⚡️Ethereum might be getting a major upgrade

Plus: Hyperliquid TVL analysis and a brand new way to view token unlocks

Read Time: ~5 minutes

⚡Snapshot

Achieving financial freedom in the changing world order

Hyperliquid & Solana activity increasing

A brand new way to understand token unlocks

📖 Recommended Reads

⚡Financial Freedom & Neofeudalism

How to navigate the coming world changes

Forget spending mental energy on what you could have done better

Exciting Bittensor (TAO) updates

Strategy’s holdings now exceed 538,000 BTC

⚡Vitalik’s new blog post has a radical idea for Ethereum

Buterin proposed replacing the EVM with RISC-V for the execution layer

⚡Why do you read this newsletter?

Help shape the future of Dynamo DeFi.

Our mission is to deliver only what helps you successfully navigate this market.

What topics matter most to you? Which strategies do you want to learn?

This 5-question survey will help us understand what’s most valuable to you and will directly influence our content moving forward.

Tell Us What Matters in 60 Seconds.

🔢Onchain Analysis

Hyperliquid TVL Approaching ATH

Hyperliquid TVL is up 50% in the last month as the onchain ecosystem begins heating up.

The L1 now has five protocols holding more than $20m in TVL, not including the Hyperliquid DEX.

Many protocols have doubled or tripled their TVL in the last 30 days. Some of these protocols are less than 30 days old - that’s why the 1m Change column is blank.

The Hyperliquid flagship DEX still takes the lion’s share of onchain fees generated.

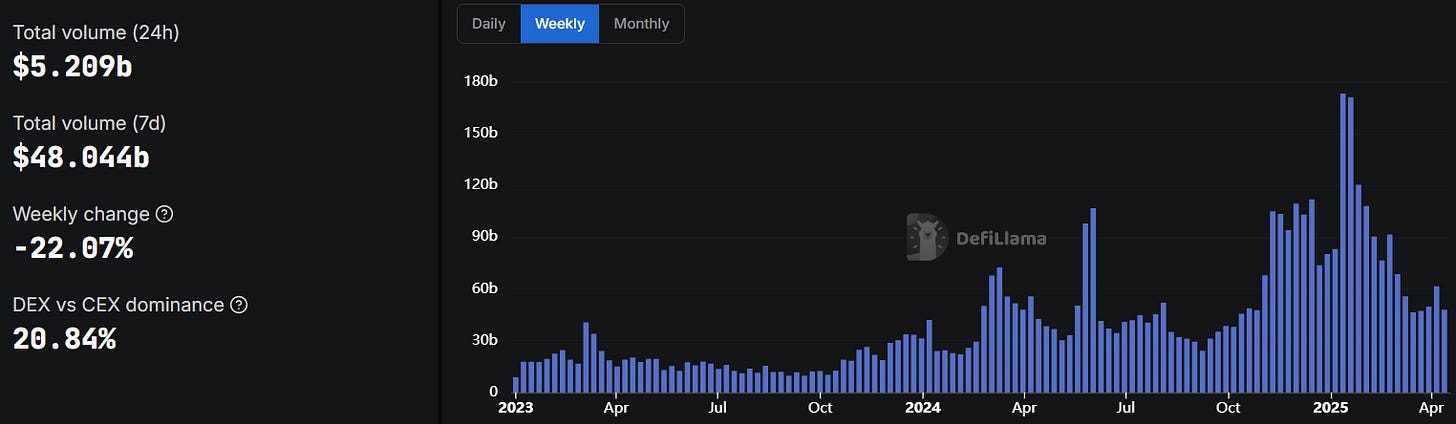

Onchain Volume Holding Steady after Brief Spike

Onchain activity is hovering around levels from late October, about six months ago now.

Most DEXs saw a spike in activity two weeks ago but dropped back again last week.

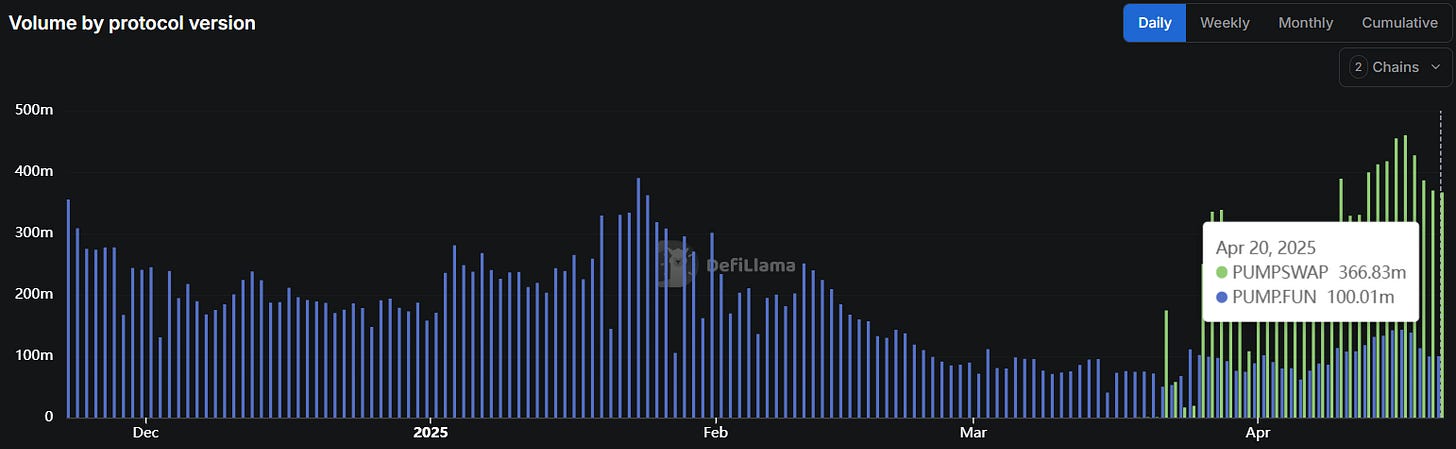

Pumpfun launchpad volume remains unchanged but the new product PumpSwap is pushing volume to new highs, and last week was Pumpfun’s highest total volume week ever.

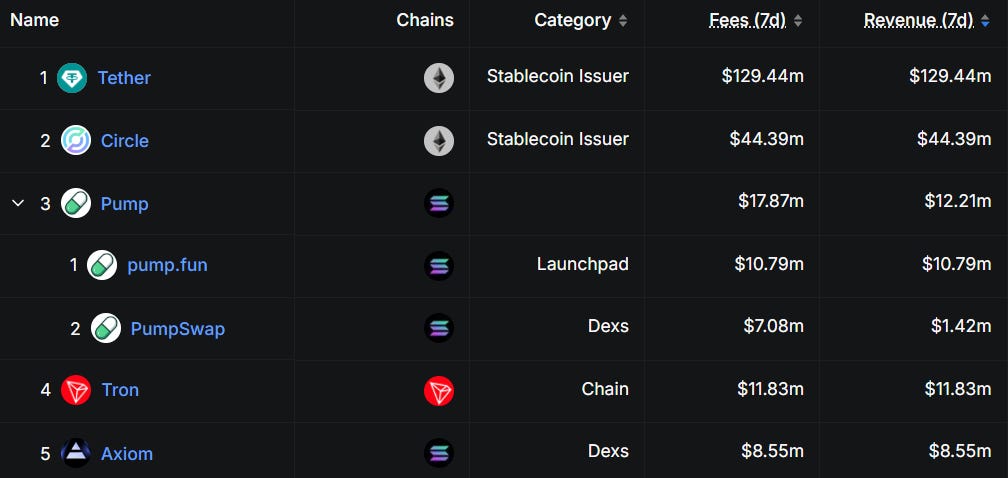

Pumpfun was the leader in 7d fees and revenue outside of stablecoin issuers.

Pumpfun’s new PumpSwap product is helping the project maintain a similar level of onchain dominance that we’ve seen over the last year, despite lower total activity.

🚜Farm of the Week

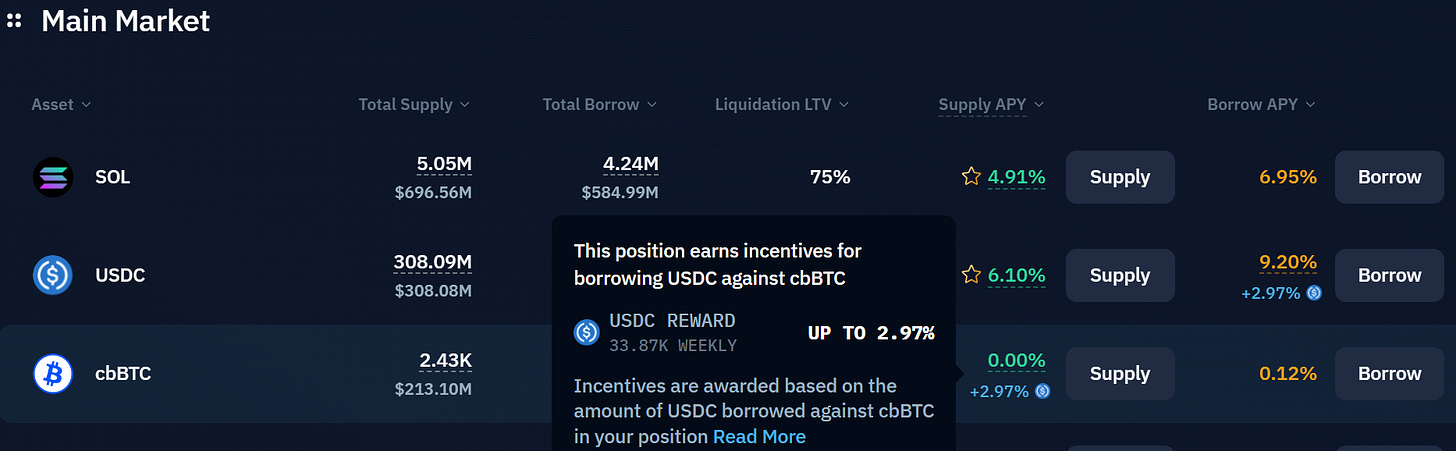

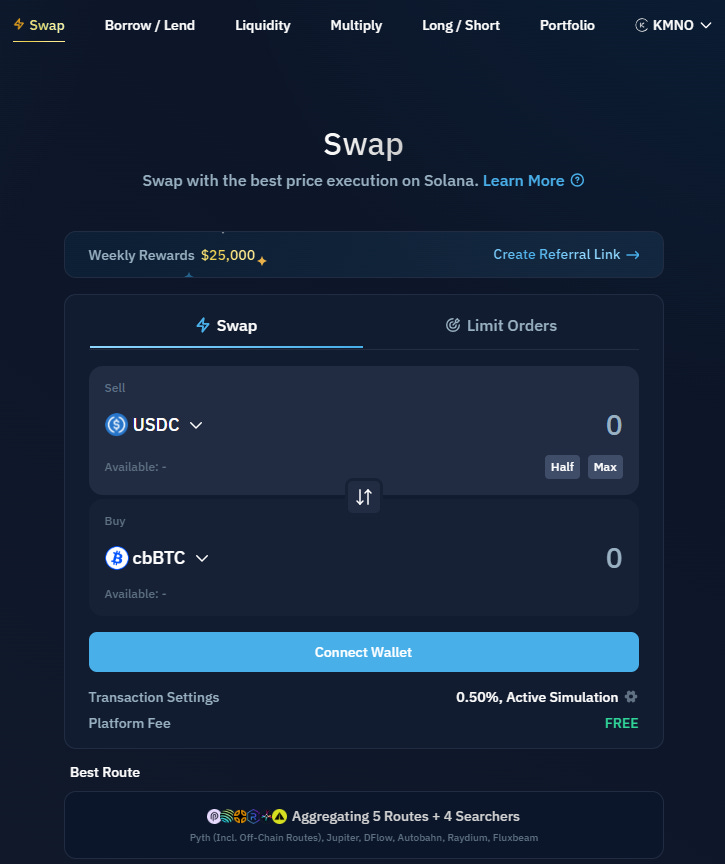

Get Paid to Borrow Against cbBTC on Kamino

Kamino is offering a weekly USDC reward in the form of APY to borrow against deposited cbBTC. cbBTC is Coinbase’s wrapped BTC.

3% APY isn’t exactly a killer yield, but to get paid for borrowing against an asset you’re simply holding can be quite helpful if you need to make a purchase without selling your Bitcoin.

How it Works

Head to Kamino’s Borrow / Lend page and select the cbBTC Market. Supply TVL is up and to the right - getting wrapped BTC on Solana is a welcome feature for holders who want to put their holdings to work.

If you’re not holding cbBTC but want some onchain wrapped Bitcoin, you can swap for it anywhere - on Jupiter, in your Phatom wallet, or using Kamino’s swap aggregator.

Just don’t borrow too much against your cbBTC. You don’t want to get liquidated and be forced to sell your Bitcoin.

Risks

I Turned ChatGPT Into My Personal Crypto Analyst

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

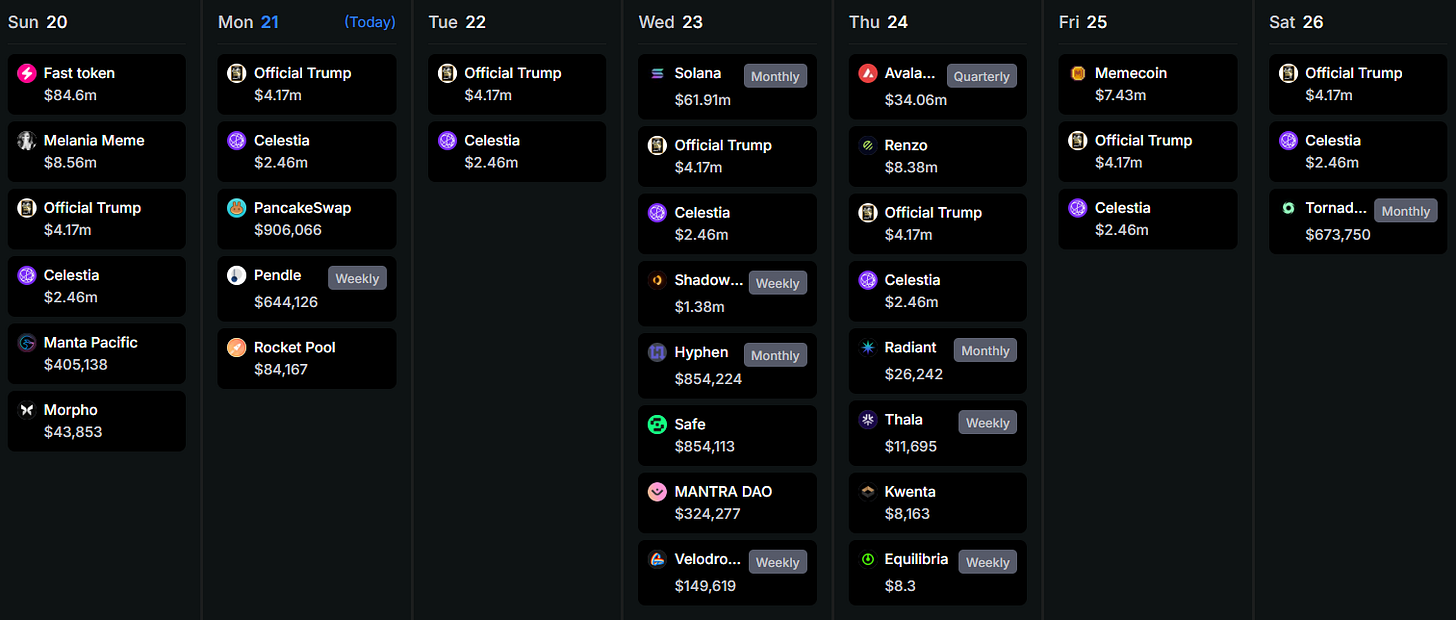

See Token Unlocks in a Brand New Way

Use DeFiLlama’s new Token Unlocks Calendar to get a detailed view of upcoming token unlocks.

Get unlock details by month or week, and get a full calendar to better understand what unlocks are coming. You can see unlock frequency at a quick glance.

DeFiLlama also built a TreeMap to see unlocks by month for the rest of the year. Hover over any box to get specific unlock info.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 S&P Global Services / Manufacturing PMI data - April 23rd

📊 March New Home Sales data - April 23rd

📊 March Durable Goods Orders data - April 24th

📊 March Existing Home Sales data - April 24th

📊 Total of 8 Fed Speaker Events

📊 20% of S&P 500 companies report earnings

Token Unlocks: $490m Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓ID (2.94%) - April 22nd

🔓EIGEN (0.53%) - April 22nd

🔓SHADOW (14.56%) - April 23rd

🔓BICO (0.8%) - April 23rd

🔓REZ (28.02%) - April 24th

🔓MEME (8.03%) - April 25th

🔓VENOM (2.86%) - April 25th

🔓ALT (7.92%) - April 25th

🔓TORN (2.42%) - April 26th

🔓 AXL (1.65%) - April 27th

🔓UDS (30.54%) - April 27th

🔓VELO (2.47%) - April 27th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 OpBNB mainnet - April 21st (Source)

🚀 Hedera testnet upgrade - April 22nd (Source)

🚀 Injective lyora mainnet - April 22nd (Source)

🚀 Axie Infinity migration - April 22nd (Source)

🚀 Haven1 mainnet launch - April 22nd (Source)

🚀 Layer1X X-MNAIS Testnet Release - April 24th (Source)

🚀 Initia mainnet launch - April 24th (Source)

🚀 Dolomite TGE - April 24th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi