⚡How to Research Crypto On-Chain

Introducing the On-Chain Academy

Crypto is back.

Let's review this year so far:

1) Bitcoin ETFs from Blackrock, Fidelity, and others were approved

2) Bitcoin surpassed its all-time high in price

3) Decentralized exchange volume reached a level on-par with its 2021 peak

4) Tokens ranging from RWAs to memes reached $1B+ valuations

5) The total crypto market cap is up more than 3X since the start of 2023

Despite this, a recent poll on Crypto Twitter with 15,000 responses saw 32% of respondents report being flat or down since the start of 2023.

How is this possible?

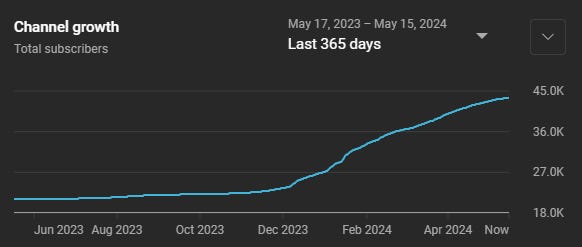

For one thing, there are, without a doubt, new market participants. I know, I know, people love to say that retail hasn't arrived yet (and they haven't in full force). But as someone who makes videos about crypto on YouTube, one of the more retail friendly platforms, I can assure you that there's been a massive surge in attention since 2023.

There's also something else at play: in previous cycles nearly everything pumped in one way or another. A large part of that was because, in the past, most projects were built on promises. Now, there's a more clear difference between projects that have executed and found product-market-fit versus those that are still relying on promises of future development.

Take for example, the top protocols by fees collected. You have some protocols collecting millions of dollars in fees a week, while others barely make anything.

People that want to rely on future promises and have a shot at the next 100X have largely turned to memecoins. Even memecoins, in their own way, have a sort of fundamentals. On-chain stats like the number of holders and social stats like engagement on Twitter can give clues to which communities are gaining traction.

What to do?

Learn to do your own research.

If I were starting from zero, these are the first skills I'd want to learn to do my own fundamental analysis on-chain:

How to find new tokens on-chain

How to evaluate tokens with on-chain fundamentals

How to use a variety of research tools like DefiLlama, DEX Screener, Token Unlocks and Artemis

How to use on-chain analysis

I'd want to understand what the key metrics are, where to find them and, crucially, how to use them properly:

TVL

Fees & Revenue

Volume

Stablecoin Flows

Gas Expenditure

Token Holders

Being able to find and synthesize this information puts you miles ahead of the average crypto trader and allows you to make your own decisions without relying on influencers.

I compressed all of this into a 3 hour mini-course designed to teach you the fundamentals of on-chain research.

The On-Chain Academy includes 5 video walkthroughs:

Complete DefiLlama walkthrough (49 min)

Complete Artemis walkthrough (29 min)

Normally a course like this would cost $100+, but I decided to make it available at no extra charge for Dynamo DeFi Pro subscribers.

In addition to the On-Chain Academy, for $11/month (less than lunch in most countries), Pro subscribers get:

Access to a Discord with over 300 DeFi enthusiasts

Weekly premium newsletters with market and on-chain metric analysis

Monthly group Zoom calls to discuss trends driving the crypto market

If you’re ready to take your DeFi knowledge to the next level, all of the resources are there ready for you.

Until next time,

Dynamo DeFi