The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

In this issue:

🔢On-Chain Metrics

📈Trends & Narratives

🛠️Tool Spotlight

📅Key Events This Week

🔢On-Chain Metric

Total Value Locked Trends

Total DeFi TVL (including Liquid Staking) dropped from $66.4B to $63.1B this week, with the decrease driven by the Vyper programming language exploit, which allowed nearly half of Curve’s TVL to be drained.

Of top 10 chains, Tron, Solana, and Pulse grew, while other chains shrunk.

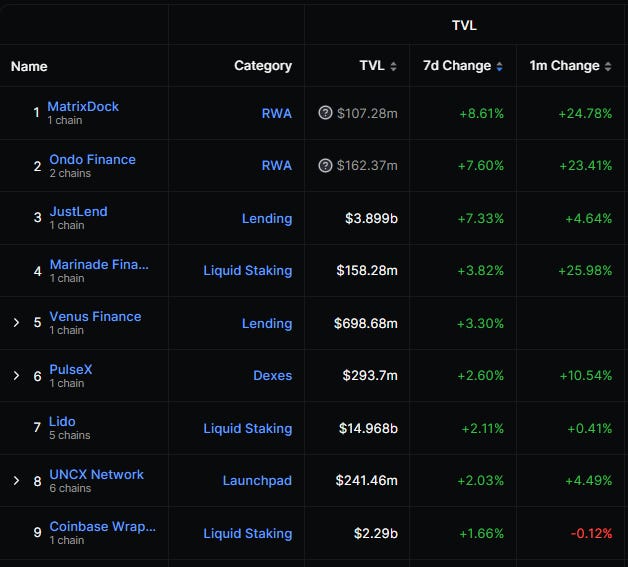

Only a few $100M+ protocols saw TVL growth this week, with Real World Assets and Liquid Staking protocols were overrepresented among these.

Cross-Chain Flows

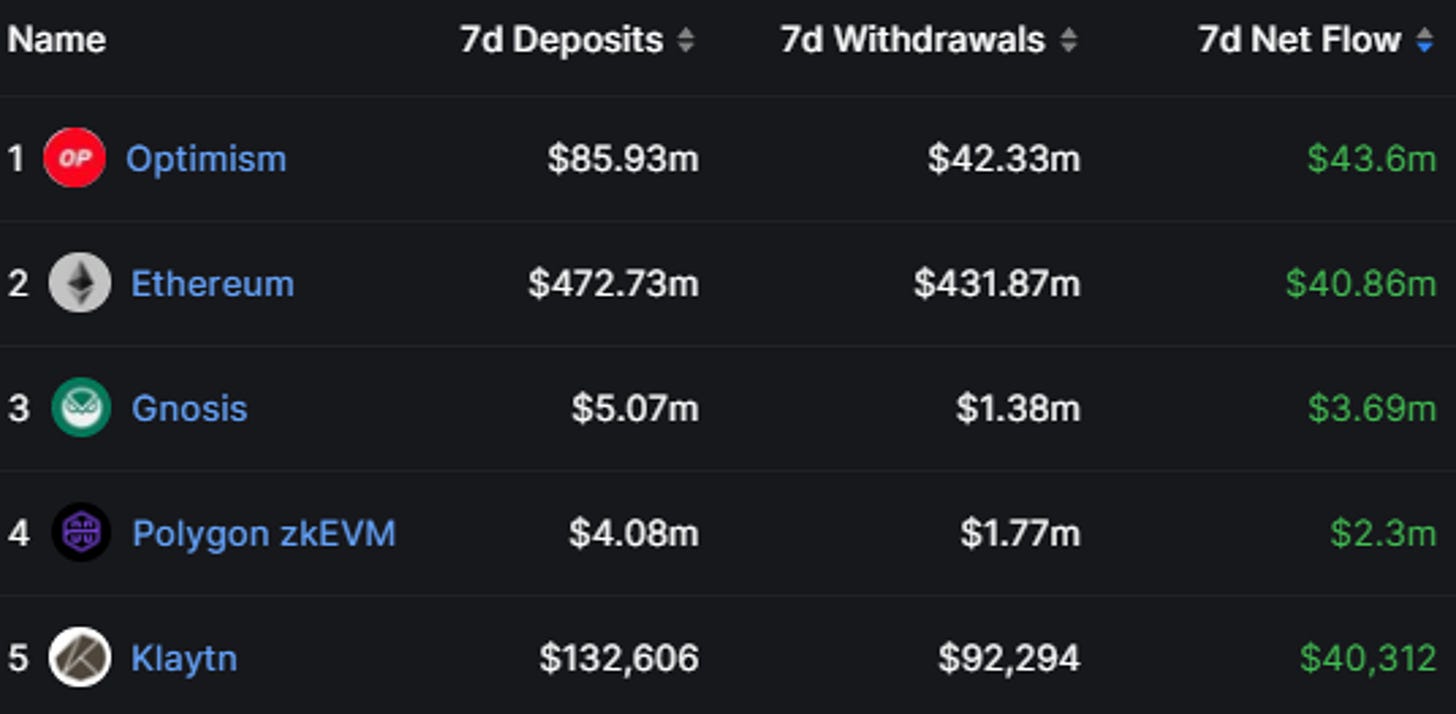

Optimism, Ethereum, Gnosis, and Polygon zkEVM saw the largest 7-day net inflows.

Top Earning Protocols

The standout among the top earning protocols this week was Optimism, which broke into the top 10.

A surge in activity, driven by the Worldcoin rollout, pushed Optimism’s network activity to new records.

📈Trends and Narratives

Curve Exploit Sends World of DeFi Reeling

Curve, one of the largest and most trusted protocols in DeFi, saw multiple pools drained due to an issue in with the Vyper programming language.

This exploit, and the rush of liquidity providers to pull liquidity from other pools as a precaution, saw Curve’s TVL drop by nearly 50% in a single day.

Coinbase’s Base Chain Delivers Early Wins and Pain

Coinbase’s new Base chain saw a rapid inflow of TVL following its launch.

This influx of money sent some memecoins on the chain skyrocketing.

Unfortunately, many of those tokens, including the flagship one, BALD, rugpulled.

Despite a rocky start, I am generally bullish on Base, given its backing by Coinbase. If you want to bridge to and use Base, I made a video walkthrough here.

Bot Mania Continues

The hype around Telegram and Discord bots continued this week. Here redphone outlines thoughts on how they could evolve into a new financial primitive.

The trading bot narrative gained enough traction that Bloomberg ran an article on it, highlighting its potential to onboard retail users to DeFi.

If you’re trading on-chain, snipe DEX listings, set limit orders, swap MEV free, and more with Unibot. (Affiliate Link)

🛠️Tool Spotlight

Track DeFi Categories with the DefiLlama Categories Tool

One key page I use to track crypto trends is the DefiLlama Categories tool. This dashboard shows the total TVL across different DeFi categories. I used this to spot the Liquid Staking and RWA narratives early.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter, TikTok, and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi