⚡Injective Ecosystem Shines

Plus Metis anticipation builds, stablecoins flow to Solana and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

📈Trends and Narratives

Injective Ecosystem Shines

With INJ pushing into the 30 coins by market cap, attention has focused on its still nascent ecosystem. In the past, the top ecosystem tokens of a layer 1 have tended to outperform the layer 1 when it does well (and underperform when it does poorly):

CAKE to BNB in 2021

JOE to AVAX in 2021

BONK to SOL in 2023

This thread goes through 5 Injective projects to watch:

Like Solana earlier this year, Injective also has a plethora of ecosystem primitives that either are still on testnet or don’t yet have a token. This thread by Miles Deutscher outlines some that could airdrop a token in the future:

Decentralized Sequencers Launch and Ecosystem Grant Sparks Interest in Metis

While most focus has been on alternative Layer 1s recently, investors who bet directly on a modular and rollup-centric future for Ethereum have also been doing well. OP and TIA have been top performers of the past couple months.

One other Layer 2 that hasn’t gotten as much attention recently is Metis, but that is rapidly changing. In January:

Metis is launching a 9-figure ecosystem fund

Metis will decentralize their sequencer, becoming the first Layer 2 to do so

This thread goes through some Metis ecosystem projects that may be worth watching:

⚡Learn to Make Money in Crypto with Dynamo DeFi Premium

The paid version of Dynamo DeFi gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

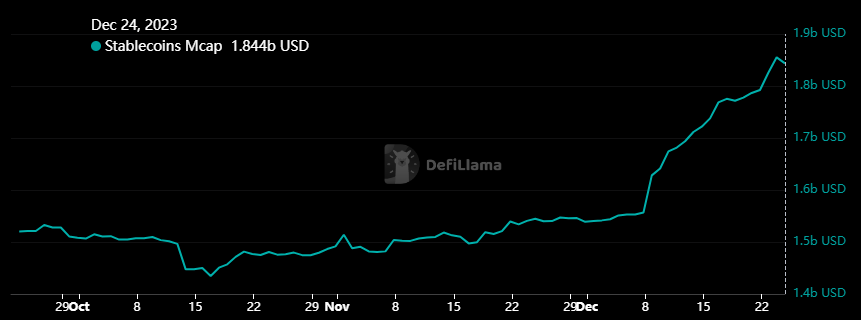

Stablecoins Flow into Solana

After months of rising DEX volume, stablecoins finally started to enter the Solana ecosystem over the past few weeks, rising from $1.5B in mid-November to over $1.8B now.

Generally speaking DEX volume increases precede an increase in stablecoins as DEX volume raises on-chain APRs. Stablecoin inflows are also a good sign, as it signals that investors:

Trust the chain to hold “safe” assets

Are preparing to invest new money in the ecosystem

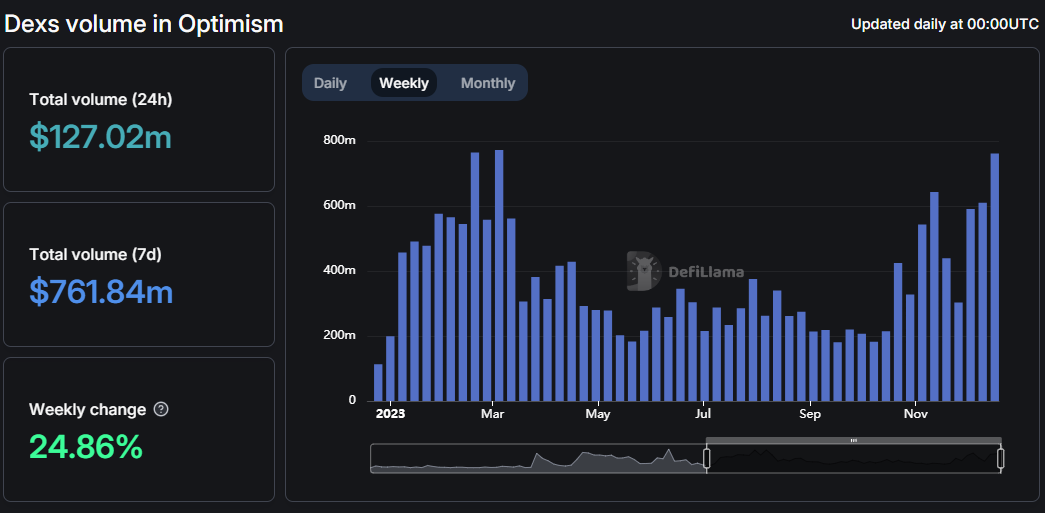

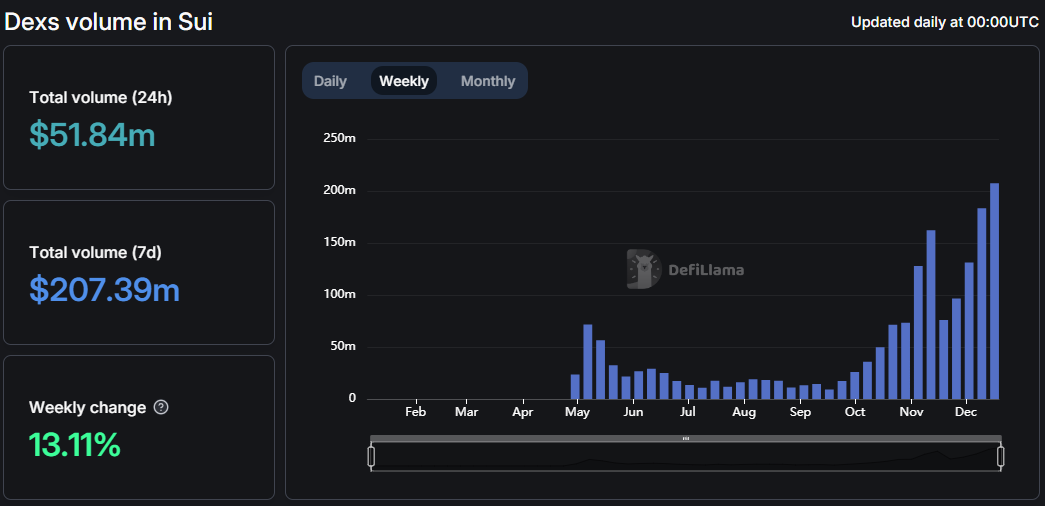

Optimism, Base, Sui, and Other Chains See DEX Volume Rise

Several other chains have established themselves as strong performers, exhibiting consistent growth in DEX volume over time. Three that stand out are Optimism, Base, and Sui.

Optimism DEX volume has been on the rise since October, hitting its highest point since March this week.

Sui has one of the cleanest DEX volume uptrends of any chain. With one interuption in November, it has been steadily increasing since this summer.

While subtler than Optimism and Sui, Base volume has also been on a slow, but steady, rise since bottoming in September.

🛠️Tool Spotlight

Tool to Check Cosmos Airdrops

With the Cosmos ecosystem re-entering focus, it’s worth remembering that stakers of Cosmos ecosystem tokens are often eligible for airdrops.

With Cosmos being such a diverse ecosystem that spans many chains, keeping track of all of the airdrops you qualify for can be challenging. This “Cosmos Airdrops” dashboard allows you to easily check all of the airdrops that your wallet is already qualified for.

As more Cosmos ecosystem airdrops roll out, this will be especially important.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi