⚡DeFi is getting exciting again

Plus booming crypto casinos, Arbitrum grants, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week.

📈Trends and Narratives

DeFi is Getting Exciting Again

Can you feel it?

After a year and a half of soul-searching, DeFi is back. All the heads-down building of DeFi teams is starting to bear fruit.

Prisma Finance launched the PRISMA, the Prisma DAO governance token, creating extremely high rates on blue chip assets (note that there is a vesting period for token rewards). Watch to see if this sparks an arms-race for yields on LSTs.

At the same time, Solana DeFi has been popping off, as I’ve been covering in this newsletter. It’s possible to pre-farm a number of future ecosystem primitives now. I outlined some strategies in this post:

If Ethereum rollups are more of your thing, the Arbitrum DAO is distributing ARB grants to 29 projects. Read all about who’s getting the grants and how to qualify in this thread:

These Crypto Casinos are Booming

Rollbit has been performing insanely well over the past month, sparking renewed interest in the GambleFi narrative.

Like I’ve pointed out many times in this newsletter, the gambling and crypto industries have a ton of synergy:

Overlap in users

Gambling and sports betting companies often struggle with traditional payment rails

Crypto allows founders to spin up composable, gamblefi primitives

One other GambleFi project that caught my eye is WINR Protocol. WINR is building an Layer 3 chain on Arbitrum for GambleFi infrastructure and already have several dapps launched. I always prefer infrastructure as a picks and shovels play when possible—successful infrastructure can benefit from network effects, making their upward potential greater than a single dapp.

This post goes into more detail about WINR:

This thread from Nikyous goes into some lesser-known GambleFi projects:

⚡New Dynamo Research Content Weekly

The paid version of Dynamo DeFi, called Dynamo Research, gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access this week’s call here.

🔢On-Chain Analysis

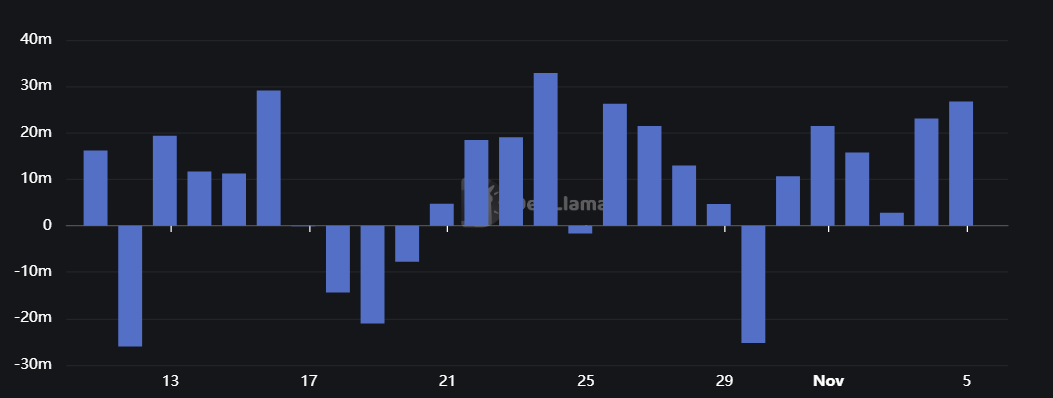

Arbitrum Net Flows

In anticipation of ARB grants going live, $75M flowed into Arbitrum this week, the most of any chain. Bridge flows are a better indicator than TVL that new money is entering an ecosystem.

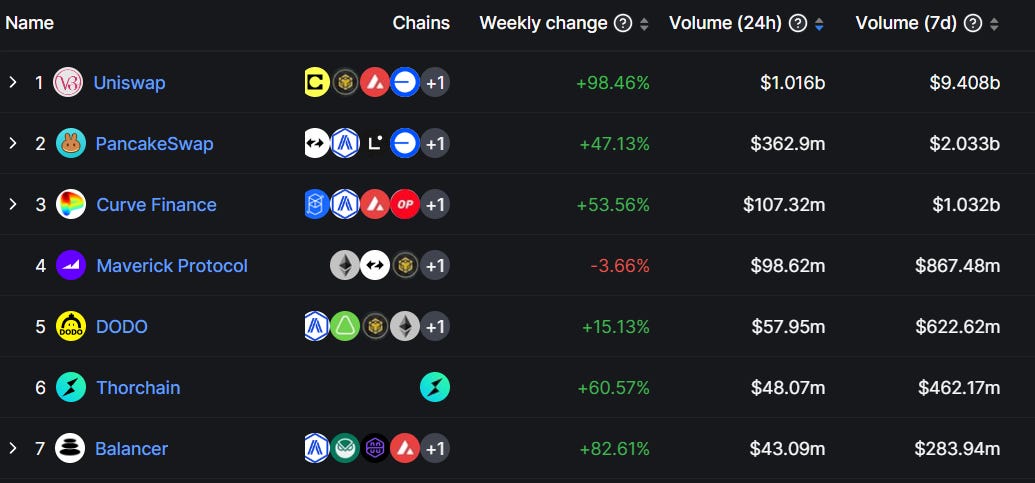

ThorChain Volume Shows Demand for Cross-Chain Swaps

ThorChain volume continued on its ascent this week, growing week over week for the second week in a row and reaching its second highest point in this past year.

ThorChain is currently the 6th largest DEX by volume. I’m keeping an eye to see whether it can push into the top 3.

🛠️Tool Spotlight

Track Top DEX Traders with ChainEDGE

Recently I’ve been using ChainEdge to track smart money movements for my paid newsletter. It tracks the top token inflows for a pool of top 0.01% DEX traders. It’s pricey, but overall I’ve found it to be one of the best smart money tools.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi