⚡Court greenlights FTX to sell $3.4 billion of crypto

Plus looking back one year from the Merge, ARB incentives, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

🔢On-Chain Metrics

On-Chain At a Glance

Total TVL (including liquid staking) ticked up to $60.7B this week as prices rebounded. Still, no significant movement from the range we’ve been in for the past year.

According to IntoTheBlock, aggregated exchanges saw modest outflows of 482.9 BTC this week.

Looking Back 1 Year After the Merge

This week marked 1 year since Ethereum’s successful transition to Proof of Stake. Let’s look at some on-chain data that quantifies the impact of the one of the most significant events in crypto history.

The amount of ETH staked has nearly doubled, growing to 26.8M ETH (10s of billions of dollars). Over 22% of ETH is now staked.

Since The Merge, Liquid Staking has grown from being the 3rd largest DeFi category to the largest. Liquid Staking protocols now command over $21B in TVL, over $8B more than Lending and Dexes.

Since The Merge, ETH has turned deflationary, its supply dropping by nearly 300,000, a 0.244% decrease. This makes ETH, fairly unique among assets as it now is:

Yield-bearing

Deflationary

A means of payment for transactions (in the Ethereum ecosystem)

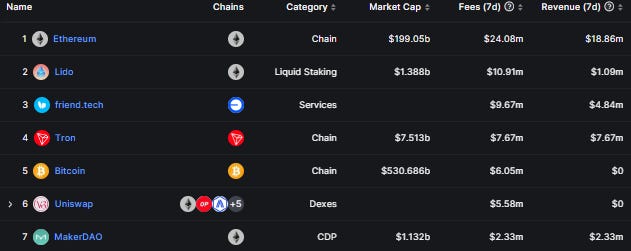

Friend.tech Generates Millions in Fees Daily

Interest in friend.tech continued to soar this week, with it averaging over $1M in transaction fees daily. This includes one day where it generated over $2M in fees and came close to Ethereum’s fees.

Huge Inflows to Arbitrum

This week, Arbitrum received over $100M of inflows, a reversal of recent trends, as people bridged in anticipation of ARB incentives being approved.

📈Trends and Narratives

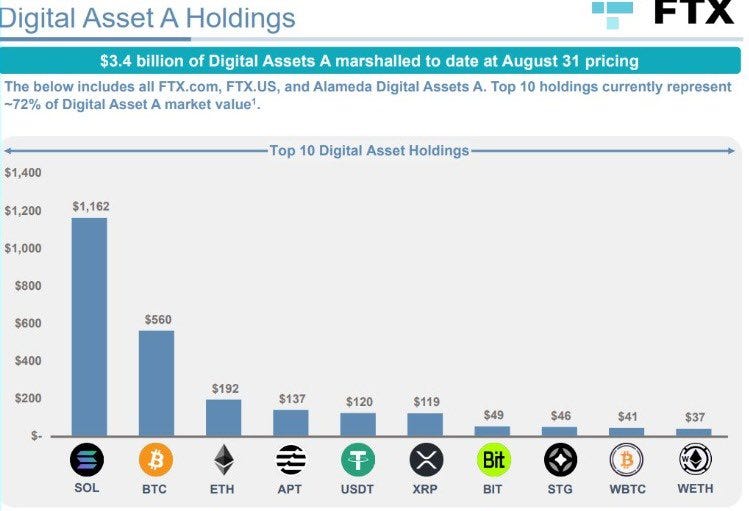

Court Greenlights FTX to Liquidate $3.4 Billion of Crypto

As expected, a court gave the FTX estate the greenlight to start liquidating their crypto assets this week. As of August, their assets totaled $3.4 Billion in value, with SOL and BTC being their largest holdings.

But don’t panic yet:

They have a limit on how many tokens they can sell weekly.

Most of their SOL and APT are locked and won’t fully vest until 2025.

tedtalksmacro outlines the details here:

Arbitrum Ecosystem Prepares for Incentives

In an effort to kickstart growth again, following a slow summer, Arbitrum governance approved a 50M ARB incentive program, to be distributed to Arbitrum protocols that apply for a grant.

There are hundreds of DeFi protocols on Arbitrum now, so to find the beneficiaries of this program, you’ll probably need to monitor Arbitrum community news feeds and the Arbitrum governance forum.

🛠️Tool Spotlight

Friendex on SpotOnChain

As friend.tech has grown, an entire ecosystem of tools and applications has sprung up around it. One such tool is SpotOnChain’s Friendex, which allows you to easily track the price history for specific keys as well as to view that owner’s PnL.

📅Key Events This Week

Prepare for the Next Bull Market with Double Your DeFi This Fall

My friend The DeFi Edge and I are teaching another cohort of our Double Your DeFi course this November. To recap, this is an intensive course to improve your DeFi skills in 5 weeks.

I secured a $300 discount for the first 5 people that sign up from my email list.

Use the coupon code: DynamoDeFi

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi