⚡DEXs Just Had Their Biggest Month Ever: 2025's First Major Signal

DEX volume analysis and 2025's biggest bets, plus a massive APY on VIRTUALS

Read Time: ~4 minutes

⚡Snapshot

Predictions for 2025

New Moon Math: Hyperliquid, Solana’s edge & AI

700% APY on VIRTUAL

New Dynamo Defi website and metrics dashboard (in beta) are live!

📖 Recommended Reads

⚡Predictions, lessons and longs for 2025

69 theses from redphone

⚡AI Agent Infrastructure is not even close to priced in

They’re not just chatbots anymore

AI, DePIN, RWAs and more… what’s missing?

⚡Bitwise files for ETF comprised of companies that hold Bitcoin

Companies over $100M market cap & holding at least 1,000 BTC would qualify

⚡Tether Adds 7,629 BTC to Reserve Address

Total reserve holdings now worth $7.7B

⚡No-fluff toolkit for serious traders

I built the Onchain Academy to be the resource I wish I had.

In less than 3 hours, you’ll be able to:

Track smart money flows before they trend

Spot undervalued gems using on-chain metrics

Find the next big airdrops using real data

Analyze protocols like a professional

Skip the expensive lessons. Get instant access to my complete framework →

🔢Onchain Analysis

DEXcember

December DEX volume smashed records, crossing $450B in monthly volume for the first time.

Solana led the charge, followed closely by BSC and ETH volume. Raydium is Solana’s largest DEX, while BSC & Ethereum’s most impactful DEXs are PancakeSwap and Uniswap.

Hyperliquid dominates onchain perps. Jupiter and dYdX are a distant 2nd and 3rd.

DEX volumes dropped significantly over the last week, which is typical for the holidays.

The story: Solana continues to win, and benefits directly from the AI agent frenzy. DEXs like Uniswap & Aerodrome are fee-generating machines.

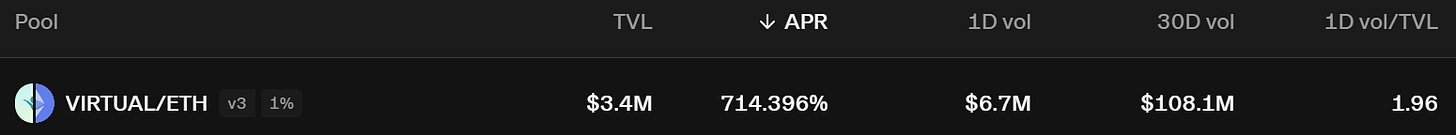

🚜Farm of the Week

VIRTUAL-ETH on Base

If you’re holding VIRTUAL or ETH, you can get over 700% APR providing liquidity.

How it Works

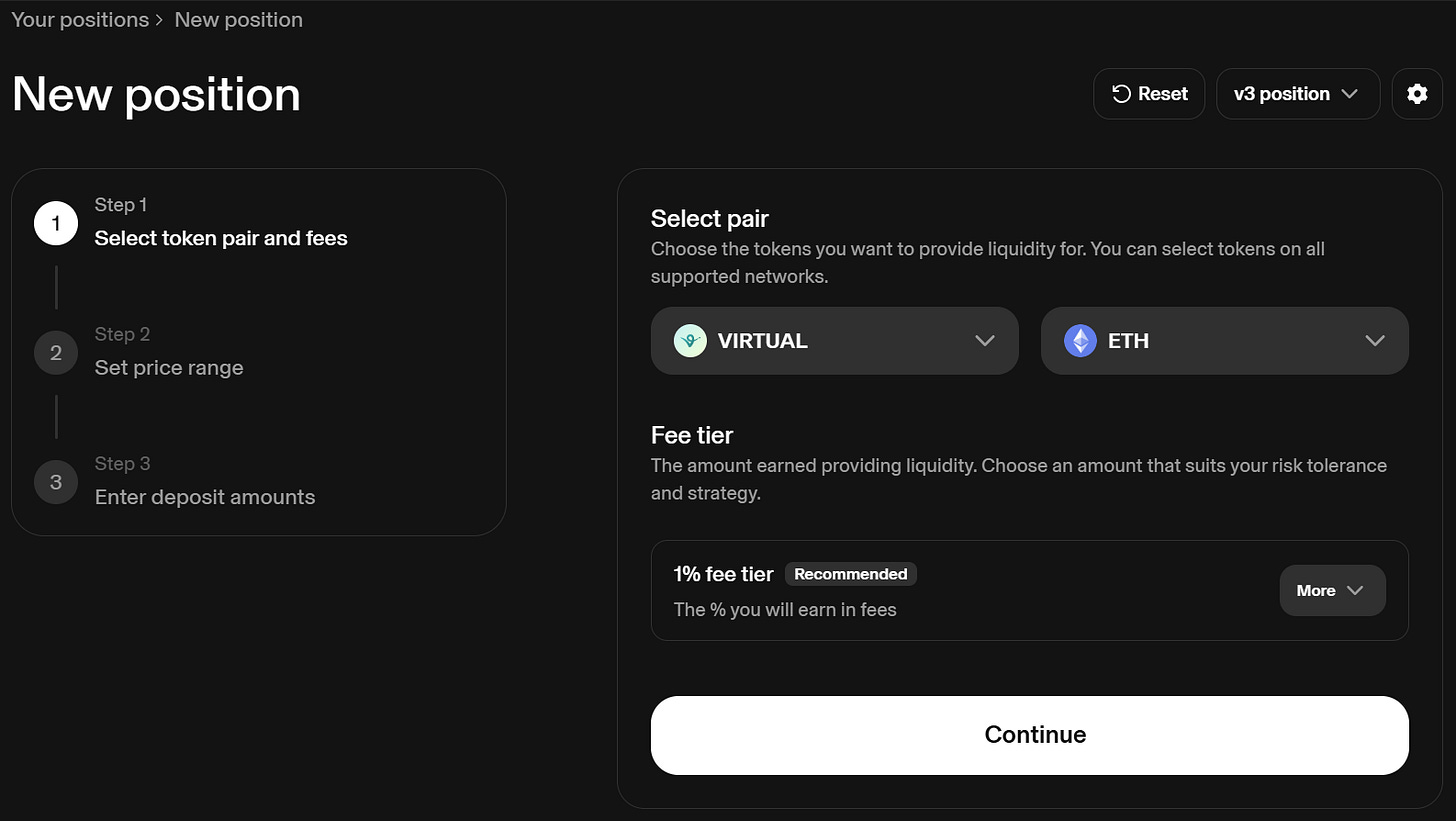

Uniswap makes it easy to provide liquidity. Simply select the pool to see its analytics and hit “Add Liquidity” in the top right corner.

Settings are already optimized, so hit continue, where you’ll enter the liquidity range (you can provide “Full range” if you don’t want to have to manage the position, or you can select a custom range for higher APY). Then enter the amount of tokens you’d like to supply, then deposit!

You’ll earn fees when swaps are made within your liquidity provision range.

Risks

If price moves out of your liquidity range, you won’t earn fees. Keep an eye on prices and adjust if necessary.

Moon Math: The rise of Hyperliquid, Solana’s Competitive Edge, and AI’s Impact

Check out the new podcast I’m doing with Stephen, aka The Calculator Guy, aka the Founder of DeFi Dojo.

⚡I learned crypto the hard way so you don’t have to

In 2021, I lost it all chasing hype. Then I developed a systematic approach to find real value in crypto. Here it is →

🛠️Tool Spotlight

Step Finance

Step Finance is an asset management tool on Solana. It tracks a portfolio across wallets, staking, NFT holdings, yield positions, leverage positions in one dashboard.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 November Pending Home Sales Data - December 30th

📊 Initial Jobless Claims data - January 2nd

📊 Tesla Q4 Deliveries data - January 2nd

Token Unlocks: $970M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓BDX (4.78%) - December 30th

🔓OP (2.50%) - December 31st

🔓SUI (2.19%) - January 1st

🔓ZETA (9.35%) - January 1st

🔓DYDX (1.17%) - January 1st

🔓MAV (8.44%) - January 1st

🔓AI (17.85%) - January 1st

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Fear alpha stag launch - December 30th (Source)

🚀 Arty token burn - December 31st (Source)

🚀 Alkimi soft staking pool launch - January 1st (Source)

🚀 Tars AI virtual assistant launch on Solana - January 1st (Source)

🚀 SCPT token burn - January 1st (Source)

🚀 FXN V2 launch - January 2nd (Source)

🚀 Clore’s gigaspot launch - January 3rd (Source)

🚀 OmniXEP mobile wallet launch - January 4th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi