⚡Celsius Sues Tether for Billions

Plus Canto chain halts, Aerodrome volume hits new highs, and more

Estimated Read Time: ~5 minutes

⚡In Today’s Edition

Celsius sues Tether for billions in BTC

Canto chain halts, patch expected soon

Aerodrome volume hits new highs

Key macro events this week

📖 Recommended Reads

⚡Celsius sues Tether over $2B worth of Bitcoin

Celsius accuses Tether of fraudulent transfers before bankruptcy

⚡Arbitrum TVL approaching ATH while ARB token approaches all time low

Arbitrum’s popularity isn’t transferring to the ARB token, is revenue sharing coming in the future?

⚡Canto chain halts, down for over 36 hours

A patch is scheduled for today, August 12 at 12:00 UTC. Canto claims all funds are safe

ETH gas briefly fell below 1 gwei

⚡Digital asset investment products saw inflows of $176M last week

Flows show “unanimous positive sentiment”, ETH gets the lion’s share of inflows

⚡U.S. telcos initiate traffic offloading tests onto Helium mobile network

Two large U.S. carriers look to Helium for network support

Dynamo DeFi Referrals

⚡Refer your friends to Dynamo DeFi. Get rewarded.

💵Earn rewards for supporting the newsletter - get a helpful infographic with the best crypto tools after just one referral.

💵Refer 3 friends and get a full month of Dynamo DeFi Pro (the best place to make more money in crypto & DeFi) completely free.

💵Refer 15 friends and you’ll get six months of Dynamo DeFi Pro on us!

Hit the button to see our referral page and copy the link there to share with anyone & start earning rewards.

🔢On-Chain Analysis

Aerodrome is a Juggernaut

In the last 30 days, Aerodrome has positioned itself in the top 20 protocols in terms of fee generation. With $7.5M in 30 day fees, Aerodrome is bringing in more fees than Marinade, dYdX, Curve and Base chain.

Aerodrome is doing the majority of volume (nearly 60%) on Base chain.

Aerodrome is a top five protocol by volume in the last 24 hours, accounting for ~7% of total DEX swap volume.

🚜Farm of the Week

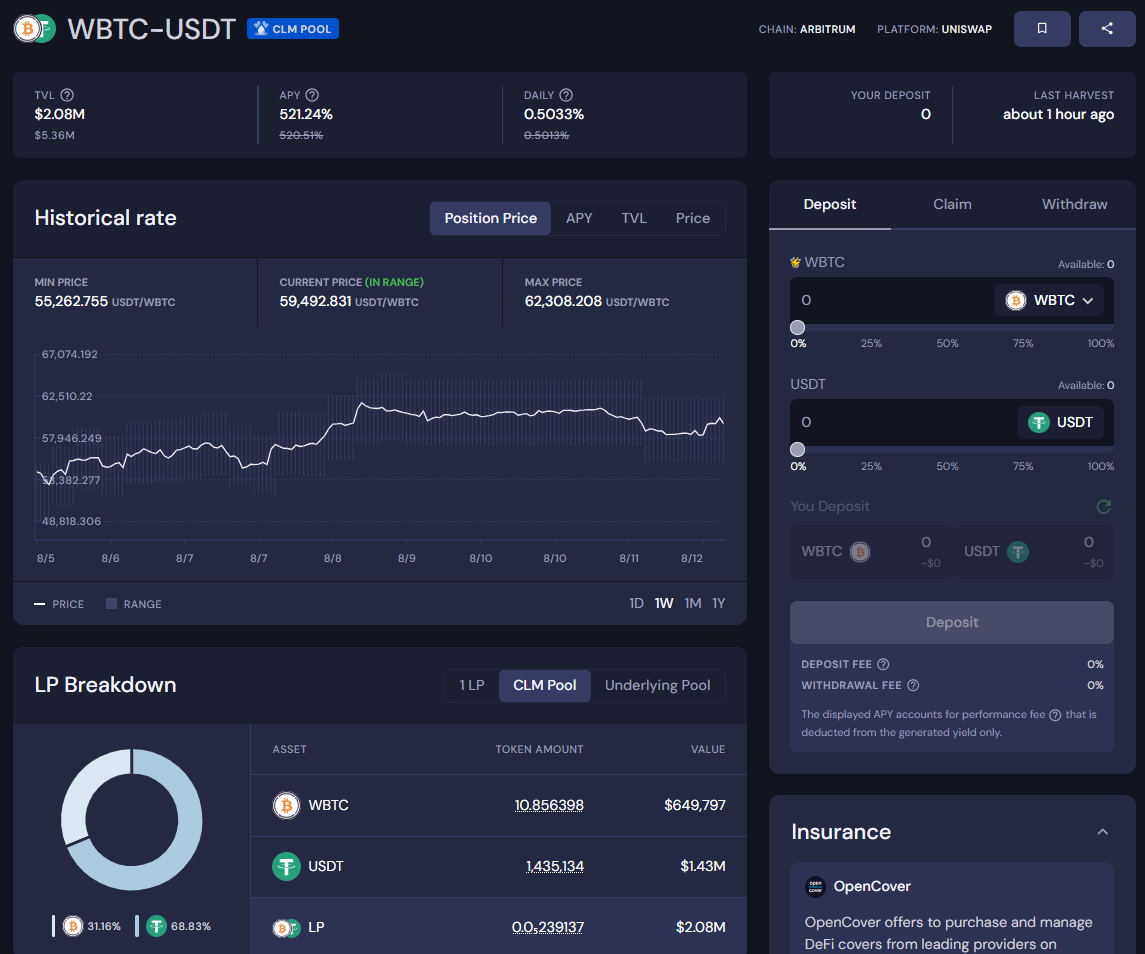

WBTC-USDT on Arbitrum

Beefy Finance is a cross-chain yield aggregator with $270M in TVL. The WBTC-USDT pool is currently producing a high APY due to heavy Uniswap volume on the Arbitrum chain.

How it Works

Earn over 500% APY on WBTC by providing liquidity to the CLM (Cowcentraded Liquidity Manager) Pool.

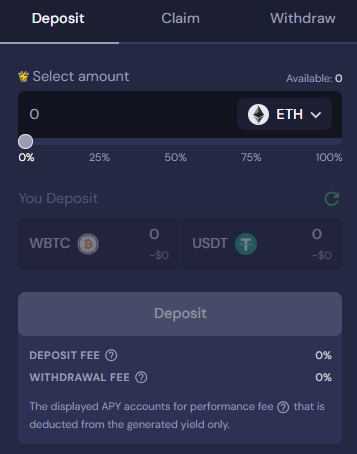

Simply select the amount of WBTC and USDT you’d like to add, and click Deposit.

You can also select a number of different assets to deposit, and Beefy Finance will swap them into WBTC and USDT for you with the appropriate ratio.

Risks

The current APY is quite high, expect APY to drop within the coming days/weeks if swap volume falls. You can track that right here.

Aggregator risk: using a yield aggregator means there are smart contracts that rely on other smart contracts, essentially stacking the risk of multiple dependent protocols instead of just one.

The total pool TVL is just over $2M, which is relatively small. Watch for pool TVL to dip below $1.5M, that would be a signal to exit the pool.

Impermanent Loss

How to Build a DeFi Portfolio on Solana

⚡Get Better at DeFi with Dynamo DeFi Pro

Take your crypto expertise to the next level with Dynamo DeFi Pro, the premium service designed to provide you insights into the on-chain economy and the knowledge to conduct your own in-depth research.

Dynamo DeFi Pro members get access to:

⚡Exclusive Discord Community - Engage in lively discussions on trading strategies, on-chain data and airdrop alpha. Learn more here.

⚡Live Community Calls & AMAs - Join 3X monthly live sessions with our community and get all your questions answered in real-time.

⚡Premium Newsletters & Curated Data Analysis - Receive actionable insights and special in-depth reports on tokens with strong fundamentals.

⚡In-Depth Pre-Recorded Videos - Watch comprehensive videos where I share my research process. View past videos here.

⚡Monthly Group Strategy Calls - Participate in exclusive monthly video calls to discuss market trends, the latest in crypto, and more. Access calls here.

Get ahead with Dynamo DeFi Pro, for just $11/month (less than the cost of lunch in most countries).

🛠️Tool Spotlight

Use Arkham Intelligence to Track Fund Activity

Last week, we used Arkham Intelligence to track Jump Trading’s onchain ETH-selling activity.

Arkham has several helpful tools for onchain sleuthing and research.

First, a collection of helpful dashboards to help track trading activity and chain overviews in real time.

You can also monitor large entity holdings, view balance history and track transactions.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

🗳️Prediction Pulse: Forecast the World Better

Prediction Pulse is a new newsletter launched by the Dynamo DeFi team about prediction markets.

On Tuesdays and Fridays, you get everything you need to know about the upcoming election, trending markets with the biggest moves, and our favorite prediction market picks to capitalize on🤝

Prediction markets, through which participants can place wagers on world events like elections, are one of the fastest growing crypto verticals. Join hundreds of subscribers and get critical updates on big markets.

📅Key Events This Week

Macro Events

📊Federal budget balance - August 12th

📊Elon Musk and Donald Trump X space - August 12th

📊July PPI data - August 13th

📊July CPI data - August 14th

📊July retail sales data - August 15th

📊Philly Fed Manufacturing Index - August 15th

📊July housing starts data - August 16th

Token Unlocks

🔓TokenUnlocks: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓SAND (9%) - August 14th

🔓CYBER (8.54%) - August 14th

🔓UXP (2.05%) - August 14th

🔓STRK (3.95%) - August 15th

🔓ARB (2.77%) - August 16th

🔓 APE (2.31%) - August 17th

🔓ENA (0.82%) - August 18th

🔓ROSE (2.24%) - August 18th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 JustBet beta launch - August 12th (Source)

🚀 Aleph zero EVM mainnet - August 12th (Source)

🚀 Kujira PILOT sale - August 12th (Source)

🚀 Flow crescendo testnet - August 14th (Source)

🚀 Cronos zkEVM mainnet - August 15th (Source)

🚀 Etherscape launch on Enjin- August 16th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi