⚡Bitcoin Stairway to Heaven [Dynamo DeFi Pro Mid-Month Report]

On-chain insights and DeFi strategies

In this newsletter:

Dynamo’s Thoughts

Market Outlook

Market Health - as determined by metrics

Category & Chain Trends - which categories and chains are growing?

On-Chain Metrics

On-chain Highlights - Curated charts from the past week showing fast-growing DeFi protocols

On-chain Milestones - Chains and protocols that hit on-chain milestones, such as breaking their ATH in TVL

💡Dynamo’s Thoughts

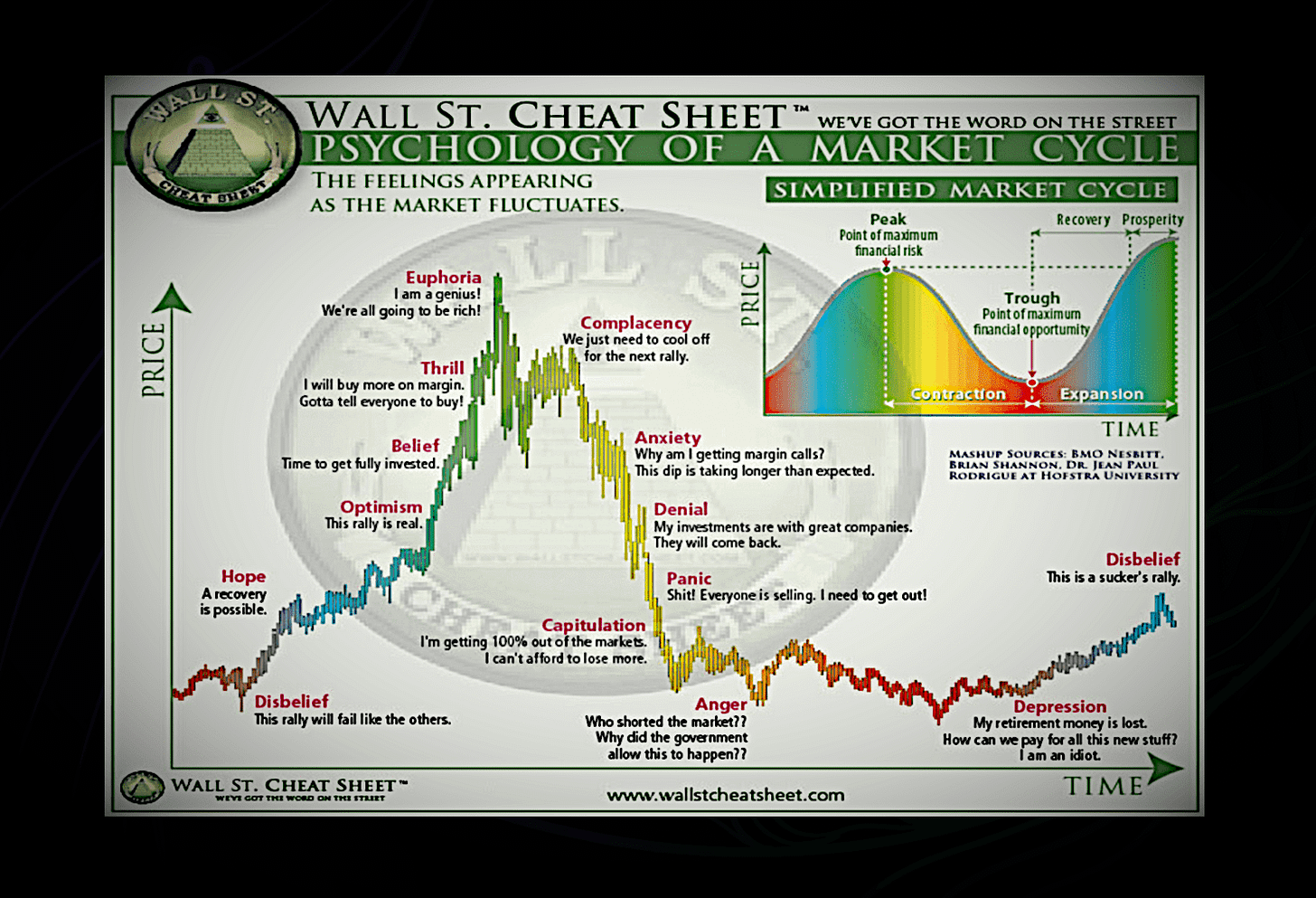

Are we near the end of the cycle? Are we still in “disbelief”? Do cycles even matter anymore?

These questions pop up on Crypto Twitter every time Bitcoin makes a significant move - whether it's breaking all-time highs or pulling back below $90k (hard to believe that was fewer than 2 weeks ago). Or recently, even when Bitcoin barely moves at all.

Even in recent days, despite Bitcoin hitting a new all-time high and perhaps the most bullish government-related crypto news in history, many are asking whether the cycle is over. Here’s another possibility: Bitcoin is on a “Stairway to Heaven”.

The Bitcoin Stairway to Heaven is the idea that Bitcoin will, over time, see rapid expansions and repricings, followed by periods of consolidation & bleeding. This will happen over years, on a high time frame, not months.

Note that this doesn’t mean up only. In fact, it means NOT up only. However, it means no more 80% retraces and no more 4-year cycles. Instead, imagine an asset that fluctuates but with a consistent bias upwards and hits a new all-time high most years, similar to how tech stocks have behaved the past decade.

The Institutional Landscape Fundamentally Changed

In 2021, the institutional world was divided. Today, nearly every major financial institution has embraced Bitcoin - from BlackRock to the US Government. When previously skeptical giants shift their stance, it changes market dynamics.

Many of the largest institutions (including the US government as of this week) now embrace Bitcoin, even if it’s for the sole purpose of making money.

Structural Support is Strengthening

ETFs now hold over 1.1M BTC (5.7% of supply) after just one year.

You could argue that the more these ETFs hold, the more they can dump on the market, but that hasn’t been the case so far. On most Bitcoin dips, the ETFs have had modest outflows at first, followed by continued inflows as buyers DCA in.

We are just finishing year 1 of having Bitcoin ETFs in the US. What will the impact be as it becomes consensus to allocate a small % of retirement portfolio's to digital assets?

Long-term holders now control 14.5M BTC, up from 12.5M three years ago.

The 200W SMA (~$40k) theoretically provides a "worst case" floor - far higher than previous cycles. For the record, the price of Bitcoin has gone below this level before, but not by much.

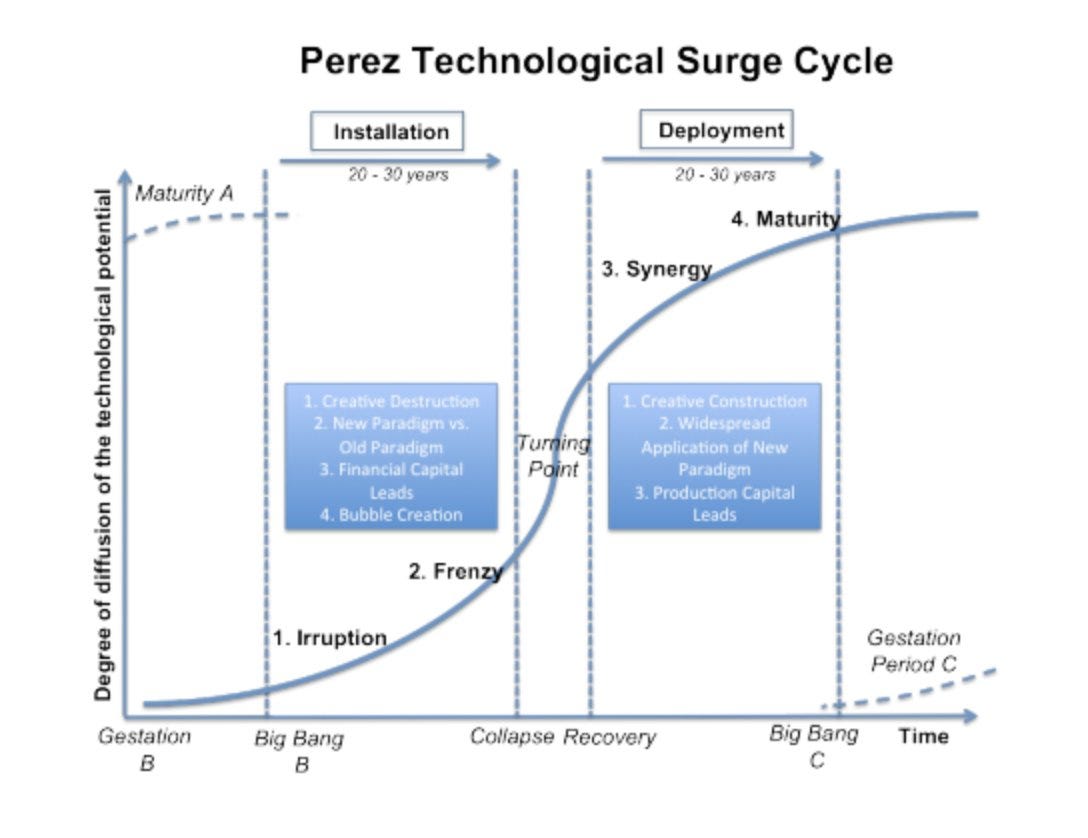

Entering the Deployment Phase

Chris Burniske had a great post about this.

Using Carlota Perez's technology adoption framework, Bitcoin appears to be transitioning from Installation (marked by speculation and bubble creation) to Deployment (characterized by widespread adoption and steadier growth).

These factors increase the likelihood that future “cycles” could see less extreme drawdowns (for Bitcoin. Can’t say the same about alts, memes & agents).

Up Only?

No. We could absolutely still see significant drawdowns - potentially even 60%+ from cycle peaks. But the days of 80%+ crashes may be behind us, barring a fundamental Bitcoin failure or black swan event.

What This Means for You

Don’t miss the secular trend, looking for a cyclical trend.

Take profit systematically. Consider a DCA framework - selling a fixed percentage of the portfolio monthly ensures you won’t get caught during a freefall after a potential blow-off top.

Use the 200W as a “worst case” drawdown level. Because of Bitcoin’s previous respect for this trendline, many participants will likely be buying there as a line of support.

Stay focused on the long-term stairway, not short-term steps

By the way, most memes and most AI agents will probably still draw down 90% (or in some cases, 99%). There are already plenty of instances of this happening.

Remember: Markets rarely repeat exactly, but they often rhyme. Bitcoin's stairway to heaven won't be a straight line up - it will be a series of mini-cycles, each potentially less volatile than the last.

Significant opportunities will be available to those who understand the switch from cyclical trend dominating to the secular trend dominating, and are willing to take calculated risks at the right time.

Just remember, asymmetric returns in crypto come from buying when people have declared a token or sector dead. Not from top-ticking the latest hype cycle.

🔭Market Outlook

We’re changing the format of this newsletter slightly. We’ll now do a comprehensive onchain metrics report two weeks after the monthly group zoom call. This is to give a mid-month update on the trends driving the market, in addition to our more regular premium articles and the real-time metrics bot in our Discord.

Keep reading with a 7-day free trial

Subscribe to Dynamo DeFi to keep reading this post and get 7 days of free access to the full post archives.