⚡ETFs and Rumors of ETFs

Plus GambleFi heats up, the evolving DEX landscape, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

📈Trends and Narratives

ETFs and Rumors of ETFs

This week started with a frenzy in the crypto market. The Cointelegraph Twitter account shocked the markets by tweeting out that the Blackrock (iShares) Bitcoin Spot ETF had been approved.

Bitcoin quickly rocketed up past $30K.

Unfortunately, the euphoria was short-lived as the highly reputable Eleanor Terrett quickly reported that BlackRock issued an official statement that the ETF was still under review.

The carnage from this whipsaw saw over $65 million of BTC liquidated within minutes.

While this was a false alarm, it’s increasingly likely that someday soon we’ll get the real news. Last week, SEC declined to appeal the court’s Grayscale ruling.

Additionally, the short-lived pump on BTC and altcoins gave us a hint of how different coins and tokens will react to an eventual BTC ETF approval.

GambleFi Heats Up

Sports betting is one of the fastest growing industries in the United States and, as a sector that frequently deals with banking issues, is a natural fit for crypto.

Jake Pahor analyzed Rollbit, the current market leader for crypto sports betting:

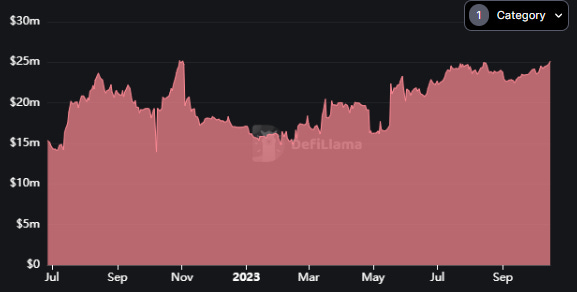

Additionally, Prediction Markets, a DeFi sector closely tied to gambling, have grown from $15M in TVL to over $25M in TVL since July.

⚡Save Hours of Research Each Week

The paid version of Dynamo DeFi, called Dynamo Research, gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more.

🔢On-Chain Analysis

The Evolving DEX landscape

As one of the most proven crypto business models, the dominant DEXes are sure to accrue massive value during the next crypto bull run.

Uniswap is still number one (by a lot), but competitors like Maverick and Thorchain have seen their market share grow recently.

According to The Block, the DEX to CEX spot trade volume is still in a long-term uptrend. This is at a time when the on-chain economy is slow (as someone who spends all day monitoring it). If this continues, I’m expecting total DEX volume to break its all-time high the next time the crypto market heats up in earnest.

For more, check out my in-depth analysis of how different metrics affect DEX market cap from last week:

Gnosis Chain TVL Skyrockets with Yield-Bearing Stablecoin

The launch of sDAI on Gnosis Chain brought highly elevated yields on DAI to one of the most decentralized Proof of Stake chains recently. Since the start of this month, TVL on the chain has increased by nearly $70M as yield hunters bridged to take advantage of this opportunity.

Here’s the TL;DR of how this works:

Bridged DAI is used as gas on Gnosis

That DAI is now earning yield through SparkLend

This yield is earned by users that stake their bridged DAI as sDAI

Initial days after launch, this allowed for some crazy opportunities, as sDAI stakers on Gnosis earned over 20% APR.

🛠️Tool Spotlight

Find Whale Wallets and Check Performance with Loch

An on-chain analysis tool I’ve recently started using recently Loch. Loch has an on-chain leaderboard that’s useful for finding wallets by size.

You can click into wallets to view a simple breakdown of their holdings and historical performance. For example, here’s the dashboard for one account I found using this method.

📅Key Events This Week

Prepare for the Next Bull Market with Double Your DeFi This Fall

My friend The DeFi Edge and I are teaching another cohort of our Double Your DeFi course this November. This is an intensive course to transform your DeFi skills in 5 weeks.

I secured a $300 discount for the first 5 people that sign up from my email list.

Use the coupon code: DynamoDeFi

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

Awesome thanks Patrick. Catching up on reading Substack.