⚡Blast TVL Blasts Off

Plus Ethena's big idea, farm of the week, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week. Be sure to also check out my YouTube for more regular content.

Upgrade to the premium newsletter for access to premium articles, videos, and a Discord group.

NEW FORMAT: This week, I’m testing out a new format with the newsletter. I’m focusing on 1 trend and 1 piece of on-chain analysis, and added a farm of the week section.

📈Trends and Narratives

Ethena’s Big Idea

Last year, Arthur Hayes wrote an article titled “Dust on Crust” where he proposed an idea to create a synthetically backed fiat stablecoin - he called it the Nakadollar - that was designed to be independent of any existing banking system.

The mechanism by which this stablecoin was to be built would be long Bitcoin and short BTC perp contracts - basically a market neutral position that maintained the value of $1 no matter where the market goes.

Fast forward one year, and one of Arthur’s readers (to be fair, not just any reader, his name is Guy and he used to work at a multi-billion dollar hedge fund) implemented Arthur’s proposal, and improved upon it.

The project is called Ethena, and it runs on ETH because the ETH network offers a native yield.

Ethena’s stablecoin USDe has been live for 3 weeks and already is nearing $1B in TVL, making it the 6th largest stablecoin by market cap.

In his latest essay, Arthur goes into detail about how Ethena works, why it’s important, and why it will dethrone stablecoin behemoth Tether.

In a world of endless DEX’s, NFT marketplaces and project forks, it’s inspiring to see a project go BIG - stablecoins are arguably crypto’s most impactful use case so far, and Tether looks untouchable. If Ethena can do what Arthur is proposing, Ethena is going to be big.

How to Capitalize

Ethena currently offers ~67% APY on staked USDe. To stake, simply:

Go to https://app.ethena.fi/

Mint USDe on the Buy page

Stake it for sUSDe on the Stake page

Here’s a more detailed how-to. You won’t be able to access this page if your computer network’s IP address is in the United States.

Also, we know an Ethena governance token is coming, so there may be airdrop potential here.

⚡Monthly Dynamo DeFi Pro Call Last Week

The premium version of Dynamo DeFi gives you deeper insight into the crypto market. Last week, we had our monthly Zoom call to discuss the latest market trends.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Community calls & AMAs in Discord. 3X per month I’m holding community calls and AMAs in the Dynamo DeFi Discord.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access calls here.

🔢On-Chain Analysis

Blast DeFi TVL Breaks $1 Billion

Blast, the highly-anticipated Ethereum Layer 2, has been growing steadily since their mainnet launched 2 weeks ago. Blast distinguishes itself through ETH and stablecoins bridged from Ethereum mainnet earning native yield on-chain. Today Blast crossed a major milestone, with its TVL surpassing $1B.

🚜Farm of the Week

ExtraFi on Base

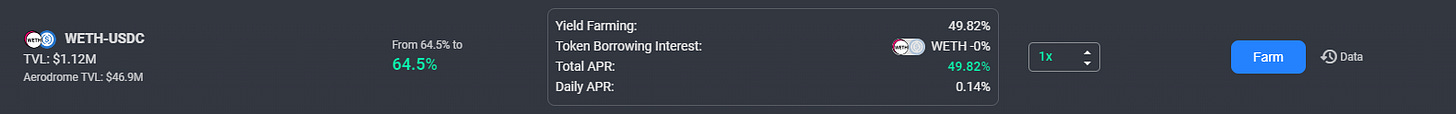

Extra Finance is a leverage yield farming protocol on Base and Optimism. Extra received an Optimism grant and has solid stablecoin and non-stable pair farms on both Optimism & Base networks. With the Base network starting to gain popularity, this is a way to leverage that ecosystem for yield

How it works

You can lever up your yields if you hold EXTRA tokens and stake them for veEXTRA, but even without leverage you can still earn ~65% on your WETH in their WETH-USDC pair on Base.

Here’s how you can open a farming position.

Risks

🛠️Tool Spotlight

View Apps from the Perspective of another Wallet

If you’re tracking smart money wallets one way to get deeper insights can be to “impersonate” their wallet. This doesn’t allow you to make any transactions of course, but it allows you to see how apps look from that wallet’s perspective. This can be useful for seeing information such as their liquidation price and farming rewards. To do this use an app called Impersonator.

Make the Most of the Bull Market with Double Your DeFi

The bull market is here. Are you prepared to make the most of it?

My friend The DeFi Edge and I are teaching another cohort of our Double Your DeFi course this April. This is an intensive course to transform your DeFi skills in 5 weeks.

Spots are limited and this course is on track to sell out.

📅Key Events This Week

Macro Events

📊 US CPI- March 12th

📊 US PPI - March 14th

Token Unlocks

🔓 APT (6.73%) - March 12th

🔓 CYBER (5.98%) - March 15th

🔓 UXD (2.05%) - March 15th

🔓 PERP (0.58%) - March 15th

🔓 ARB (76.62) - March 16th

🔓 PSP (0.83%) - March 16th

Launches

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Beldex .bx domain sales - Mar 12th (Source)

🚀 Immutable testnet shanghai upgrade - March 12th (Source)

🚀 Wemix night crow’s game launch - March 12th (Source)

🚀 Entangle’s $NGL Launch - March 13th (Source)

🚀 PropyKey’s Launch- March 13th (Source)

🚀 Decun Upgrade - March 13th (Source)

🚀 Radix’s project ignition launch- March 14th (Source)

🚀 Cardano USDM launch- March 16th (Source)

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi