⚡Has Points Farming Replaced Yield Farming?

Plus Sui DeFi, inscriptions take off, Arbitrum inflows, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week.

📈Trends and Narratives

Has Points Farming Replaced Yield Farming?

The system of farming points for a future airdrop is becoming more and more common. The way it works goes something like this:

Rather than announcing a token right away, a protocol announces a points system for using it.

There’s an implication (sometimes outright statement) that the points will be used as qualification for a future token airdrop.

Users are able to pre-farm a future token without having the worry about the game theory of the reward token.

Eventually, the protocol retroactively rewards early users based on the points system.

Blur, the NFT marketplace, used this quite effectively with their airdrop.

Jito, an MEV-powered liquid staking protocol on Solana, just announced their airdrop after a months-long points system.

Other Solana protocols, such as MarginFi, a lending protocol, and Tensor, the leading Solana NFT marketplace, currently have points systems of their own.

This week, a new Ethereum Layer 2 called Blast launched with a points system of their own that’s based on usage and referrals of other users.

Blast quickly attracted over $500M of deposits as users scrambled to acquire points.

I’ve personally held off on using Blast for a couple reasons:

There is no way to bridge back until next year.

The Layer 2 isn’t live yet, so you’re really just sending funds to a smart contract controlled by a multisig.

It’s already heavily saturated.

But, regardless of whether I’m using Blast, the effectiveness of these points systems speaks for itself. I suspect they’ve gained so much popularity because they’re able to avoid the token selling that kills many protocols as they’re starting to take off. Instead, by not launching a token right away, they leave the APR to the user’s imagination.

Given that multiple protocols have used this to attract 9 figures in TVL, expect a lot more “points” systems in the near future.

Inscriptions Take Off on Multiple Chains

Inscriptions have now been implemented on chains beyond just Bitcoin. Millions have been created on other chains like Polygon and Avalanche. This post by hitesh goes through more details:

⚡Get Better at DeFi with Dynamo DeFi Premium

The paid version of Dynamo DeFi, called Dynamo Research, gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access this week’s call here.

🔢On-Chain Analysis

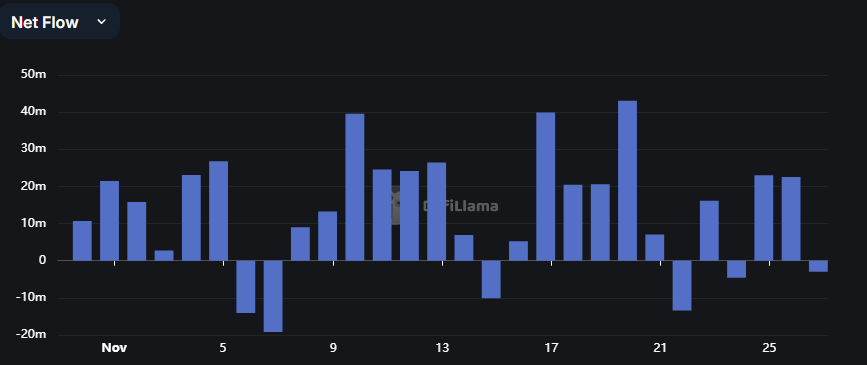

Arbitrum Experiences $90M of Inflows

Capital continued to flow into Arbitrum this week as users chased the short-term incentives program. Over $90M has been bridged to Arbitrum in the past 7 days.

Sui DeFi Silently Breaks $140M in TVL

Sui, a new high throughput Layer 1 that uses the Move programming language, has been steadily gaining TVL since June. So far it has over 20 DeFi protocols launched. Notably, unlike most new ecosystems, Sui’s DEX and Lending TVL grew before its liquid staking TVL.

🛠️Tool Spotlight

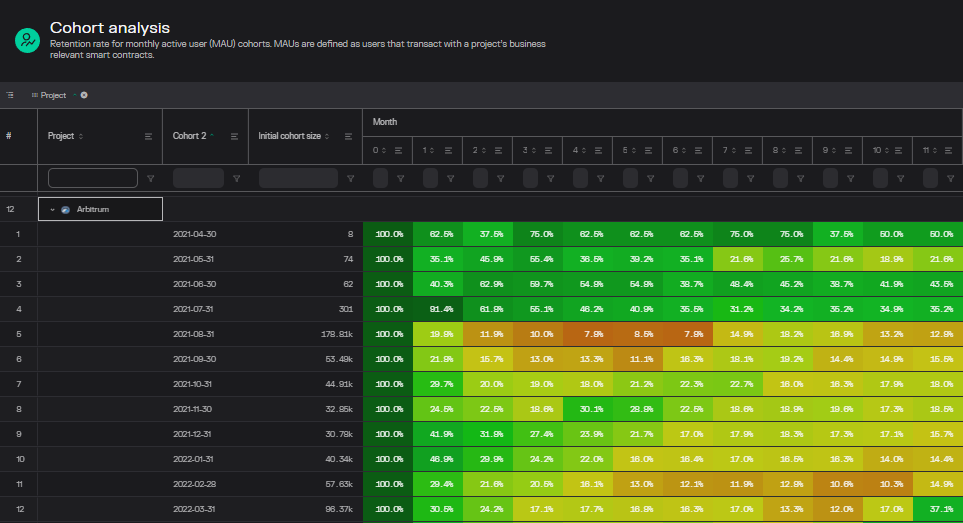

Tracker Dapp User Retention with Token Terminal’s Cohort Analysis Tool

A useful tool I came across this week was Token Terminal’s cohort analysis tool. This tracks user retention by protocol over different time periods.

Although, it’s technically a pro feature, you can still see a preview for free.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi