⚡️Bitcoin Moves and DeFi Responds (what to watch)

What’s happening across chains, where yields are spiking, and the DeFi trends we’re tracking

Read Time: ~4 minutes

⚡Snapshot

What to watch after BTC’s big move

Take your DeFi skills to the next level with part 3 of the (free) DeFi 101 Course

200% yields on Aptos

Live Pro call this week - live call covering hot market trends after BTC’s run

📖 Recommended Reads

⚡What to Watch After BTC’s Big Move

Bitcoin makes a new high: what comes with it?

⚡Where the AI Agent Space Stands Right Now

Market momentum is back: updates on Virtuals, TAO, & others

Learn advanced yield strategies and how to find DeFi opportunities

⚡The US Dollar remains the most dominant global currency

USD’s share of global payments is at 48%, the highest in over a decade

⚡Potentially undervalued revenue-generating protocols

List of protocols with the lowest P/F ratio

⚡Bull Market: Don’t Miss the Most Explosive Trends

Last month we covered airdrop opportunities on Hyperliquid, revenue-generating apps and corporate BTC treasuries before many of them went bananas.

This Thursday at 5:30pm EDT we’re going live with updated market research including our favorite areas of the market, and what we’re watching.

Pro members also receive the recording to watch anytime and the entire research catalogue of Pro calls.

We’ll be doing a Q&A after the presentation for all attendees. Submit your question ahead of time and receive dedicated research slides by becoming a sovereign member.

🔢Onchain Analysis

Big Winners in DeFi

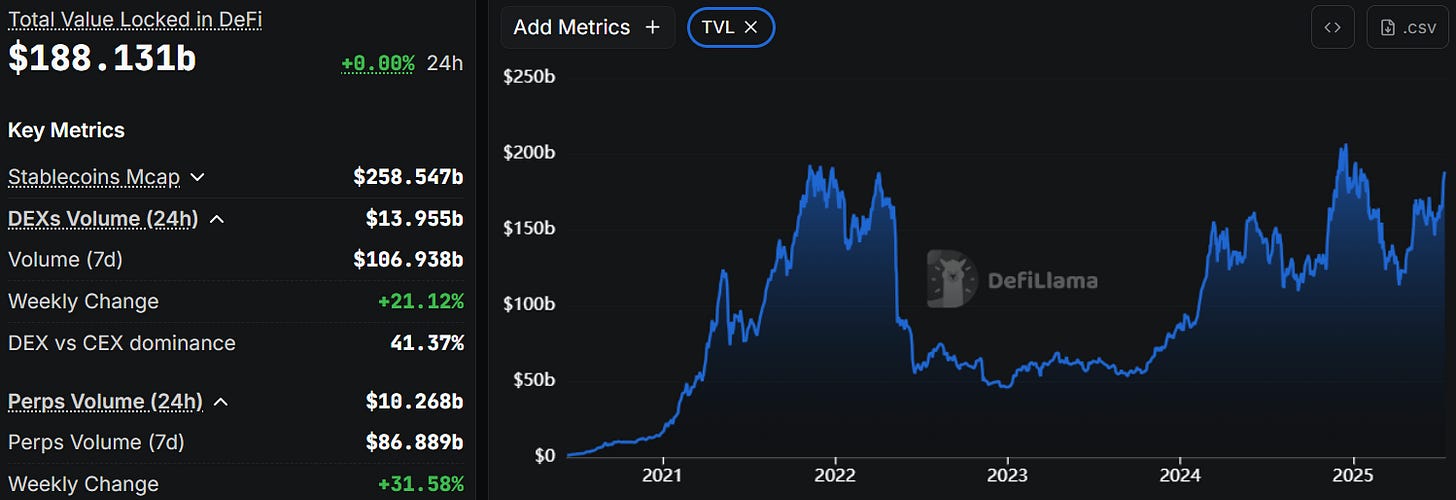

Stablecoin market cap is at an all-time high. Volumes are up, and total DeFi TVL is marching up to all-time highs.

Which protocols and chains are doing especially well?

Aave TVL crossed $30b for the first time ever

Alternative Layer 1’s Hyperliquid, Aptos & Sui all hit all-time highs in stablecoin market caps

Aptos is especially interesting, nearly every month sees more stablecoins onchain. Additionally, Aptos leads chain inflows over the last 30 days.

The Risk Curators Category is growing quickly. Euler DAO, Gauntlet and Steakhouse Financial combine for over $3b in TVL and each protocol has TVL at all-time highs. This signals demand for risk analysis; users want to make sure they are safely engaging in DeFi and these protocols assist with that.

As crypto adoption spreads, watch which sectors are growing quickly overtime. You can do that on DeFiLlama’s Categories dashboard. This is a secular trend that will unfold over years so it’s best to zoom out, find growth and follow it.

🚜Farm of the Week

Earn Yield on Hyperion

Hyperion is a swap aggregator, CLMM and vault platform backed by OKX & Maelstrom.

TVL is over $117m and the liquidity pools offer good yields right now.

How it Works

We’re going to focus on the APT-USDC pool, but most of the pools listed above are solid (the APT-xBTC pool will suffer more impermanent loss than the others, fyi).

For a breakdown and understanding of impermanent loss, watch our short description on it here.

Head to Hyperion’s Pools page. You’ll need to connect your wallet in the top right corner (using the OKX wallet offers bigger yields in xBTC pools).

We’ll select the APT-USDC pool, and simulate a $500 total deposit. Selecting a 20% range allows the price of APT to go up or down 10% and remain in our liquidity range, minimizing impermanent loss (although it’s still a real risk!).

Our estimated APR on this pool from onchain swap fees is 197%. This can change often, we just don’t want to see the APR drop drastically. That would mean swap volumes have slowed and our funds may have better uses elsewhere.

Risks

If you don’t want to hold the APT token, the USDT-USDC pool will not suffer nearly as much impermanent loss risk and is considered delta neutral.

Risk level: Medium

⚡How to Find New DeFi Protocols on Solana

⚡Get Rewarded for Buying & Selling Crypto

Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks.

Get $50 instantly for signing up, depositing and trading $200.

🛠️Tool Spotlight

Dexu AI Project Mindshare

Dexu AI’s Project dashboard shows which projects are hoarding the most mindshare over a defined time period: available from 1d to 90d timeframes.

Here’s what the landscape looks like over the last 7 days. The dashboard also tracks project follower growth and leaderboard scores ranking projects by defined metrics.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 US CPI data - July 15th

📊 US PPI data - July 16th

📊 June Retail Sales data - July 17th

📊 12 Fed speaker events this week

Token Unlocks: $825m Unlocking This Week

🔓SEI (1%) - July 15th

🔓CYBER (2.06%) - July 15th

🔓CONX (204.01%) - July 15th

🔓VANA (8.69%) - July 15th

🔓STRK (3.53%) - July 15th

🔓ZCX (15.91%) - July 15th

🔓ARB (1.87%) - July 16th

🔓PSP (1.08%) - July 16th

🔓APE (1.95%) - July 17th

🔓ZK (2.41%) - July 17th

🔓UXLINK (9.17%) - July 17th

🔓DBR (25.79%) - July 17th

🔓FTN (4.65%) - July 18th

🔓QAI (70.4%) - July 18th

🔓CLOUD (114.56%) - July 18th

🔓ZETA (4.78%) - July 19th

🔓TRUMP (100.17%) - July 19th

🔓ZRO (23.13%) - July 20th

🔓MELANIA (3.53%) - July 20th

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 Appcelerator launch - July 14th (Source)

🚀 The Starfall open beta launch - July 14th (Source)

🚀 PaLM AI launch - July 15th (Source)

🚀 Caffeine AI release - July 15th (Source)

🚀 Everybody's Bingo game launch on Cross - July 17th (Source)

🚀 Lorenzo protocol launch - July 18th (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

📈 Kraken: Ranked the best crypto platform in 2025, Kraken’s simplicity and top-tier service make it the best place to trade crypto & stocks. Get $50 for simply signing up and trading $200 with this link.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi