⚡Base Continues Rapid Growth

Plus MakerDAO plans Solana fork, long-term holders accumulate, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

🔢On-Chain Metrics

Total Stablecoin Liquidity Grows

While DeFi TVL (including liquid staking) stayed flat at around $58B, stablecoin market cap inched up this week. Over the past 2 weeks, total stablecoin market cap has increased by $2B, the first time this has happened since March 2022.

Base and Aerodrome TVL Soars

Aerodrome, a new ve(3,3) DEX on Base, quickly accumulated nearly $200M in TVL. This doubled the the Base TVL, pushing it to nearly $400M and making it the 9th largest chain.

In the absence of a native token, Aerodrome, as the largest DEX and Dapp on Base, could turn into a proxy bet on the entire chain.

On-Chain Metrics Show Long-Term Holder Accumulation

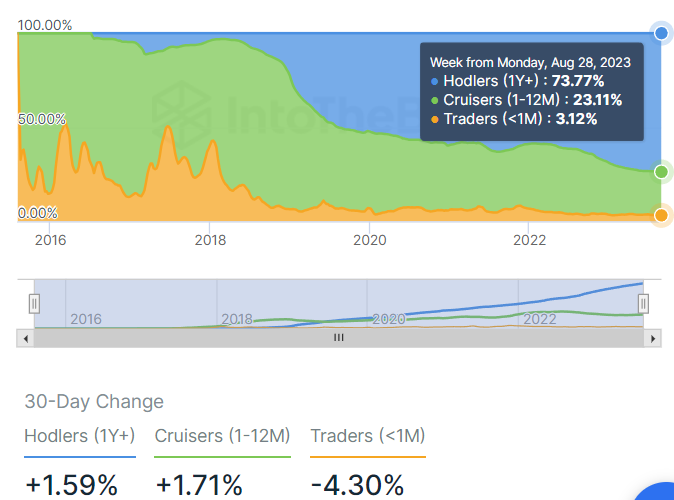

Long-term holders continue to accumulate Bitcoin, with over 69% of BTC now in the hands of holders that have held it for over 1 year This is close to an all-time high.

Long-term holders also continued to accumulate ETH, with the percent of ETH held for over a year hitting an all-time high of 73.77% this week.

Liquidity Flows to Polygon, Gnosis, and Optimism

Bridge flows this week saw major outflows from Ethereum, with inflows to Polygon, Gnosis, and Optimism.

Note that Coinbase doesn’t track bridge flows for Base, but those are likely even more positive than Polygon.

Top Earning Protocols

Ethereum, Lido, and Tron held their positions as the top fee-generating protocols over the past 7 days. Notably MakerDAO had the 7th highest fees, but the 3rd highest revenue.

Looking to Interview Fund and Wealth Managers

I’m designing a special product geared towards wealth managers, family offices, and funds.

If that’s you and you’re open to answering a few questions about your needs in blockchain education, intelligence, and data, respond to this email. We can chat either over email or in a call.

📈Trends and Narratives

MakerDAO Plans Solana Fork

In a move that shocked many in the Ethereum community, MakerDAO founder announced plans this week to not only launch a native blockchain for Maker, but to fork the Solana codebase to do so.

He lists three reasons for choosing the Solana codebase:

Solana is “highly optimized for the purpose of operating a singular, highly efficient blockchain”

Solana proved its resilience by surviving the FTX collapse

Solana codebase has already been successfully forked by other chains

While MakerDAO won’t run on Solana mainnet, this, to me, affirms that Solana has produced interesting tech and is on track to stick around for future cycles.

TON Ecosystem Takes Shape

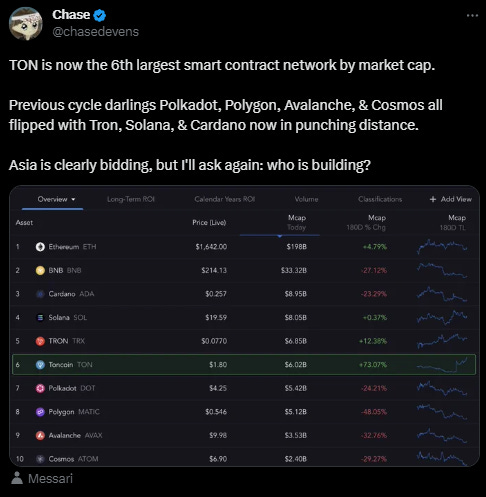

The TON blockchain, a chain that’s the unofficial, official blockchain of Telegram, announced a new wallet interface this week. Given Telegram’s massive reach and ubiquitous use within crypto, this has focused renewed attention on TON itself.

TON is now one of the largest smart contract networks, ahead of Polygon and Avalanche; however, it’s ecosystem is extremely underdeveloped. If TON is able to attract builders and users, that’s a ton of liquidity to quickly flow into DeFi applications.

Prepare for the Next Bull Market with Double Your DeFi This Fall

My friend The DeFi Edge and I are teaching another cohort of our Double Your DeFi course this November. To recap, this is an intensive course to improve your DeFi skills in 5 weeks.

I secured a $300 discount for the first 5 people that sign up from my email list.

Use the coupon code: DynamoDeFi

🛠️Tool Spotlight

Track Token-Level On-Chain Stats with IntoTheBlock

You may have noticed earlier in this newsletter that I included new on-chain stats about long-term holders. I’ve started using IntoTheBlock to track on-chain metrics like this as well as exchange flows. I’ll continue sharing interesting findings in this newsletter.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi

This is amazing. Thank you

Thanks for the recap 🙏