⚡How to Spot Layer 2 Trends

Plus Sanctum airdrop farming, TON TVL hits all-time high, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

Upgrade to the premium newsletter for access to premium articles, videos, and a Discord group.

📈Trends and Narratives

How to Spot Layer 2 Trends

Is it just me, or does it seem like there are more Layer 2 blockchains than applications?

Base, Blast Mode, Mantle, Linea, Starknet, Metis, Mode… I could go on.

Many of these chains have distinct competitive advantages, and many of them are a net positive to the DeFi ecosystem.

Layer 2 chains provide a breadth of opportunities for builders to build applications that people want to use. Builders have plenty of options on where they want to go, and so do users! In many ways, this is a good “problem” to have.

It’s certainly better than having too few - not having alternatives to Ethereum’s expensive settlement layer would cost users a lot of money!

But in order for us to take advantage of these new chains - the new applications, the points programs, the user incentives, mainnet launches and TGE’s - we have to be more attentive.

Here’s something I saw this week that I thought was interesting: Optimism, one of the ‘OG’ layer 2 blockchains, had the highest Net Flow (flows coming in - flows going out) out of any chain combined over the last 7 days.

OG Layer 2 chains don’t get as much hype on Crypto Twitter as many of the new chains, but their activity is surprisingly resilient and, oftentimes their prices seem to be holding up much better than chains with recent TGE’s.

According to L2Beat, Arbitrum and Optimism are still the top 2 Ethereum Layer 2s by assets deposited.

Most token prices have performed rather unimpressively as of late, but in crypto that can change in an instant. A helpful tip is to find which chains are growing in activity, and spend time there to capitalize on the opportunities within the ecosystems before the rest of the herd. Some metrics that are important to track when assessing Layer 2s:

Total deposits

DeFi TVL

DEX volume

Stablecoins

How to Capitalize

Using tools like DeFiLlama, keep an eye on flows week-to-week to see where the money is headed. Try to understand why the money is moving - toward one protocol within a specific chain, or are there chain user incentives across the board?

Find a niche - farming these newer layer-2’s for airdrops hasn’t met expectations of many hopeful users. Do you find more success in chains that have been around for a bit longer, like Optimism and Arbitrum, or do you enjoy digging around in newer chains like Base and Blast?

The L2’s ain’t stoppin’ - many more large L2’s are expected to launch this year. Finding the right chain (growing TVL, builder incentives, reputable backers) could lead to a large airdrop, especially as airdrop farming falls out of favor with many users recently.

In my weekly Pro update, I cover category and chain flows in detail using custom scripts.

⚡Learn about DeFi with Dynamo DeFi Pro

The premium version of Dynamo DeFi gives you deeper insights and teaches you how to research yourself.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

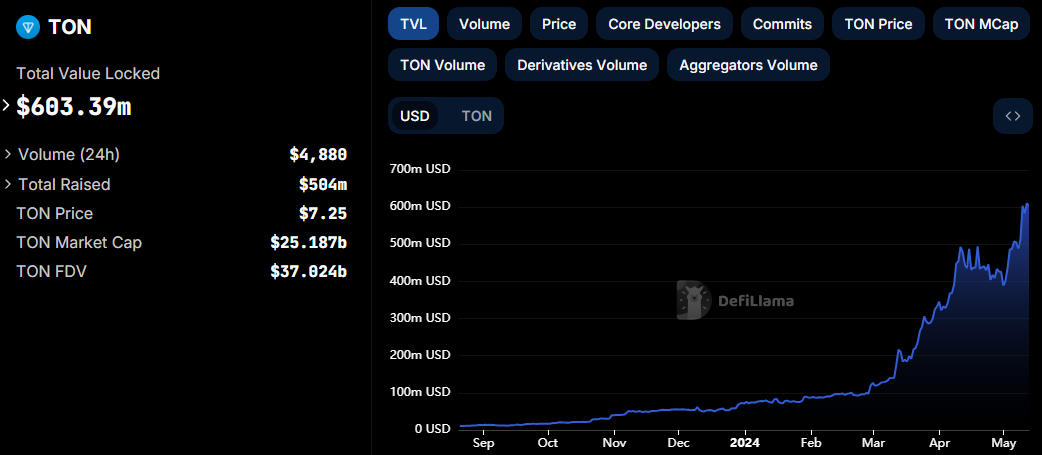

TON Surpasses $600M in TVL

TON, the chain closely linked to Telegram, has been on an absolute tear this year. Year to date, deposits in the TON DeFi ecosystem have grown from under $100M to over $600M. While TON is already top 10 by market cap, its ecosystem is still developing and there are likely opportunities there.

🚜Farm of the Week

Sanctum

Sanctum is a LST-Fi project on Solana, backed by Sequoia, Jump, Dragonfly, and Solana Ventures. The project has quickly accumulated nearly $600M in TVL, up from $25M in March.

How it Works

This is a two-for-one; you can earn yield from SOL through LSTs, while earning ‘EXP’ for a potential airdrop during Sanctum’s detailed ‘Wonderland’ campaign.

Here’s a helpful rundown on exactly how to join the Wonderland campaign - it’s easier than it looks:

Go to Sanctum and sign up for Wonderland

Deposit SOL as INF in the Infinity section

Trade SOL for hSOL (Helius SOL), jupSOL (Jupiter SOL), and other Sanctum LSTs in the Trade section

Accumulate EXP for your Sanctum pets

You can also watch the YouTube guide I made on this.

You can swap SOL for any LST or deposit into the Infinity Pool, which is essentially a basket of LSTs.

Risks

🛠️Tool Spotlight

Dive Deeper into DAO Research with DeepDAO

DeepDAO is a research dashboard, tailor-made for DAO stats. It contains information like:

Treasury

Governance proposals

Governance participants

This can be a useful resource when doing research into projects who have a DAO as a central part of their protocol development and token value proposition.

📅Key Events This Week

Macro Events

📊FOMC member Jefferson speaks - May 13th

📊FOMC member Mester speaks - May 13th

📊US PPI data - May 14th

📊FOMC member Cook speaks - May 14th

📊Fed chair Powell speaks - May 14th

📊US CPI data- May 15th

📊FOMC member Bowman speaks - May 15th

📊FOMC member Barr speaks - May 16th

📊FOMC member Mester speaks - May 16th

📊FOMC member Bostic speaks - May 16th

📊FOMC member Waller speaks - May 17th

📊FOMC member Kugler speaks - May 18th

Token Unlocks

🔓 UXP (2.05%) - May 14th

🔓 DYDX (0.79%) - May 14th

🔓 CYBER (4.13%) - May 14th

🔓 ARB (3.49%) - May 15th

🔓 STRK (8.79%) - May 15th

🔓 PSP (0.83%) - May 16th

🔓 APE (2.48%) - May 17th

🔓 IMX (1.75%) - May 17th

🔓 MANTA (2.66%) - May 18th

🔓 ROSE (2.54%) - May 18th

🔓 PIXEL (7.05%) - May 19th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Bouncebit mainnet Launch - May 13th (Source)

🚀 $PAIRED token staking Launch - May 13th (Source)

🚀 Victoria VR early access - May 14th (Source)

🚀 Bitcoin WZRDS runes release - May 14th (Source)

🚀 Immuntable Medieval Empires Beta launch - May 14th (Source)

🚀 Entangle Points program launch - May 15th (Source)

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi