7 Investments I'm Making in 2026

Uranium, Digital Property, Profitable DeFi, and more

This year, I’m planning to deploy time and capital into 7 distinct areas that I believe offer asymmetric upside. Some are massive megatrends that everyone sees coming. Others are overlooked niches where I think I have an edge. One isn’t even a financial instrument, but I think its ROI will be just as high as the others. Several of these aren’t even easy to copy unless you’re me; they’re a snapshot of where I’m personally putting time, attention, and money in 2026.

1) Digital Properties

“First time founders focus on product. Second time founders focus on distribution.”

This year, one of my main focuses is going to be on building digital “real estate” to control distribution. By digital real estate I mean niche social accounts, websites, YouTube channels, Facebook groups, Telegram news feeds, etc. Anything that gets eyes online.

Controlling digital property is like owning property with a storefront. Rather than walking by, users encounter the property in searches, from LLMs or on social media. Like a storefront, their attention can be redirected to products, either that you own yourself or that you’re advertising.

I’m going to be blunt here. If you haven’t started building an audience already, you’re at a disadvantage. AI has dramatically lowered the cost of content creation, flooding the Internet with slop.

It’s more difficult to build an audience than it was 5 years ago. However, it’s only going to become more difficult from here. I suspect in another 5 years, we’ll look back on how easy it was to build an audience in 2026.

If you’re just starting, here’s my recommendation:

Choose a niche with enough of an audience to get feedback, but that isn’t oversaturated.

Start. ←The most important part

Iterate on what works.

Nowadays, most web traffic goes through a small number of sites. Building out pages and groups on other sites is likely a better use of time than building standalone sites.

In particular, I think groups on Facebook and X are underrated as a distribution mechanism. I already started a DeFi group on X that has over 18K members. I plan to acquire or create more groups in 2026.

I’ve also already started the process of creating niche DeFi tools, content sites, bots, and social accounts. Some of these will be tied to my name. Some won’t be.

By the end of the year, I intend to have dozens of digital properties in the finance and crypto niches. These will compound with each other and enable me to more easily launch new properties and businesses in the future.

AI makes it easier than ever to launch and maintain content and micro-saas pages.

Earlier this year, I vibe-coded a few geography games and then left them alone. Now they organically get nearly 1K plays per week. And that’s without any marketing.

Nothing is stopping you from cooking up something interesting except for yourself (more on this in investment 6).

By the way, if you aren’t already, subscribe to my Substack and YouTube for more strategies on building digital property in the future.

2) Uranium and Those That Mine It

Uranium is one of the most reflexive, explosive assets in the world.

The AI boom demands energy and nuclear is one of the cheapest, most reliable ways to provide that at scale.

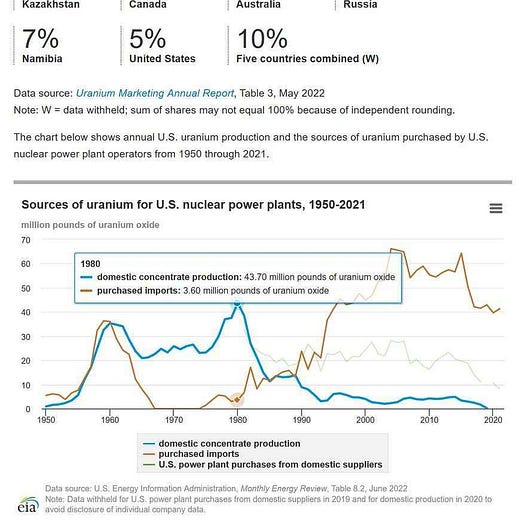

Despite being critical to operations, uranium is actually only a fraction of the cost for nuclear plants (~10-20%). As a result, demand for uranium tends to be highly price inelastic, while supply faces severe constraints.

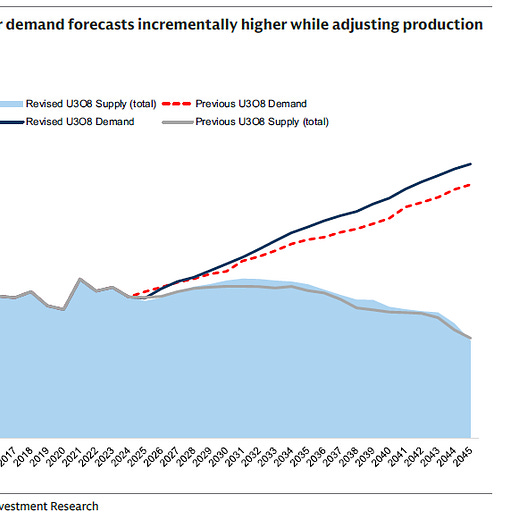

The structural supply deficit is projected to widen after 2025, pushing prices up further.

Now the US is likely starting a strategic uranium reserve, adding more demand pressure.

There are a few ways to speculate on uranium:

Invest in the spot uranium via the Sprott Physical Uranium Trust (SPUT).

Invest in an ETF of Uranium miners through URNM. Miners tend to act as beta to the spot uranium price as price increases lead to margin expansion.

Invest in specific miners.

My main position in uranium miners (and my largest equity position in any industry) is in UUUU 0.00%↑ (Energy Fuels). I’m expecting the US strategic uranium reserve to prioritize US miners. Energy Fuels operates the only conventional mill in the US and is also a play on domestic production of rare earths.

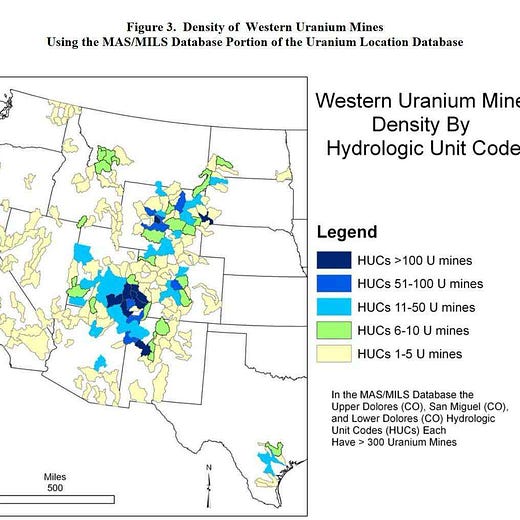

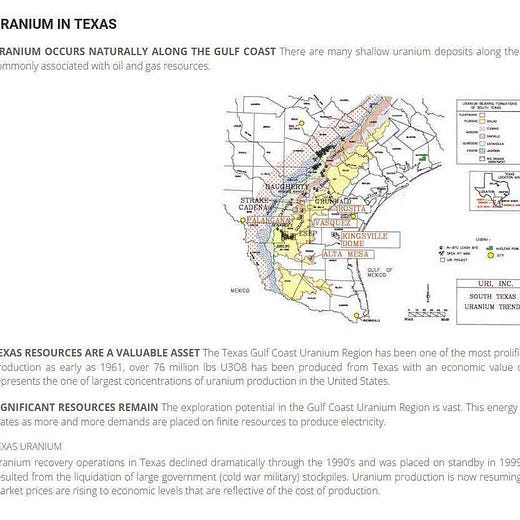

US production of uranium is down significantly from a decade ago.

Energy Fuels combines a national security related mandate with a structural supply deficit that is pushing prices higher. Full disclosure, I first-invested in UUUU 0.00%↑ years ago when it was much cheaper, though I’ve added more to my position on the recent dip.

I wrote my thesis on uranium in more detail here.

3) Revenue-Generating DeFi Protocols

Yes, I’m still investing in crypto.

But not just any cryptos. Cryptos that are linked to profitable Decentralized Finance applications. DeFi is mature enough that certain teams are leveraging the global distribution of crypto and backend automation of smart contracts to generate huge profits with a small headcount. Identifying and investing in those teams is the single best opportunity in the industry right now.

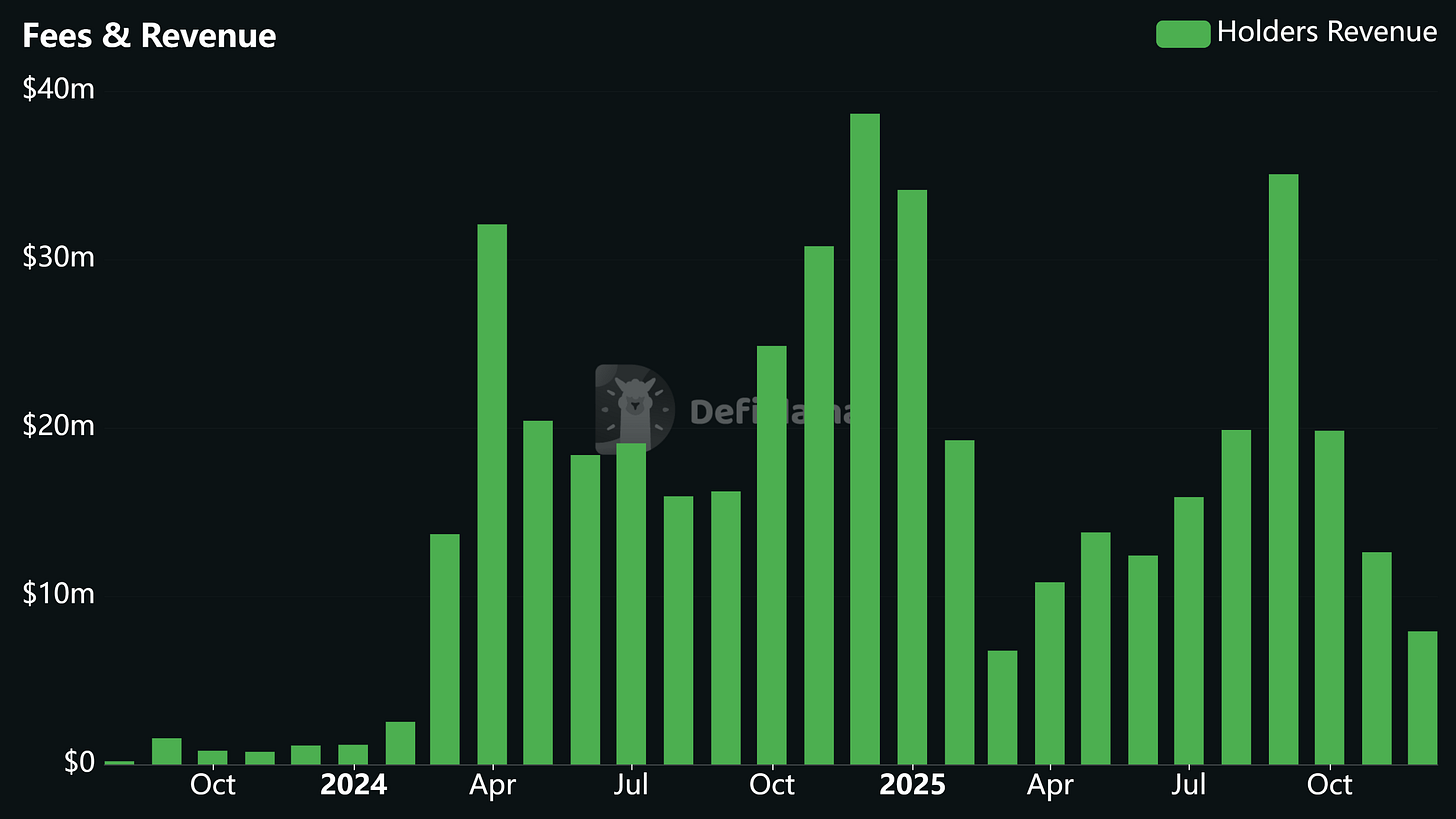

You can easily track revenue data for crypto apps through DefiLlama. I look for applications that have generated significant revenue over multiple years and that pass on that revenue to tokenholders either in the form of dividends or buybacks. At this point, too many tokenholders have gotten shafted by bad tokenomics from protocols that appeared successful on paper, which is why unlike previous years, I’m planning to be highly selective with my investments.

I will only be investing in protocols that have proven their ability to operate and are generating real revenue. In general, to be considered, a protocol will need to meet these criteria:

Producing significant revenue compared to its market cap today

Value accrual to token holders

Strong performance over multiple years

Teams that have a proven ability to execute

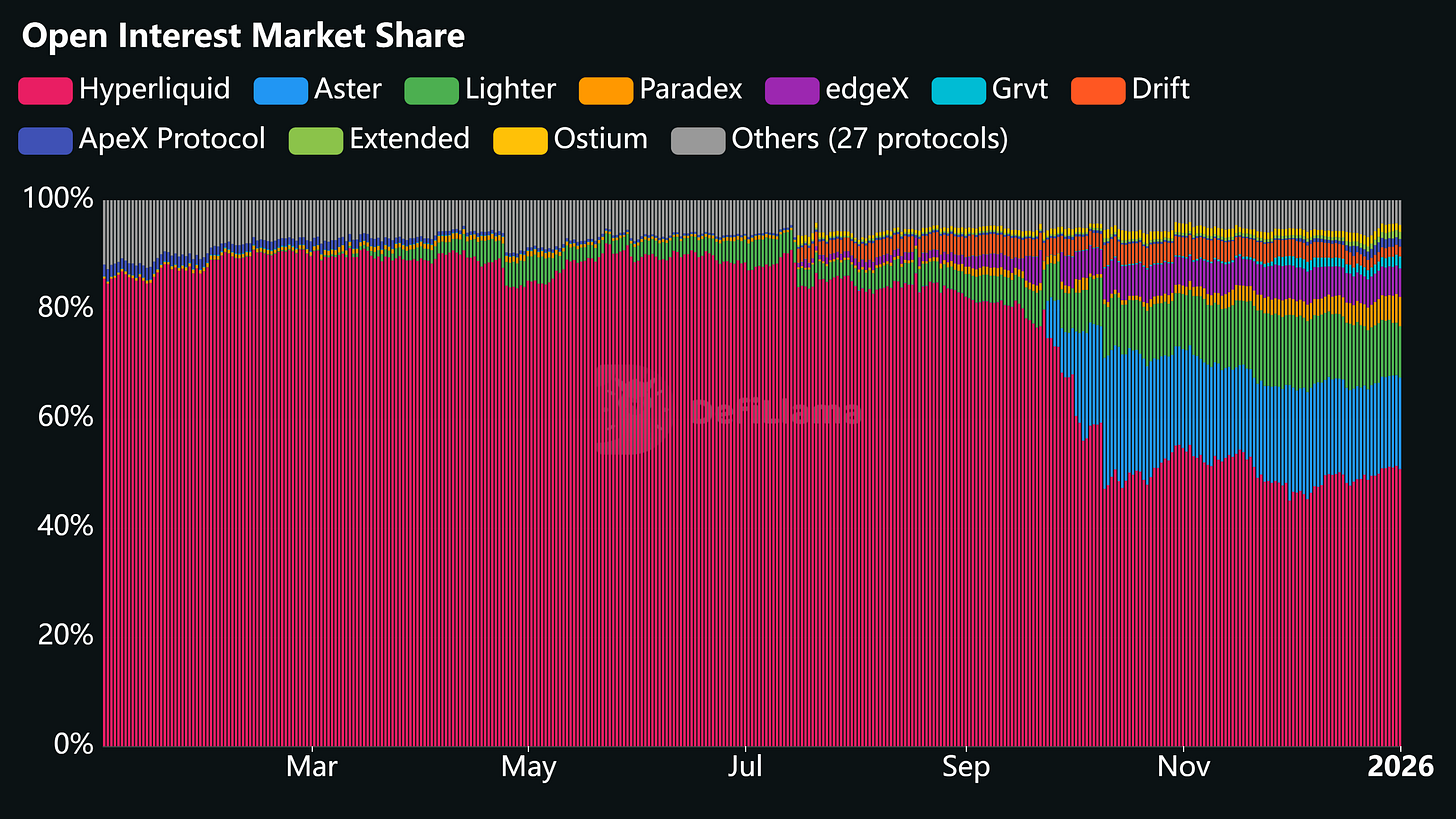

Two projects qualify at the moment: Hyperliquid and Aerodrome.

Despite competitors with airdrop programs and well-funded backers, Hyperliquid’s share of Perp DEX OI has remained remarkably steady over the past 3 months.

Moreover, Hyperliquid ended December as the highest-revenue perp DEX by far, generating over $56M in revenue.

Barring a total collapse of the perp DEX market or a competitor that produces a materially better product, I still believe it is one of the best fundamental plays in the industry.

Aerodrome, the leading DEX on Base has also demonstrated a remarkable ability to generate revenue, year-after-year. They have generated over $1m in revenue for tokenholders every month for over 2 years now. They’re expanding to Ethereum mainnet, providing more growth potential in the future.

This year, I’ll be covering these investments, how to earn yield on them, and any more I decide to buy in my newsletter.

4) Space & Satellites

I’m fighting the urge to dump my entire portfolio into SpaceX post-IPO and focus on other pursuits than investing for a decade.

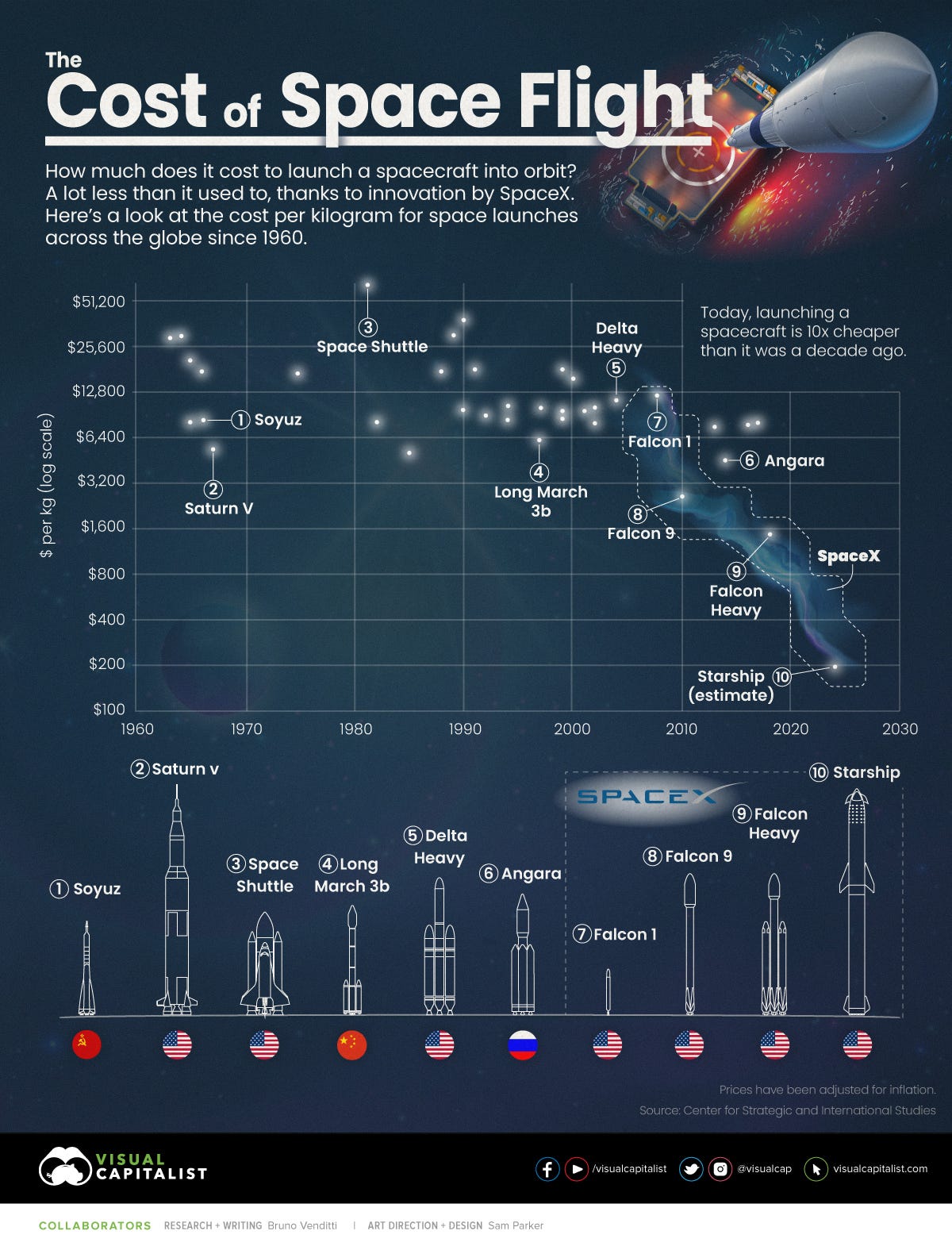

Even based on the fundamentals today alone, the space industry has phenomenal fundamentals. The cost per kg of sending items to space has dropped from around $54k/kg on the Space Shuttle to $1.5k/kg on Falcon Heavy. Estimates have this dropping below $1k/kg on the Starship, potentially even below $100/kg. Every drop in cost, dramatically increases the range of extraplanetary ventures that are profitable.

Starlink added 4.6 million users in 2025 to reach 9.2 million active subscribers. This along with the burgeoning data center satellite business can push the space industry far beyond its current size.

But even this understates the unbounded, massive upside of space.

What’s the potential upside of controlling all orbital and interplanetary logistics? What’s the potential GDP of the Solar System? Most investors are vastly underestimating the scale of space and how quickly things could accelerate.

Robotics will allow mining and manufacturing to begin on the Moon, Mars, and asteroids even before humans have a significant presence there.

Elon recently wrote this:

(Mass drivers are electromagnetic catapults that offer promise as an alternative to rockets in spacelaunch). He usually thinks about a decade in the future. So I’m expecting mining and manufacturing on the Moon to ramp up before then.

I don’t want to get too fancy here. My plan is to start buying SpaceX post-IPO and keep buying it until this thesis has played out or changed.

5) Mycological Pursuits (Mushroom Farming)

Mycology is one of the most understudied, highest potential fields to exist in 2026.

Fungi have huge potential:

Mycoremediation: Some fungi can break down oil spills, plastics, and even radioactive waste.

Medicine: Numerous medicines are already created from fungi. Penicillin, Cephalosporins, lovastatin, Ergotamine, and many others. This is with the vast majority of fungi species unidentified or unstudied.

Estimates are that 2-13 million species of fungi exist. Around 150,000 have been described. And fewer than 10,000 have been studied in depth. AI will enable a step function in how quickly species can be identified and studied for medicinal use.

Recently, studies have also suggested that psilocybin has promise for PTSD treatment and longevity.

And these are just the technologies that are within reach today. Fungi has also been proposed for more futuristic uses like bio-mining, extraterrestrial agriculture, mycelium-based construction materials, and bio-computing.

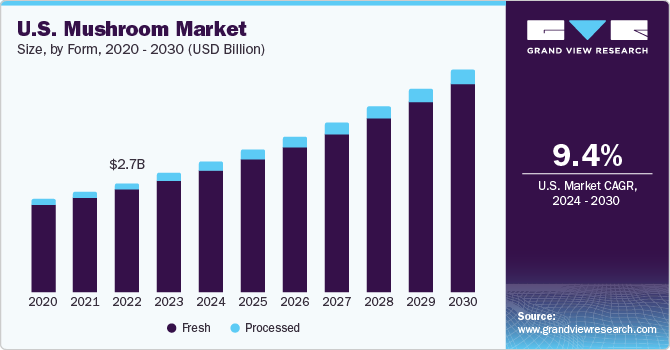

Even without these moonshot applications, the US mushroom market is projected to grow at 9.4% CAGR through 2030. This is primarily driven by demand for exotic foods and alternatives to animal products. I believe that with new industrial uses of mushrooms, the ceiling is much higher and not priced in.

I don’t know exactly how I’m going to invest in mushrooms yet. But I trust myself to figure it out, likely in the second half of the year. To start, I’m planning to learn a lot more about mycology and the mushroom industry. I’ve started growing lion’s mane (a nootropic mushroom), reading books, and reaching out to mushroom farmers.

I have an advantage here in that I live relatively close to the mushroom capital of the US and can drive there to learn more about the industry. But I always say it’s good to maximize your advantages. This is also part of my motivation for dabbling in this field as I believe my geographic advantage increases my likelihood of finding an edge.

6) Courage-maxxing

This one isn’t an investment in the same way as the others, but I believe the ROI will be just as high.

In a world where AI can generate anything, the new barrier to entry is agency. Most frequently, the missing ingredient in agency is courage.

In the modern world, we’re often divorced from actions that require courage. And perhaps that’s why so many things that ought to be done, are not.

Courage is a muscle like anything else. And, like a muscle, it needs to be trained. Do combat sports, start a business, become a volunteer firefighter, speak in public, take an unpopular position.

This year, I am going to invest significant effort into actions that require courage. Although this might seem like the least important item on this list, I actually consider it the most important. Because, it’s only through courage that my more ambitious goals are possible.

7) QQQ

For most people, just DCAing into the NASDAQ is the best use of time.

I’m not enough of an expert in AI to have any edge and my attention is already spread too thin with all of the above investments. I do know that AI and tech more broadly are going to eat the world over the next decade. The NASDAQ is the simplest, lowest effort way to get exposure to that.

Final Word

Thanks for reading. If you enjoyed this, I publish more research and thoughts like it on my Substack regularly