⚡Could DePIN be Crypto's Breakout Application?

Plus Solana regains momentum, Sui's on-chain metrics soar, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

📈Trends and Narratives

Solana Regains Momentum

After a month of consolidating, Solana is regaining momentum. Since December, it’s maintained and increased it’s share of on-chain activity, while new bullish themes emerge:

Just this week the Phantom wallet, the top wallet on Solana, flipped Coinbase in app store downloads. In past cycles, Coinbase topping the app store marked the top. If this cycle sees a higher proportion of user activity move on-chain, could Phantom reach similar heights?

In a major stress test for the network, the first Jupiter Exchange launchpad coin, WEN, launched, with hundreds of thousands of wallets claiming it. With Jupiter poised to do its highly anticipated JUP airdrop this week, the network will likely be tested further and massive attention will be on Solana.

Could DePIN be Crypto’s Breakout Application?

In the past DeFi, NFTs, and stablecoin payments have dominated on-chain transactions. However, recently a new class of projects have begun to attract users and mindshare: Decentralized Physical Infrastructure Networks.

These are, like the name suggests, decentralized networks for running physical infrastructure, like cloud computing, storage, and mobile networks.

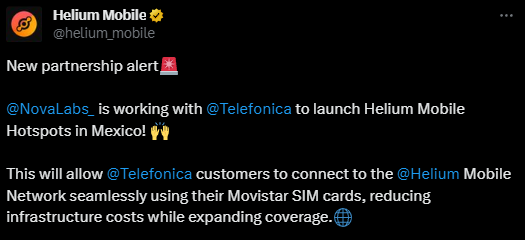

A breakout performer in this category recently has been Helium. Their mobile network has attracted tens of thousands of users over the past few months. Just this week, they announced a partnership with Telefonica to launch hotspots in Mexico. Like how stablecoins are bringing decentralized payments to the developing world, this could bring decentralized mobile service.

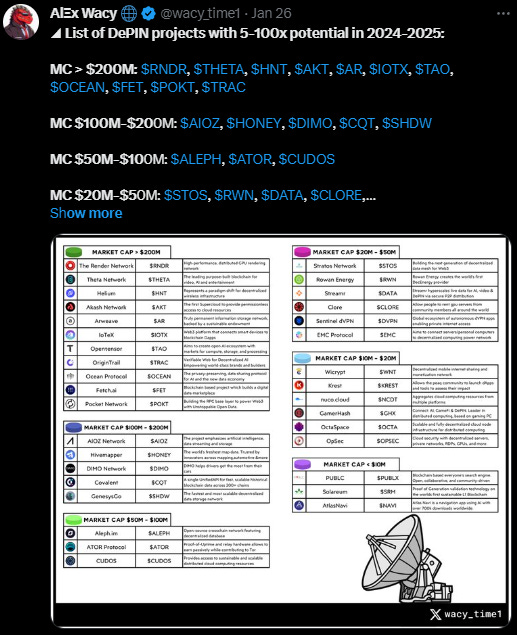

If you want to dive deeper into the DePIN ecosystem and use-cases it enables, this post outlines dozens of projects, grouped by market cap.

⚡New and Improved Dynamo DeFi Pro

I’ve made some major improvements to the paid version of the this newsletter. Read about them here:

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

Total Stablecoin Supply Climbs

After falling for 18 months, total stablecoin supply bottomed in September and has been growing since then.

This week, it passed $135B, where it was in September 2021 and April 2023.

A growing stablecoin supply is a good sign of increasing capital inflows to the crypto market.

Sui’s On-Chain Metrics Soar

Sui, a new Move-based, high-throughput chain, continues to reach new highs in both Total Value Locked and DEX volume.

This past week, it briefly entered the top 10 for both metrics.

This chain could be worth watching as an ascendant ecosystem that has never experienced a bull run before.

🛠️Tool Spotlight

Track Staking Rates and Rewards with StakingRewards

Tracking staking metrics can be effective for:

Assessing how many of a network’s tokens have been locked up (higher staking rates are better)

Determining the “risk-free rate” for that chain (all DeFi yields should be benchmarked against staking that asset

Stakingrewards.com has an intuitive dashboard for tracking everything staking-related for a host of chains and applications

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi