⚡AI tokens lead the crypto market

Plus GameFi resurgence, stablecoin levels stabilize, and more

The Dynamo DeFi newsletter covers trends, on-chain analysis and tools in crypto each week.

📈Trends and Narratives

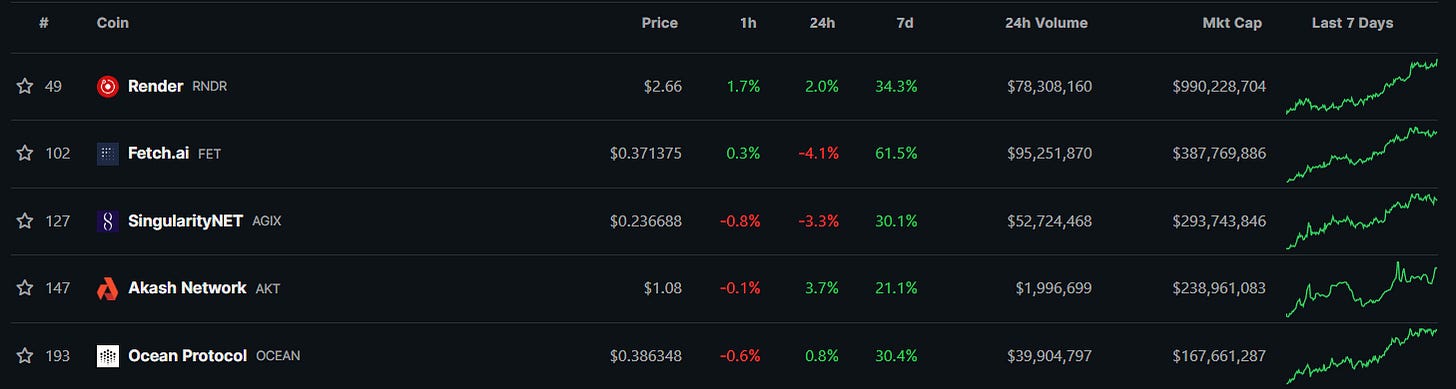

AI tokens lead the crypto market

AI-related tokens were among the best performers over the past week.

AI adoption has been the biggest tech story of the year and there has already been a corresponding bull-run in AI-related stocks. Unfortunately for retail investors, there aren’t many opportunities to get into small AI-related companies. If crypto starts to gain attention again, a lot of retail investors could seek to capitalize on the AI narrative through small tokens.

This list from Crypto, Distilled lists out a few dozen AI projects to research, organized by category.

One project I’ve been following closely is Bittensor. Bittensor is an open-source project seeking to decentralize AI development through token incentives.

GameFi resurgence on the horizon?

There’s a saying that “the next big thing looks like a toy.” Keeping in mind that, as well as the explosive growth in gaming and e-sports, could gaming be the category to bring mass adoption to crypto? Add in the fact that buying and selling digital items for large sums is already common in video games.

In this thread, Alex Wacy goes through the narrative, as well as some top projects that don’t have a token yet.

In this thread, Andrew Moh goes through the high level thesis behind this narrative, how DeFi and gaming can be a good match, and interesting projects in the narrative to watch.

⚡Join the Dynamo Research community

The paid version of Dynamo DeFi, called Dynamo Research, gives you deeper insight into the crypto market.

For $11/month (less than lunch in most countries), premium subscribers get:

⚡Discord to discuss on-chain data and trades. Learn more here.

⚡Exclusive newsletters & on-chain data indicators. Actionable insights about which tokens have strong fundamentals. Plus special in-depth reports.

⚡Pre-recorded videos. These will be longer in-depth videos where I show my research process. View past videos here.

⚡Monthly group calls. Each month, I’ll conduct a group video call to discuss the market, latest crypto trends, and more. Premium subscribers can access this week’s call here.

🔢On-Chain Analysis

Total Stablecoin Market Cap Stabilizes

After a year and a half of decreasing, the total stablecoin market cap has held steady for 11 weeks now.

Since the vast majority of stablecoins are backed by “real” money outside the on-chain economy, total stablecoin market cap can be viewed as a proxy for outside capital in crypto. If it’s shrinking, that means capital is is exiting. If it’s growing, that means capital is entering.

And capital isn’t entering yet; however, this metric at least stabilized, which shows that maybe outflows have stopped. Even during the bullish runs last summer and this spring, capital outflows continued.

DEX Volume Ticks up to Highest Point Since June

In another positive signal for on-chain activity, DEX volume ticked up this week to its highest point since June. Watch to see whether this can sustain and continue growing.

🛠️Tool Spotlight

Swap to Over 200 Chains with RocketX

Recently I’ve been using RocketX as an easy place to swap between chains, especially non-EVM chains. They give access to over 20,000 tokens on 200+ blockchains.

For example, this week I’ve been looking for ways to bridge onto the Bittensor mainnet and found that RocketX supports them. I’ve also been using RocketX to bridge onto Solana.

📅Key Events This Week

That’s all for this week. For more frequent content, follow me on Twitter and YouTube.

Until next time,

Patrick Scott

Dynamo DeFi