⚡Arbitrum Season Redux?

Plus Celestia's master plan, Solana ecosystem, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week.

📈Trends and Narratives

Arbitrum Season Redux?

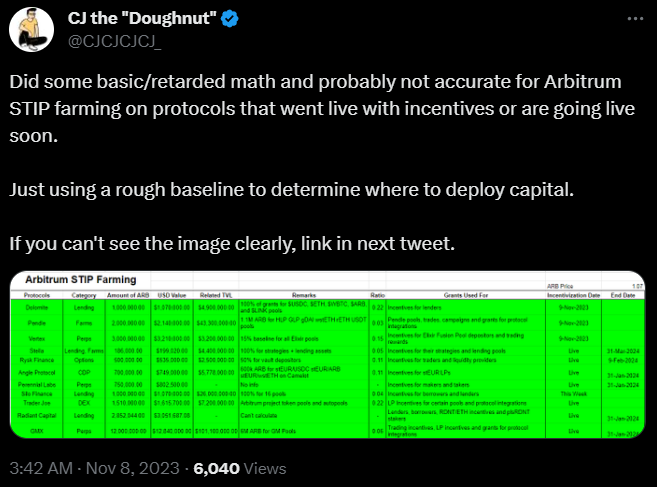

Arbitrum’s rollout of their short-term incentives program has sparked renewed interest in that ecosystem. 50M ARB are being distributed to various protocols. Each protocol will use the ARB differently to incentivize users or developers.

These ecosystem incentives, combined with a market that is heating up, could push renewed interest into the Arbitrum ecosystem.

CJ laid out a spreadsheet with how different projects are allocating their tokens:

In this thread, 0xJeff goes into detail on 10 Arbitrum plays. Really solid thread to understand what some of the top projects on Arbitrum do, the bullish case for each, and upcoming catalysts.

Celestia’s Master Plan

TIA, the token for Celestia, was one of the best performing tokens in the top 100 this week. Celestia is a new blockchain that’s focused specifically on data availability and that promises to scale rollups.

In the past, I’ve been skeptical about investing in highly technical products like this, not because they aren’t innovative, but because retail traders have difficulty understanding them. In this case, given TIA’s large mind share and strong performance, I believe marketing from a price increase could overcome that technical understanding gap.

This thread by cygaar lays out what Celestia does well:

⚡Get Better at DeFi with Dynamo Research

The paid version of Dynamo DeFi, called Dynamo Research, gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access this week’s call here.

🔢On-Chain Analysis

Solana Ecosystem Explodes on Many Metrics

This week was a massive one for the Solana ecosystem:

TVL surged to its highest point since the FTX collapse (driven only in part by SOL’s price increase)

DEX volume had one of its best weeks ever, passing both Arbitrum and BSC on one day

Active users increased 50% from their level several weeks ago

Keep an eye out on whether new users to Solana stick around to continue using the ecosystem or if the usage dies off as quickly as it grew.

Top DEX List Sees Shakeups

The list of top DEXes saw some major shakeups this week:

ThorChain jumped to the number 3 spot, surpassing Curve

Trader Joe reached rank 5 for the week, with strong volume on both Arbitrum and Avalanche

Orca, the largest DEX on Solana by volume, broke into the top 7.

Another takeaway here is that Uniswap’s dominance of DEX volume has been dropping significantly. This could be from users experimenting outside of Ethereum. However, some have wondered whether it could be due to Uniswap’s new front-end fee pushing users to use aggregators, which may route transactions through other DEXes.

🛠️Tool Spotlight

Chart Solana Tickers with Birdeye

With DEX trading on Solana taking off, many on-chain explorers are being forced to learn a new set of tools. One necessary tool if you’re trading on Solana is Birdeye, which you can use to find and chart on-chain tickers.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi