⚡️BlackRock CEO's prediction coming true despite market selloff

Bitcoin falls below $80K, but this onchain sector is up 250% this month - plus: 30% APY on stables

Read Time: ~6 minutes

⚡Snapshot

Onchain borrow rates hit 1Y lows, stables & RWAs grow

Maximizing yield and points for Sonic airdrop using SwapX

Introducing the Dynamo DeFi Crypto Fear & Greed Index Dashboard

📖 Recommended Reads

⚡Analysis on crypto markets post-Liberation Day

Excellent research & analysis from Kaiko

What does crypto need to win as an industry?

⚡Blackrock is going all-in on tokenization

Implications from Larry Fink’s letter to investors

⚡Crypto watchlist for the week ahead

Aave buybacks, multiple protocol upgrades

⚡BTC ETF outflows last week total $200m

ETFs still saw +$1.3b YTD

⚡Get a Handle on the State of the Market

This Thursday at 5:30pm EST, we’re going live with a research presentation.

We’ll be covering the state of the market, what it means for Bitcoin and where we go from here.

This presentation, recording and Q&A is exclusively for Dynamo DeFi Pro members.

To attend the presentation, join Dynamo DeFi Pro and get instant access plus:

Weekly research reports with in-depth custom metrics

Access to the Dynamo DeFi discord to strategize with DeFi’s top minds

Exclusive videos and Onchain Academy course

Click here to take the next step in your investing journey. It’s time to level up.

🔢Onchain Analysis

Onchain Borrowing Rates at Yearly Lows

The IPOR Index is a benchmark reference interest rate sourced from other DeFi credit protocols and is published onchain based on the heartbeat methodology.

Think of it like the LIBOR or SOFR in traditional finance. It’s a composite of the interest rates from multiple credit markets.

We can use these rates to indicate onchain leverage and activity. The benchmark stablecoin rates fell significantly last week and are now at lows last seen in September.

For reference, here are last week’s numbers:

These rates tell us there is little demand for onchain borrowing at the moment - it costs less than 3% APY to borrow USDT, about half the yearly average rate.

Total stablecoin market cap flat this week, still up nearly 3% on the month

There’s two markets that are continuing to grow: stablecoins and tokenization (think onchain money markets, RWA’s, etc)

BlackRock’s BUIDL fund is up 250% in the last 30 days, adding $1.4b in market cap.

The number of RWA asset issuers & holders as well as total RWAs onchain are growing relentlessly.

While many altcoins (and Bitcoin) are suffering, the trend is clear: finance is coming onchain.

Every stock, every bond, every fund —every asset— can be tokenized. If they are, it will revolutionize investing

— Larry Fink, BlackRock CEO

By the way, the lions share of this growth is happening on Ethereum.

🚜Farm of the Week

SwapX on Sonic: 30% APY Plus Triple Airdrop Potential

SwapX is a V4 DEX with advanced yield strategies and ve(3,3) mechanism.

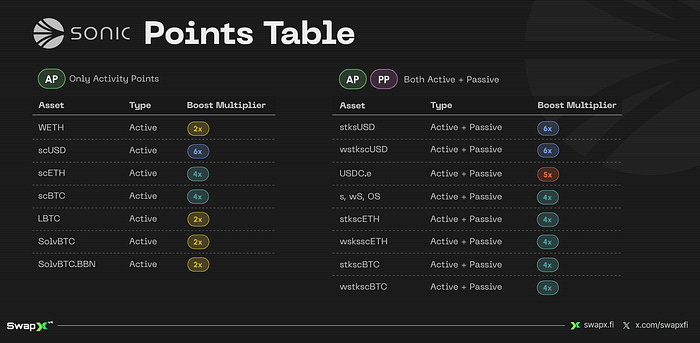

These pools are especially enticing because they simultaneously earn airdrop points on Sonic.

The first pool, USDC.e/scUSD, is our favorite.

How it Works

Adding liquidity to these pools (especially pools with scUSD) earn active and passive points boosts. Active and Passive points are two different types of points to accumulate for a portion of Sonic’s $100m airdrop.

You’ll also earn Gems - Sonic’s way of distributing S tokens to apps. SwapX promises to return 100% of the airdrop it receives to its users. SwapX was a top protocol during Sonic’s Booom bounty program and received over 8,000 gems as a pre-allocation.

When the airdrop happens, 100% of those gems go to users.

To participate, head to SwapX and sign in with your browser wallet (you’ll need to add the Sonic network, but you’ll be prompted to do so on the website). Swap for USDC.e (bridge USDC) and scUSD (a Rings Protocol stablecoin), and when you supply them to the pool you’ll earn yield, 12x Sonic points, Rings points, and Sonic Gems.

Impermanent loss is minimized because both tokens are stables.

To recap: over 30% APY on stablecoins plus huge points boosts for Sonic’s airdrop.

For more stablecoin yields, go to our top 10 stablecoin yields in April here.

Risks

What Tariffs Mean for Crypto

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

The Dynamo DeFi Crypto Fear & Greed Dashboard

Use our advanced dashboard to track crypto sentiment with more granular data.

The dashboard tracks daily Fear & Greed changes and has an interactive chart to distill what’s really going on under the market’s hood.

The Distribution tracker breaks down how much time the market spends in each category. We’re currently in Extreme Fear. Historically, we’ve spent around 18% of the time in Extreme Fear.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 Fed meeting minutes - April 9th

📊 Tariffs go into effect - April 9th

📊 US CPI data - April 10th

📊 US PPI data - April 11th

Token Unlocks: $590M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓KAS (0.59%) - April 7th

🔓TNSR (35.86%) - April 8th

🔓GMT (3.13%) - April 8th

🔓ENS (2.83%) - April 8th

🔓MOVE (2.04%) - April 9th

🔓SAGA (118.54%) - April 9th

🔓FLR (2.86%) - April 9th

🔓BIGTIME (36.98%) - April 9th

🔓AXS (5.68%) - April 12th

🔓APTOS (1.87%) - April 12th

🔓BB (97.38%) - April 12th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Solidus AItech to launch Agent Forge - April 7th (Source)

🚀MarbleX stock game launch on Immutable ZkEVM - April 7th (Source)

🚀 L1X one stop wallet profiler launch - April 9th (Source)

🚀 $AAVE buyback commences - April 9th (Source)

🚀 Neutron mercury upgrade - April 9th (Source)

🚀 Hashkey chain testnet upgrade - April 9th (Source)

🚀 IOST airdrop - April 9th (Source)

🚀 SolvBTC bera launch - April 10th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi