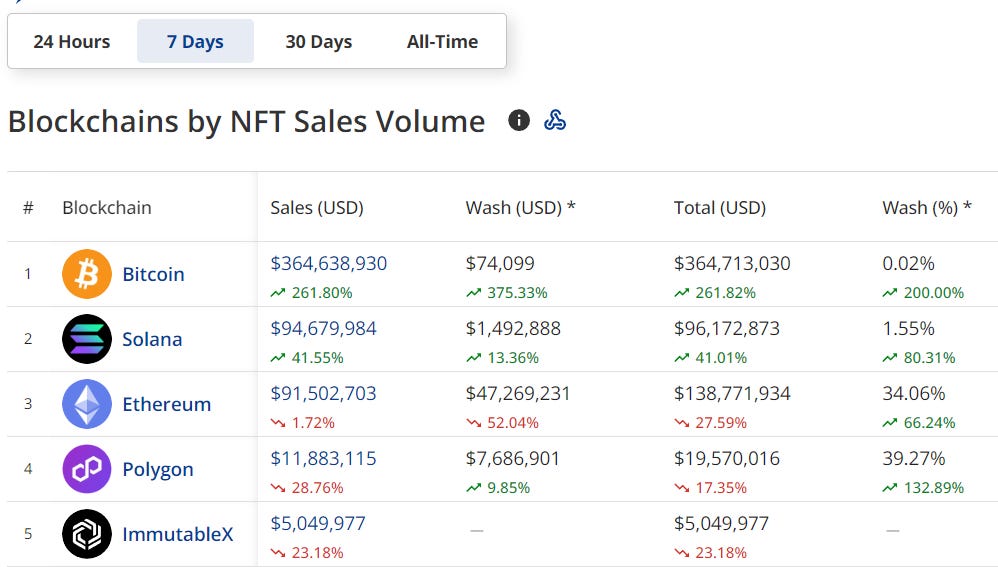

Solana DEX and NFT Volume Flips Ethereum

Solana activity continued to climb this week.

On December 14th, for the first time ever, Solana flipped Ethereum in daily DEX volume. The only other chain that has ever flipped Ethereum in daily DEX volume was BSC briefly in 2021:

Solana also flipped Ethereum in 7 day NFT sales volume, pushing it to third place.

🛠️Tool Spotlight

Track DePIN Revenue with DePIN Ninja

DePIN (Decentralized Physical Infrastructure) has been an incipient new narrative recently; however, analysts have struggled to find good data on it. This new dashboard, DePIN Ninja, while not entirely comprehensive, tracks revenue data for a variety of projects.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi