⚡Are Stablecoins Crypto's Killer App?

Plus consumer apps come to Base, EigenLayer TVL jumps, and more

The Dynamo DeFi newsletter covers the most interesting stats, trends, and tools in crypto each week.

🔢On-Chain Metrics

Total Value Locked Inches Lower

Continued weakness in the crypto market this week caused DeFi TVL (including liquid staking) to inch lower from $58.62B to $57.99B.

In percentage terms, Solana, Avalanche, and Polygon saw the largest drop of major chains.

There were a few bright spots in the market. Up-and-coming layer 2 rollups, Base, Starknet and Linea all hit all-time highs in TVL this week.

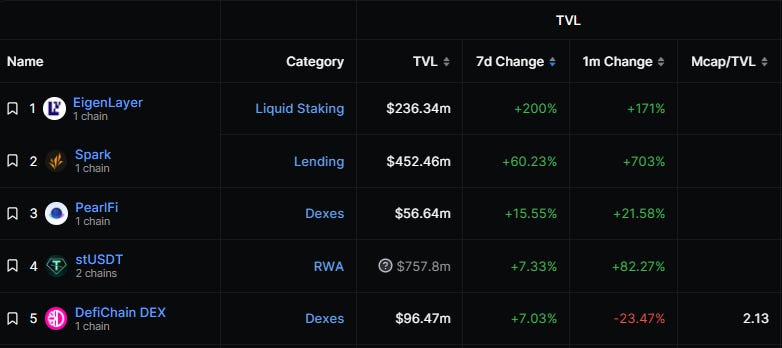

EigenLayer stood out as the large protocol with the most significant growth, increasing its TVL a whopping 200% after it allowed new deposits. EigenLayer allows depositors to re-stake their ETH, securing multiple protocols simultaneously.

Spark, PearlFi, and stUSDT, also posted strong growth numbers. Notably, all 3 of these protocols build upon RWAs.

Cross-Chain Flows to Layer 2s Pick Up

Ethereum and Gnosis had the most significant net 7 day inflows this week, while major Layer 2s, Arbitrum, Optimism, and zkSync Era had net outflows.

Top Earning Protocols

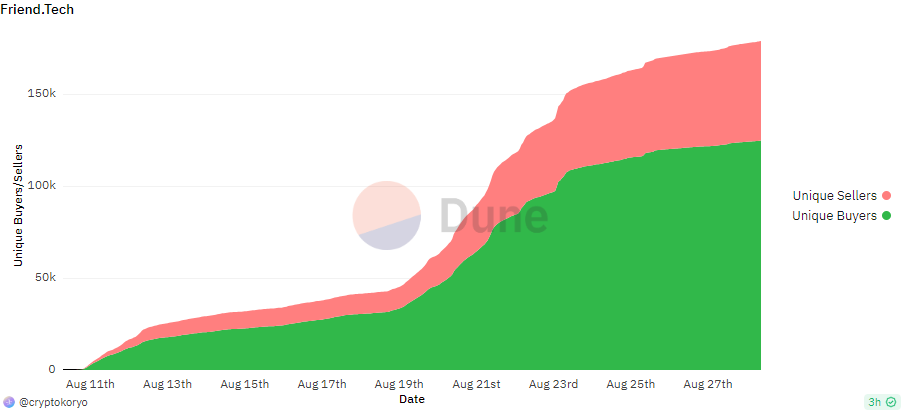

The top earning protocols this week included many familiar faces. friend.tech climbed higher in the rankings to reach number 4. Notably, this growth in friend.tech activity was driven in large part by non-native crypto users.

Prepare for the Next Bull Market with Double Your DeFi This Fall

My friend The DeFi Edge and I are teaching another cohort of our Double Your DeFi course this November. To recap, this is an intensive course to improve your DeFi skills in 5 weeks. We upgraded this cohort with the following improvements:

An exclusive alumni Discord

Hours of pre-recorded content in addition to the in-person sessions

New Narrative and Catalyst module

DeFi Playbooks in which we walk you through the practical application of lessons

I secured a $300 discount for the first 5 people that sign up from my email list.

Use the coupon code: DynamoDeFi

📈Trends and Narratives

Are Stablecoins Crypto’s Killer App?

As the speculative bubble of 2021 fades into memory, there’s one question on the mind of the crypto market: what has crypto created that is actually useful?

One obvious example is the stablecoin. This thread lays out how stablecoin adoption has been trekking upwards:

There have also been promising developments in stablecoin payments recently. An integration of Shopify with Solana Pay promises to deliver payments with lower transaction fees than traditional payment processors.

Base Sparks Consumer-Friendly Crypto Apps

Though it might seem counterintuitive for a corporate chain to spark a renaissance of consumer-focused apps, that seems to be exactly what’s happening on Coinbase’s Base chain.

The clearest example is friend.tech, which has quickly grown to over 120K unique users.

Another example is the Not Not Citi Bike Race in which NFTs can be minted to represent real life bikes as part of an interactive game.

The creation Base by a centralized exchange makes more sense if you look at Coinbase’s long-term roadmap from 2016. There, they laid out a plan to eventually build a “mass market interface for digital currency apps” that would be able to service 100M people. A custom chain, with easy onboarding from a major exchange, would fit the profile of that mass market interface.

If you’re trading on-chain, you can now snipe DEX listings, set limit orders, swap MEV free, and more with Unibot. (Affiliate Link)

🛠️Tool Spotlight

Track Bitcoin Seasonality with CoinGlass

As the importance of timing macro and market cycles has become increasingly clear, I’ve been paying more attention to historical Bitcoin patterns. CoinGlass has an interesting chart that shows Bitcoin’s seasonal performance over the years.

CoinGlass also has other useful stats like open interest and liquidations.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi