⚡A President, A Memecoin, and $110M Gone. What Happened?

Inside: BSC's surprising volume surge, Sonic's continued growth, and the LIBRA memecoin saga explained →

Read Time: ~5 minutes

⚡Snapshot

Earn Points & Yield on Sonic

The LIBRA memecoin saga - what happened

First set of weekly digital asset investment outflows in 19 weeks

Follow me on LinkedIn for more stats & stories about running a business in crypto

📖 Recommended Reads

⚡The State of Virtuals Trenches Q1 2025

Evolution of launches, forgotten agents, competitors and what’s coming next

Crunching numbers to quantify Jupiter’s promise to buy back JUP with 50% of fees

⚡Unit announces native spot trading on Hyperliquid

Unit is enabling native BTC spot trading on Hyperliquid, ETH & SOL coming soon

⚡The LIBRA Argentina memecoin saga: here’s what happened

Down 90% from the peak, insider trading, and an interview with the creator

⚡Digital asset investment products see first set of outflows in 19 weeks

After $29B of inflows, Bitcoin sees $430M of outflows

⚡February Pro Call Recording: Complete Market Analysis

Last week's research presentation covered everything you need to know about the current market:

Latest ETF developments & implications

Deep dives into Solana, Hyperliquid & Sonic

AI narratives worth watching (Bittensor & AI agents)

High-conviction DeFi farming strategies

RWA & perpetuals market analysis

Get instant access to the recording + research slides →

🔢Onchain Analysis

Binance Smart Chain Sees Volume Jump

While many chains are experiencing large drops in DEX volume, BSC saw a 50% jump.

This is in part due to CZ, Binance’s CEO, posting a picture of his dog. This sparked a lot of speculation volume on memes named after his dog.

On the topic of DEX volume: Sonic’s weekly DEX volume chart is up and to the right.

Much of the volume the past few weeks came from Shadow Exchange, Solana’s leading DEX.

Sonic’s Points Program is attracting developers and users in anticipation of the upcoming airdrop. We’ll share a strategy below to start earning points in the ecosystem.

Sonic’s TVL is up another 40% since we mentioned it in last week’s newsletter, crossing $500M.

Sonic’s growth right now is eyecatching, but the ultimate test for a chain is how well the activity sticks after a large airdrop. The two big questions for Sonic are: (1) will the TVL be sticky post-airdrop? (2) how high can Sonic and it’s ecosystem go in the meantime?. Until then, Sonic continues to stand out by its raving fans and strong metrics growth.

They pulled it off last cycle under the name Fantom. Perhaps they can do it again.

🚜Farm of the Week

Earn Points & Yield on Sonic

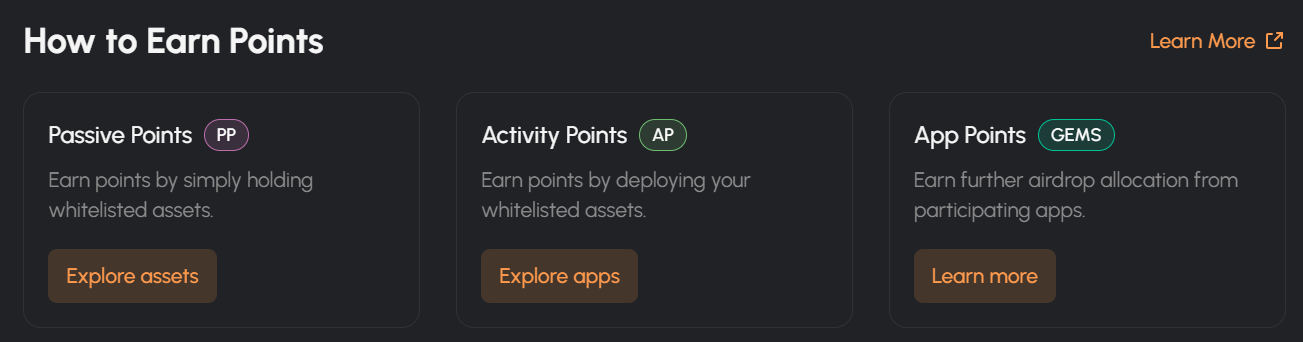

There are three types of points on Sonic.

This allows for different strategies depending on a user’s trading style - it appeals to holders, traders and DeFi power users.

For information on how to qualify for the Sonic airdrop, check out this blog post or watch my video.

How it Works

For those interested in simplicity, who don’t want to actively trade: simply mint scUSD on Sonic.

This action earns boosted 6x Passive and Activity Points, extra rewards from Rings and VEDA, and a Sonic Gem.

For a more active strategy: lend S (Sonic’s token) or USDC on Silo Finance for up to 10x Sonic Activity Points and 1 Silo point per dollar lent / borrowed per day.

How to capitalize: Head to the Sonic Points page and use my referral code HQBA3B.

Risks

Sonic DeFi: Yield & Airdrop Farming

⚡Capitalize on Volatility with Hyperliquid

Hyperliquid is the premiere decentralized perps exchange. It’s one of the best crypto products I’ve ever used.

It’s fully onchain, with zero gas fees and low trading fees (you’ll get a discount on trading fees by using this referral link)

If you think the market will drop, you can protect yourself against downside by shorting anything from Bitcoin to AI agent tokens with minimal slippage.

Get started on Hyperliquid in 2 minutes →

🛠️Tool Spotlight

Use DeFiLlama to Find & Check for Airdrops

DeFiLlama’s Airdrops page has a continuously updated list of newer protocols that may airdrop, as well as an airdrop checker for EVM & Solana addresses.

More helpful DeFi Tools: The Dynamo DeFi Crypto Tools List

📅Key Events This Week

Macro Events

📊 US Stock Market closed - February 17th

📊 January Housing Starts data - February 19th

📊 Fed Meeting Minutes - February 19th

📊 January Existing Home Sales data - February 21st

📊 20% of S&P 500 companies report earnings

Token Unlocks: $790M Unlocking This Week

🔓Tokenomist: Track token unlocks and make better investment decisions. Use my code DDNM5 for 5% off Pro Plans.

🔓APE (2.16%) - February 17th

🔓QI (0.83%) - February 17th

🔓PRIME (1.37%) - February 17th

🔓QAI (10.88%) - February 18th

🔓ROSE (0.83%) - February 18th

🔓FTN (4.66%) - February 18th

🔓EIGEN (0.53%) - February 18th

🔓TRIBAL (6.11%) - February 19th

🔓MELANIA (40.83%) - February 20th

🔓MRS (11.87%) - February 21st

🔓IMX (1.41%) - February 21st

🔓BICO (0.75%) - February 22nd

Launches & Updates

Note that these launches are mostly unvetted by the Dynamo DeFi team and this isn’t an endorsement of any of them.

🚀 NAKA new game launch - February 17th (Source)

🚀 STEAMM beta launch on SUI - February 17th (Source)

🚀 Gods Unchained new game launch - February 18th (Source)

🚀 Wanchain new product launch - February 19th (Source)

🚀 QUAI mainnet transaction capability launch - February 19th (Source)

🚀 LAVA network NFT collection launch - February 20th (Source)

🚀 Pi open network launch - February 20th (Source)

🚀 TST token burn - February 21st (Source)

⚡Favorite Resources

If you want to dive deeper, here are some of my favorite resources:

🛠️ The Dynamo DeFi Crypto Tools List: A comprehensive list of 100+ crypto tools to help with portfolio tracking, analytics, airdrops and more.

🚀 RocketX: The 1-stop-shop to get the best rates for on-chain & cross-chain swaps.

🛡️ Ledger: The smartest way to secure your crypto. Buy & sell crypto with full control over your assets.

For more frequent content, follow me on Twitter and YouTube.

Until next time,

Dynamo DeFi