⚡BNB Activity Hits Yearly High, Chiliz Sports Mainnet Launch, and More

Plus on-chain stats show an acceleration of liquid staking and BRC-20 adoption.

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

New format on the newsletter this week. I broke out the highlights of the week into separate sections for:

On-chain metrics

Trends and narratives

Tool spotlight

Key events this week.

🔢On-Chain Metrics

High Level

Total DeFi TVL (including liquid staking), dropped from $66.65b to $65.41b this week. Major chains were down across the board, with Optimism TVL dropping the most and BSC TVL dropping the least.

BNB Activity Surges to Yearly High

DEX Volume on BNB Chain (BSC) this week grew by 24% to hit its highest point in a year. Over the past 24 hours, BSC DEX Volume was higher than Ethereum, a milestone that hasn’t been hit since 2021.

Liquid Staking Expands TVL Lead

In the past 2 years Liquid Staking has gone from having 5% the TVL of DEXes to having an equal amount last week to now having $1.39b more in TVL.

As Ethereum staking yield increasingly comes to be viewed as the safest form of yield in crypto, I expect Liquid Staking and related projects to keep siphoning TVL from the rest of the DeFi ecosystem.

📈Trends and Narratives

Chiliz Sports Mainnet Launches

The Chiliz purpose-built blockchain for sports and entertainment this week. I’ve long said that fan and community tokens are one of the clearest low-hanging fruit for crypto adoption.

Why?

Sports franchises will adopt them to make money and increase fan engagement

Fans will adopt them for non-monetary perks and to benefit financially if their team wins

BRC-20s Ecosystem Takes Shape

The ecosystem for BRC-20s, the new fungible token standard built on Bitcoin, continued to bloom this week.

BRC-20 are now accounting for roughly half of all BTC transactions.

This surge in activity has attracted the notice of crypto giants.

CoinGecko lists BRC-20s:

OKX announces a slew of BRC-20 infrastructure:

Pulsechain Launch

The long-anticipated Pulsechain launched this week. I like to keep an open mind and am treating this as another EVM chain with a highly-engaged community. There may be opportunities to make money if the ecosystem gains traction.

Stephen The Calculator Guy’s Take:

Interesting thread on the topic from Eric Wall:

🛠️Tool Spotlight

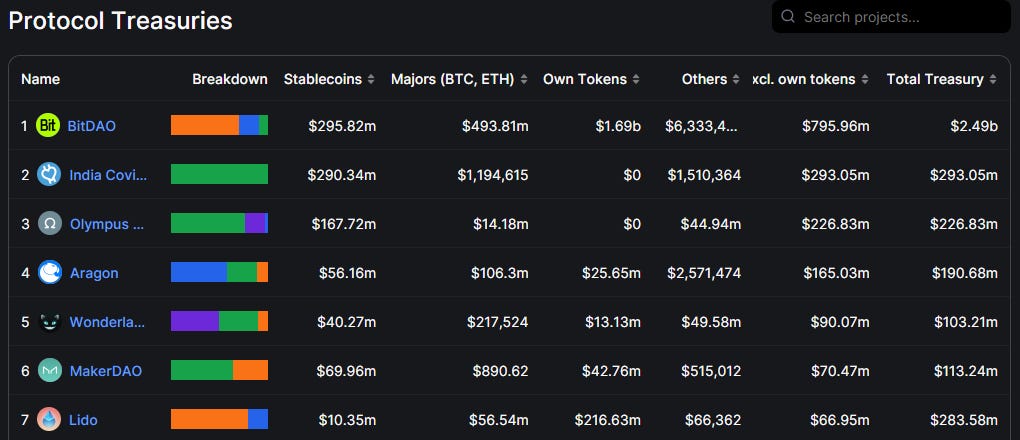

DefiLlama Treasury Dashboard

DefiLlama’s new treasury dashboard is a phenomenal for assessing project health and longevity. Use this tool to review over 200 project treasury values, broken down by stablecoins, BTC & ETH, and own tokens. Be sure to look the breakdown by token, because many projects have large treasuries, but only hold their own token.

One strategy I’m using is to cross-reference treasuries (excluding own tokens) with project market cap. Look for projects that have a large treasury compared to their market cap.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi